Answered step by step

Verified Expert Solution

Question

1 Approved Answer

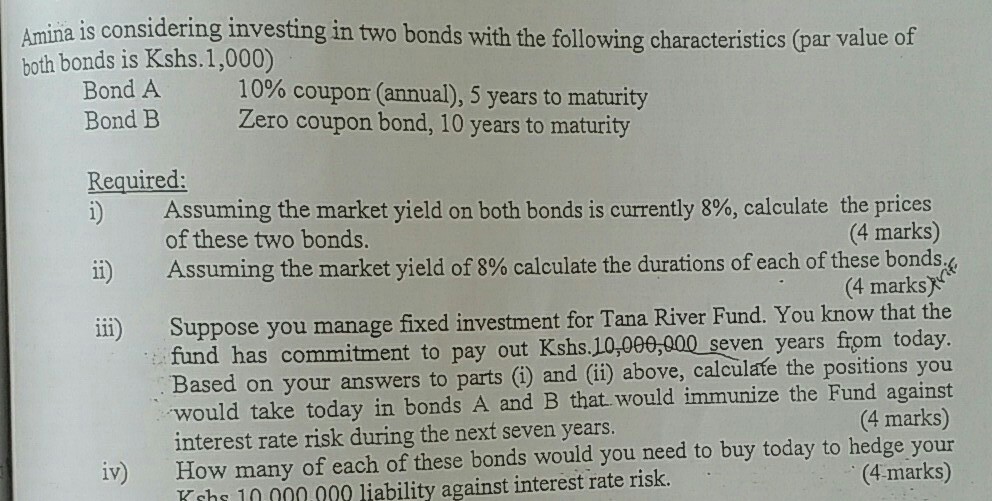

Amina is considering investing in two bonds with the following characteristics (par value of both bonds is Kshs. 1,000) Bond A Bond B 1 0%

Amina is considering investing in two bonds with the following characteristics (par value of both bonds is Kshs. 1,000) Bond A Bond B 1 0% coupon (annual), 5 years to maturity Zero coupon bond, 10 years to maturity Required: Assuming the market yield on both bonds is currently 8%, calculate the prices of these two bonds. (4 marks) Assuming the market yield of 8% calculate the durations of each of these bonds. (4 marks ii) Suppose you manage fixed investment for Tana River Fund. You know that the seven years from today. Based on your answers to parts (i) and (ii) above, calculafe the positions you would take today in bonds A and B that. would immunize the Fund against fund has commitment to pay out Kshs,10,00 (4 marks) How many of each of these bonds would you need to buy today to hedge your interest rate risk during the next seven years. iv) (4 marks) Krhs 10 000 00 liability against interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started