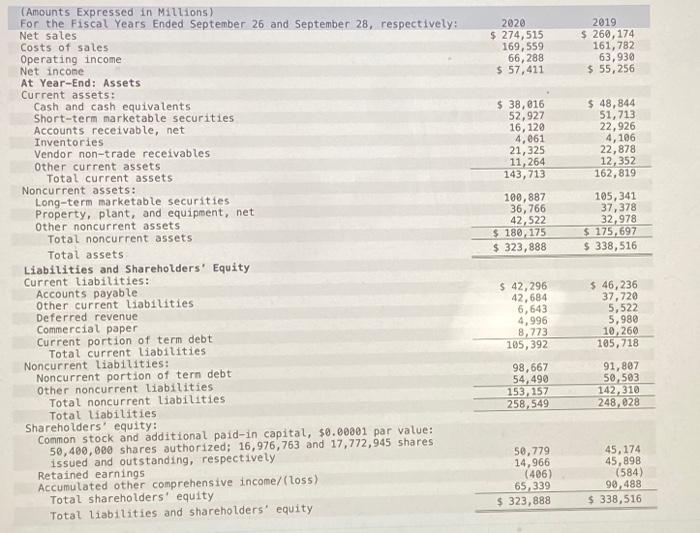

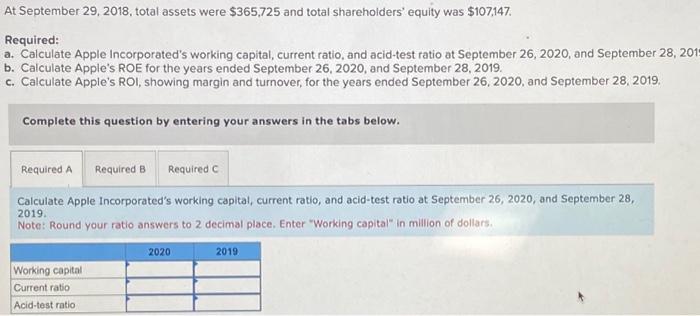

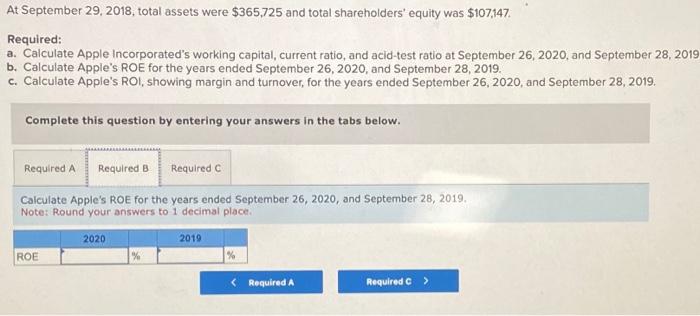

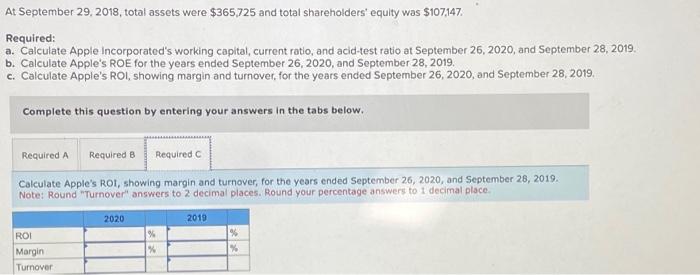

(Amounts Expressed in Millions) For the Fiscal Years Ended September 26 and September 28, respectively: Net sates Costs of sales Operating income Net incone At Year-End: Assets Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, net Inventories Vendor non-trade receivables other current assets Total current assets Noncurrent assets: Long-term marketable securities Property, plant, and equipment, net other noncurrent assets Total noncurrent assets Total assets \begin{tabular}{rr} 100,887 & 105,341 \\ 36,766 & 37,378 \\ 42,522 & 32,978 \\ \hline$180,175 & $175,697 \\ \hline$323,888 & $338,516 \\ \hline \end{tabular} Liabilities and Shareholders: Equity Current liabilities: Accounts payable other current liabilities Deferred revenue Commercial paper Current portion of term debt Total current liabilities Noncurrent liabilities: Noncurrent portion of tern debt other noncurrent liabilities Total noncurrent liabilities Total liabilities Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,080 shares author 1 zed; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/( (oss) Total shareholders' equity Total liabilities and shareholders' equity At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28 , 2 b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 2019. Note: Round your ratio answers to 2 decimal place. Enter "Working capital" in million of dollars. At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 20 b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. Note: Round your answers to 1 decimal place. At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28,2019. b. Calculate Apple's ROE for the years ended September 26,2020 , and September 28,2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 26, 2019. Note: Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place. (Amounts Expressed in Millions) For the Fiscal Years Ended September 26 and September 28, respectively: Net sates Costs of sales Operating income Net incone At Year-End: Assets Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, net Inventories Vendor non-trade receivables other current assets Total current assets Noncurrent assets: Long-term marketable securities Property, plant, and equipment, net other noncurrent assets Total noncurrent assets Total assets \begin{tabular}{rr} 100,887 & 105,341 \\ 36,766 & 37,378 \\ 42,522 & 32,978 \\ \hline$180,175 & $175,697 \\ \hline$323,888 & $338,516 \\ \hline \end{tabular} Liabilities and Shareholders: Equity Current liabilities: Accounts payable other current liabilities Deferred revenue Commercial paper Current portion of term debt Total current liabilities Noncurrent liabilities: Noncurrent portion of tern debt other noncurrent liabilities Total noncurrent liabilities Total liabilities Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,080 shares author 1 zed; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/( (oss) Total shareholders' equity Total liabilities and shareholders' equity At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28 , 2 b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 2019. Note: Round your ratio answers to 2 decimal place. Enter "Working capital" in million of dollars. At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28, 20 b. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple's ROE for the years ended September 26, 2020, and September 28, 2019. Note: Round your answers to 1 decimal place. At September 29,2018 , total assets were $365,725 and total shareholders' equity was $107,147. Required: a. Calculate Apple Incorporated's working capital, current ratio, and acid-test ratio at September 26, 2020, and September 28,2019. b. Calculate Apple's ROE for the years ended September 26,2020 , and September 28,2019. c. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 28,2019. Complete this question by entering your answers in the tabs below. Calculate Apple's ROI, showing margin and turnover, for the years ended September 26, 2020, and September 26, 2019. Note: Round "Turnover" answers to 2 decimal places. Round your percentage answers to 1 decimal place