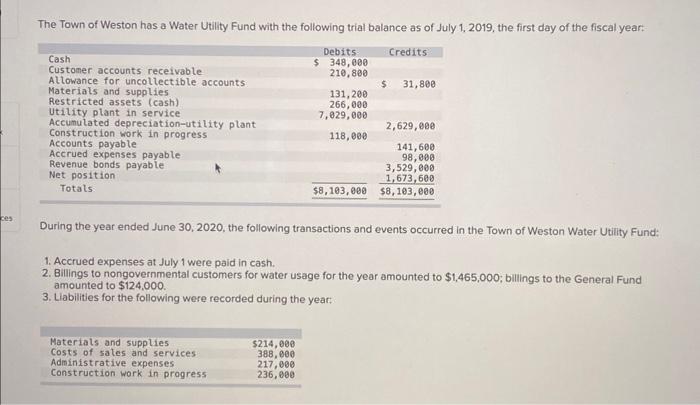

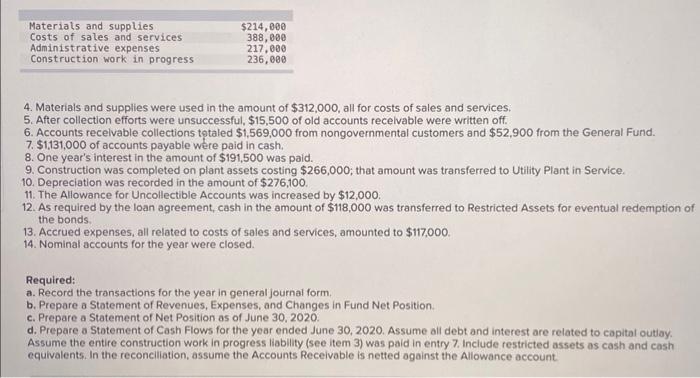

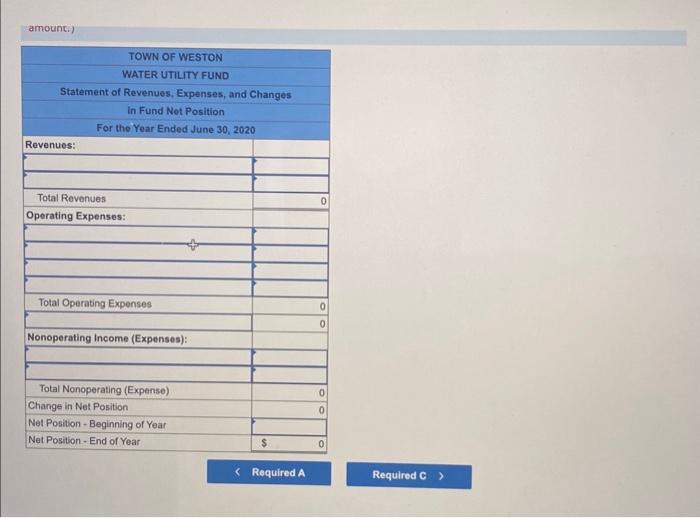

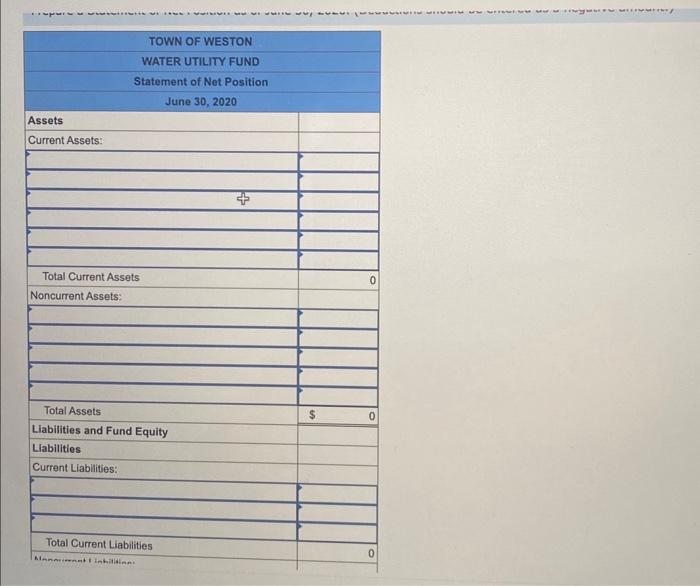

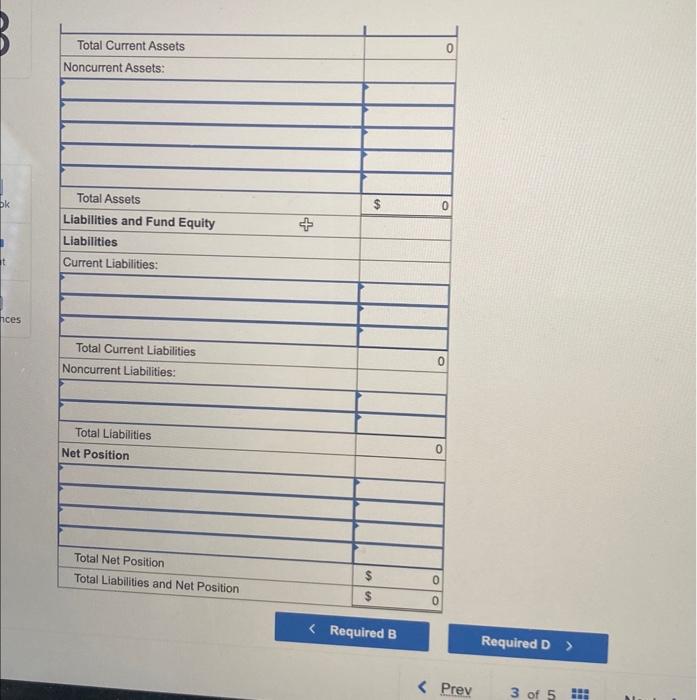

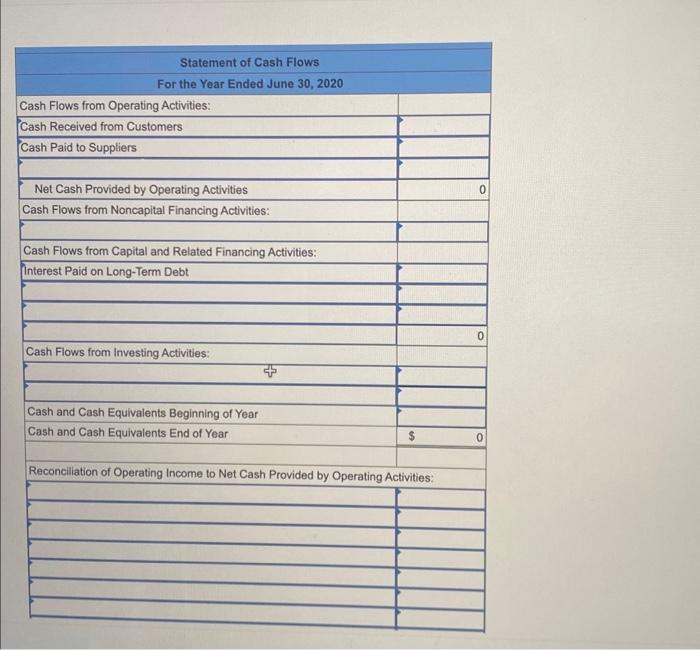

amounc.) \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ TOWN OF WESTON } \\ \hline \multicolumn{2}{|c|}{ WATER UTILITY FUND } \\ \hline \multicolumn{2}{|c|}{ Statement of Revenues, Expenses, and Changes } \\ \hline \multicolumn{2}{|c|}{ In Fund Not Position } \\ \hline \multicolumn{2}{|c|}{ For the Year Ended June 30, 2020} \\ \hline \multicolumn{2}{|l|}{ Revenues: } \\ \hline & \\ \hline \\ \hline Total Rovenues & 0 \\ \hline \multicolumn{2}{|l|}{ Operating Expenses: } \\ \hline & \\ \hline \multicolumn{2}{|l|}{20} \\ \hline \\ \hline & \\ \hline \multirow[t]{2}{*}{ Total Operating Expenses } & 0 \\ \hline & 0 \\ \hline \multicolumn{2}{|l|}{ Nonoperating Income (Expenses): } \\ \hline & \\ \hline \multicolumn{2}{|c|}{ (2) } \\ \hline Total Nonoperating (Expenso) & 0 \\ \hline Change in Net Position & 0 \\ \hline \multicolumn{2}{|l|}{ Net Position - Beginning of Year } \\ \hline Net Position - End of Year & $ \\ \hline \end{tabular} Required A Required C \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Statement of Cash Flows } \\ \hline For the Year Ended June 30, 2020 \\ \hline Cash Received from Customers & \\ \hline Cash Paid to Suppliers & \\ \hline & \\ \hline Net Cash Provided by Operating Activities & \\ \hline Cash Flows from Noncapital Financing Activities: & \\ \hline & \\ \hline Cash Flows from Capital and Related Financing Activities: & \\ \hline Interest Paid on Long-Term Debt & \\ \hline & \\ \hline & \\ \hline & \\ \hline Cash Flows from Investing Activities: & \\ \hline & \\ \hline Cash and Cash Equivalents End of Year & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Total Current Assets } & \\ \hline Noncurrent Assets: & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline Total Assets & \\ \hline Liabilities and Fund Equity & \\ \hline Liabilities & \\ \hline Current Liabilities: & \\ \hline & \\ \hline & \\ \hline Total Liabilities & \\ \hline Total Current Liabilities & \\ \hline Noncurrent Liabilities: & \\ \hline & \\ \hline \end{tabular} Required B Required D Prev 3 of 5 4. Materials and supplies were used in the amount of $312,000, all for costs of sales and services. 5. After collection efforts were unsuccessful, $15,500 of old accounts recelvable were written off. 6. Accounts recelvable collections totaled $1,569,000 from nongovernmental customers and $52,900 from the General Fund. 7. $1,131,000 of accunts payable were paid in cash. 8. One year's interest in the amount of $191,500 was paid. 9. Construction was completed on plant assets costing $266,000; that amount was transferred to Utility Plant in Service. 10. Depreciation was recorded in the amount of $276,100. 11. The Allowance for Uncollectible Accounts was increased by $12,000. 12. As required by the loan agreement, cash in the amount of $118,000 was transferred to Restricted Assets for eventual redemption of the bonds. 13. Accrued expenses, all related to costs of sales and services, amounted to $117,000. 14. Nominal accounts for the year were closed. Required: a. Record the transactions for the year in general journal form. b. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position. c. Prepare a Statement of Net Position as of June 30, 2020. d. Prepare a Statement of Cash Flows for the year ended June 30, 2020. Assume all debt and interest are related to capital outiay. Assume the entire construction work in progress liablity (see item 3) was paid in entry 7 . Include restricted assets as cash and cash equivalents. In the reconciliation, assume the Accounts Receivable is netted ogainst the Allowance account. The Town of Weston has a Water Utility Fund with the following trial balance as of July 1,2019, the first day of the fiscal year: During the year ended June 30,2020, the following transactions and events occurred in the Town of Weston Water Utility Fund: 1. Accrued expenses at July 1 were paid in cash. 2. Billings to nongovernmental customers for water usage for the year amounted to $1,465,000; billings to the General Fund amounted to $124,000. 3. Llabilities for the following were recorded during the year