Answered step by step

Verified Expert Solution

Question

1 Approved Answer

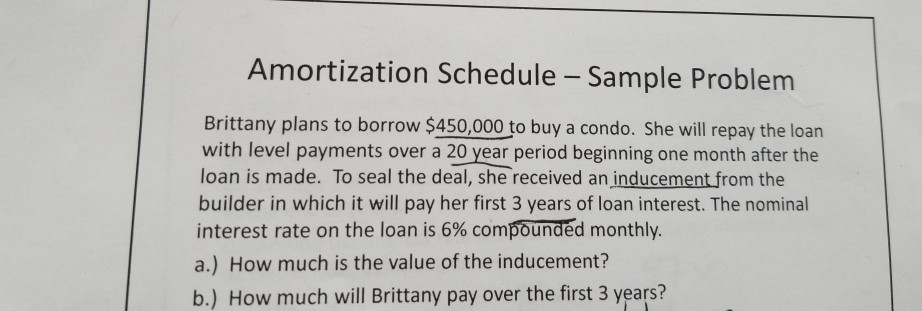

Amortization Schedule - Sample Problem Brittany plans to borrow $450,000 to buy a condo. She will repay the loan with level payments over a 20

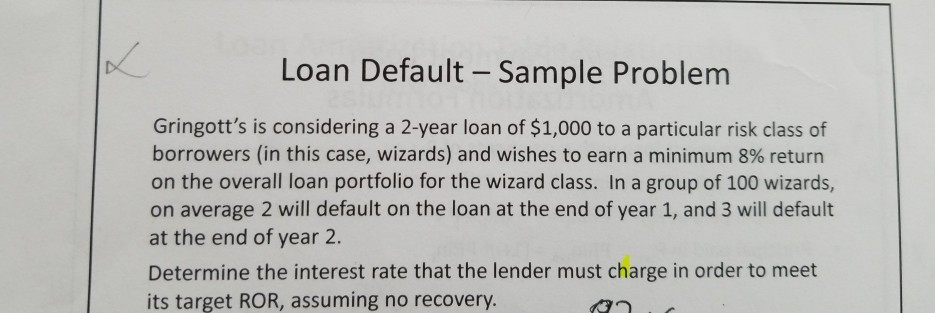

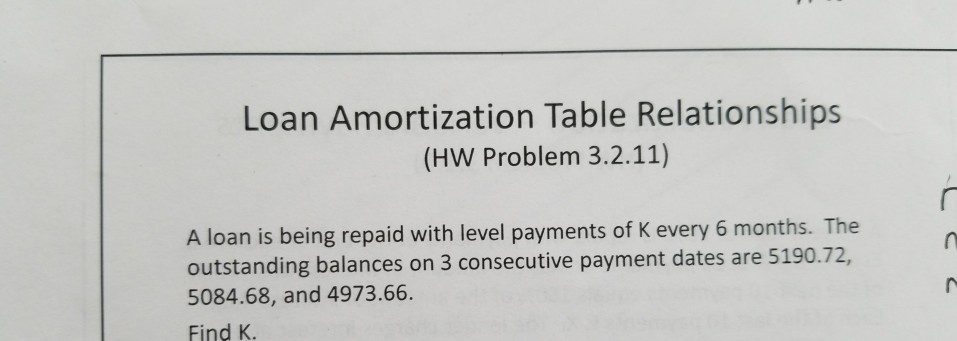

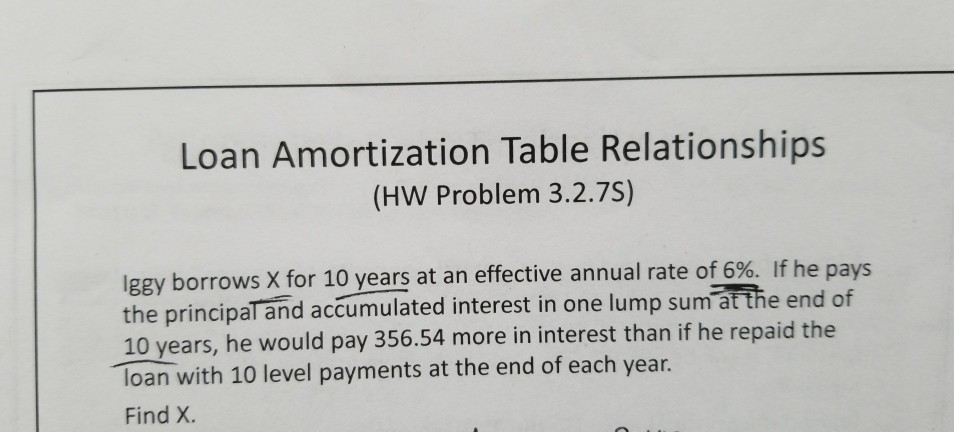

Amortization Schedule - Sample Problem Brittany plans to borrow $450,000 to buy a condo. She will repay the loan with level payments over a 20 year period beginning one month after the loan is made. To seal the deal, she received an inducement from the builder in which it will pay her first 3 years of loan interest. The nominal interest rate on the loan is 6% compounded monthly a.) How much is the value of the inducement? b.) How much will Brittany pay over the first 3 years? Loan Default - Sample Problem Gringott's is considering a 2-year loan of $1,000 to a particular risk class of borrowers (in this case, wizards) and wishes to earn a minimum 8% return on the overall loan portfolio for the wizard class. In a group of 100 wizards, on average 2 will default on the loan at the end of year 1, and 3 will default at the end of year 2. Determine the interest rate that the lender must charge in order to meet its target ROR, assuming no recovery. Loan Amortization Table Relationships (HW Problem 3.2.11) A loan is being repaid with level payments of K every 6 months. The outstanding balances on 3 consecutive payment dates are 5190.72, 5084.68, and 4973.66. Find K. Loan Amortization Table Relationships (HW Problem 3.2.7S) lgey borrows X for 10 years at an effective annual rate of 6%. If he pays the principal and accumulated interest in one lump sum at the end of 10 years, he would pay 356.54 more in interest than if he repaid the loan with 10 level payments at the end of each year. Find X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started