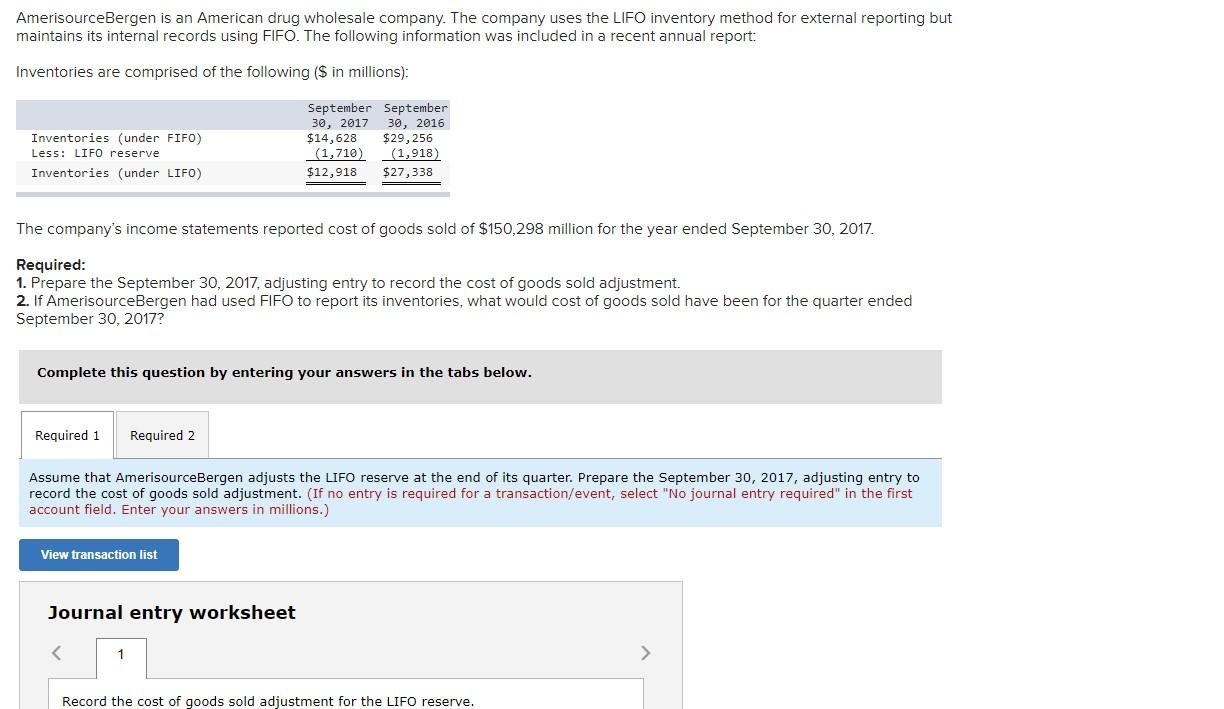

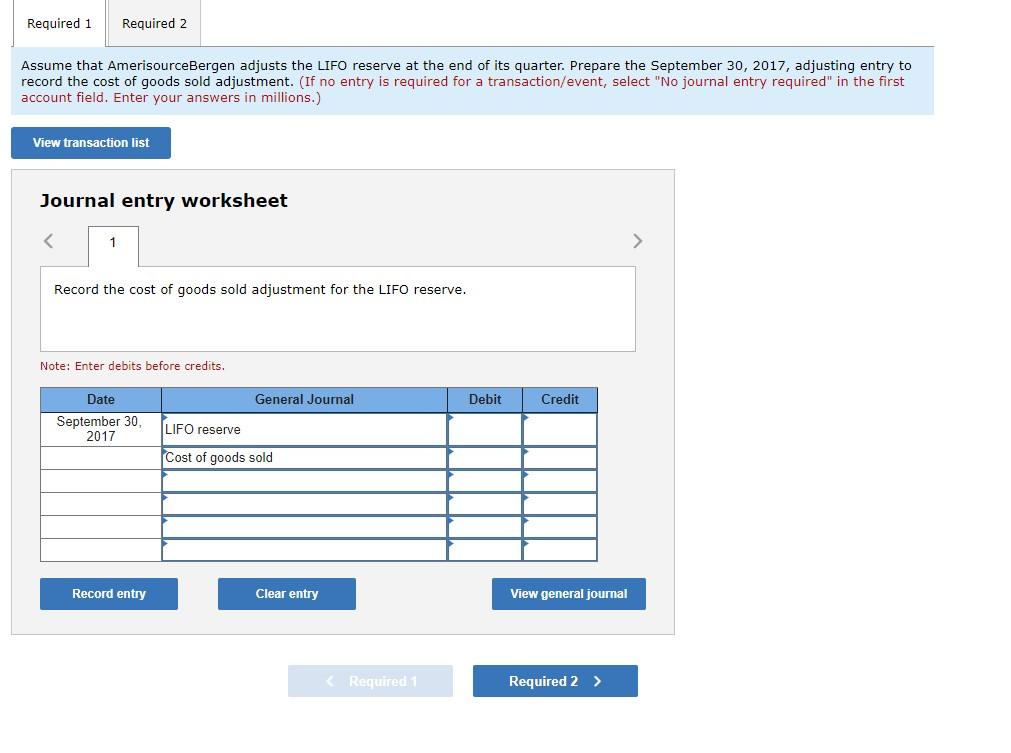

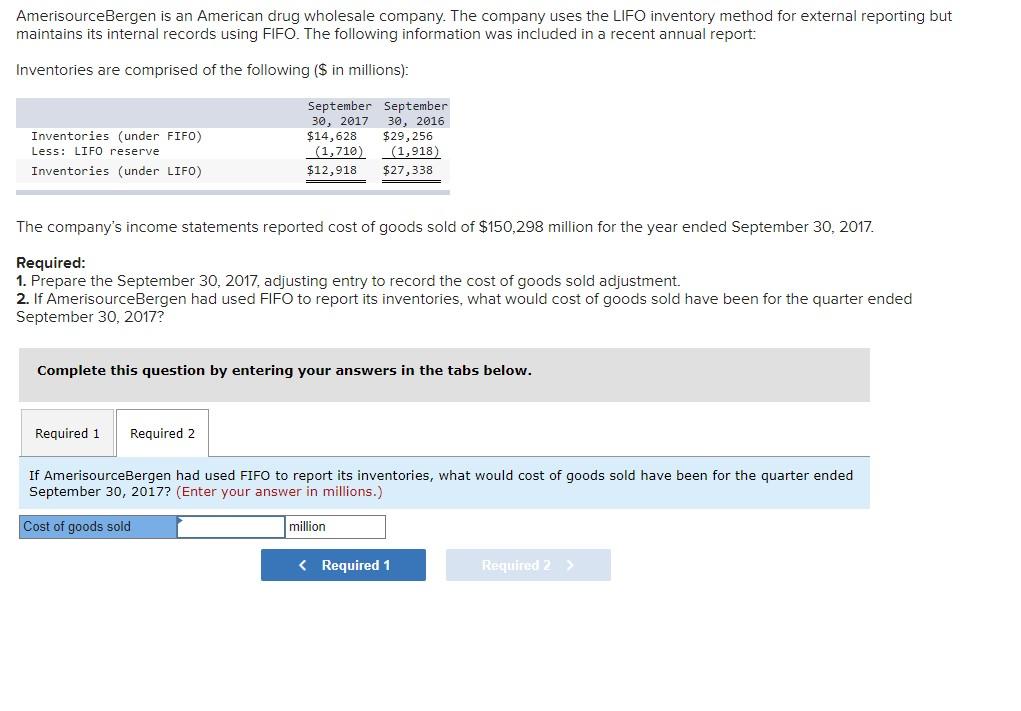

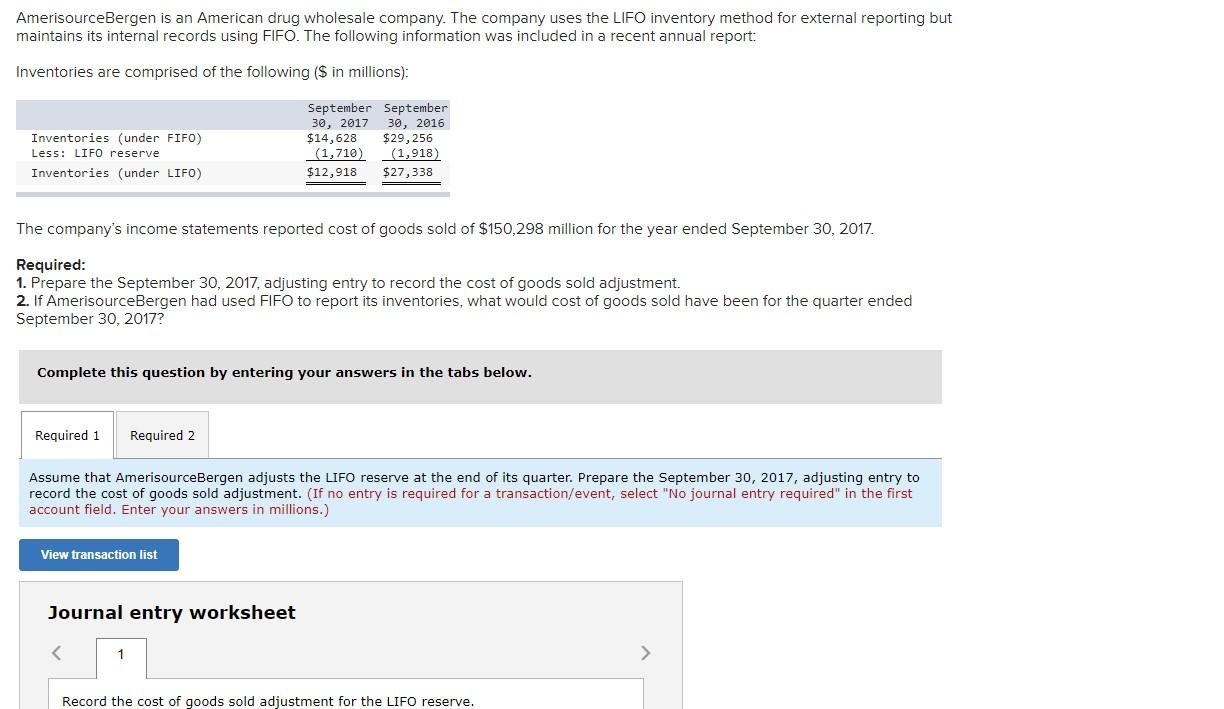

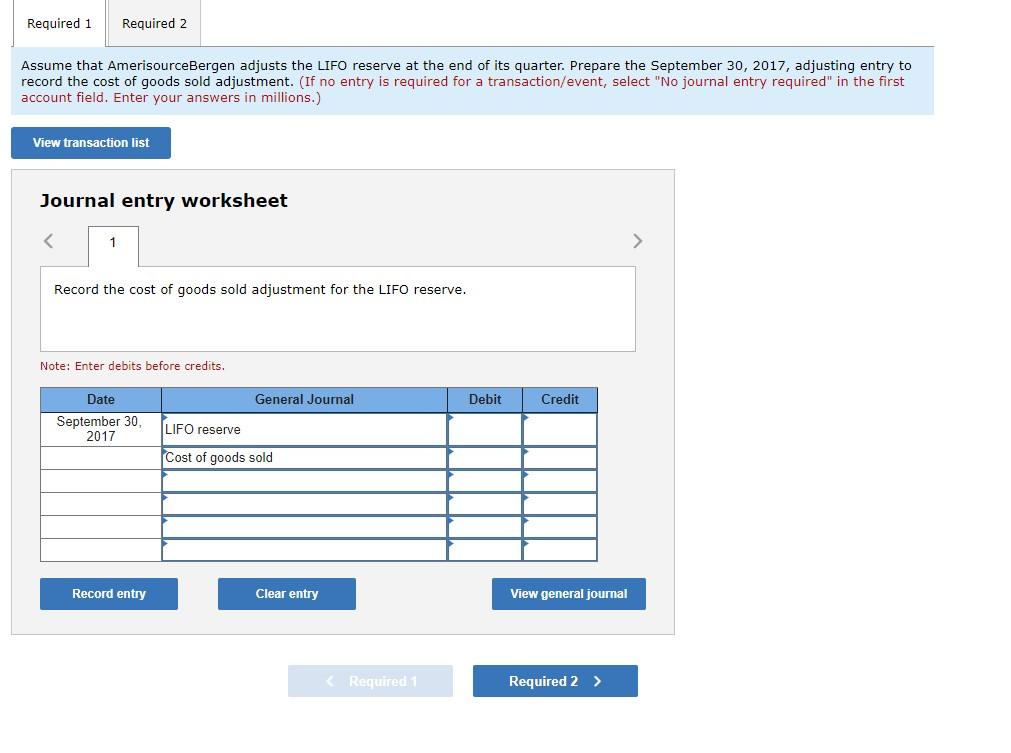

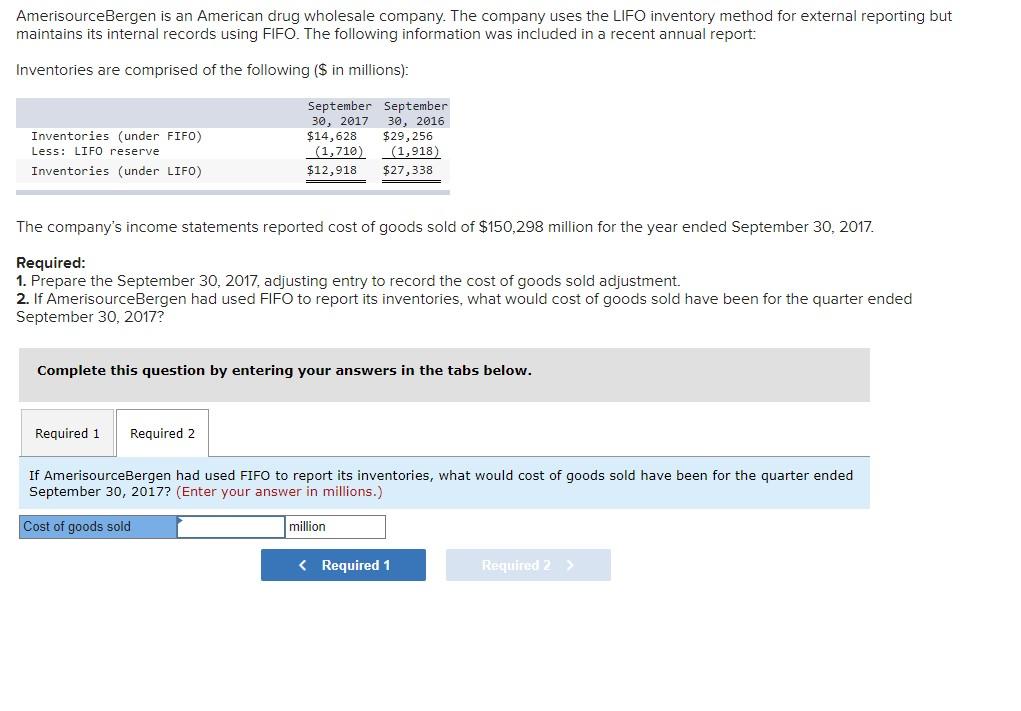

AmerisourceBergen is an American drug wholesale company. The company uses the LIFO inventory method for external reporting but maintains its internal records using FIFO. The following information was included in a recent annual report: Inventories are comprised of the following ($ in millions): Inventories (under FIFO) Less: LIFO reserve Inventories (under LIFO) September September 30, 2017 30, 2016 $14,628 $29,256 (1,710) (1,918) $12,918 $27,338 The company's income statements reported cost of goods sold of $150,298 million for the year ended September 30, 2017. Required: 1. Prepare the September 30, 2017, adjusting entry to record the cost of goods sold adjustment. 2. If AmerisourceBergen had used FIFO to report its inventories, what would cost of goods sold have been for the quarter ended September 30, 2017? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that AmerisourceBergen adjusts the LIFO reserve at the end of its quarter. Prepare the September 30, 2017, adjusting entry to record the cost of goods sold adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) View transaction list Journal entry worksheet 1 Record the cost of goods sold adjustment for the LIFO reserve. Required 1 Required 2 Assume that AmerisourceBergen adjusts the LIFO reserve at the end of its quarter. Prepare the September 30, 2017, adjusting entry to record the cost of goods sold adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) View transaction list Journal entry worksheet 1 Record the cost of goods sold adjustment for the LIFO reserve. Note: Enter debits before credits. General Journal Debit Credit Date September 30 2017 LIFO reserve Cost of goods sold Record entry Clear entry View general journal Required 1 Required 2 > AmerisourceBergen is an American drug wholesale company. The company uses the LIFO inventory method for external reporting but maintains its internal records using FIFO. The following information was included in a recent annual report: Inventories are comprised of the following ($ in millions): Inventories (under FIFO) Less: LIFO reserve Inventories (under LIFO) September September 30, 2017 30, 2016 $14,628 $29,256 (1,710) (1,918) $12,918 $27,338 The company's income statements reported cost of goods sold of $150,298 million for the year ended September 30, 2017 Required: 1. Prepare the September 30, 2017, adjusting entry to record the cost of goods sold adjustment. 2. If AmerisourceBergen had used FIFO to report its inventories, what would cost of goods sold have been for the quarter ended September 30, 2017? Complete this question by entering your answers in the tabs below. Required 1 Required 2 If AmerisourceBergen had used FIFO to report its inventories, what would cost of goods sold have been for the quarter ended September 30, 2017? (Enter your answer in millions.) Cost of goods sold million