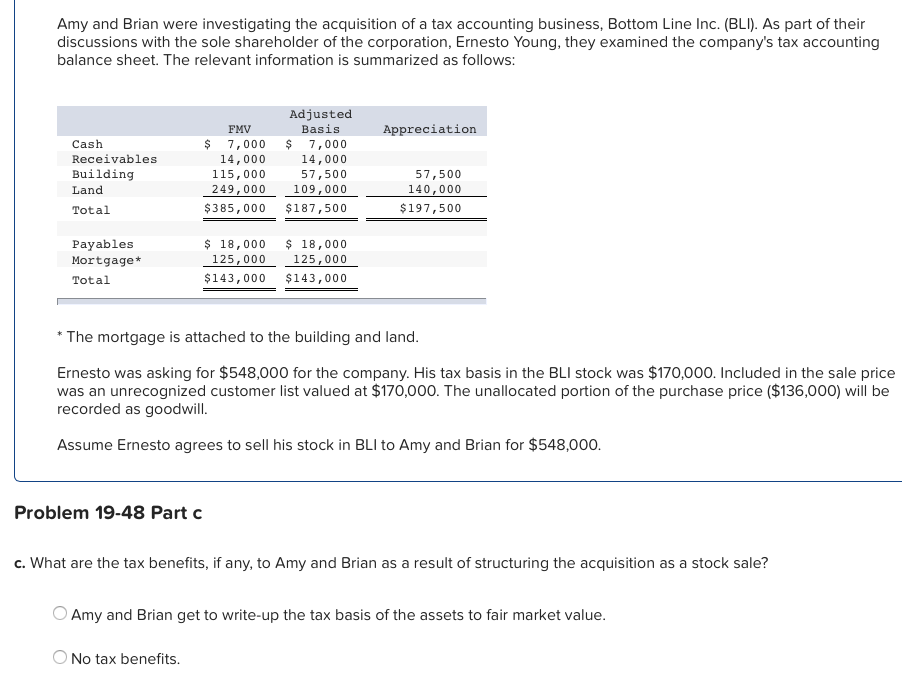

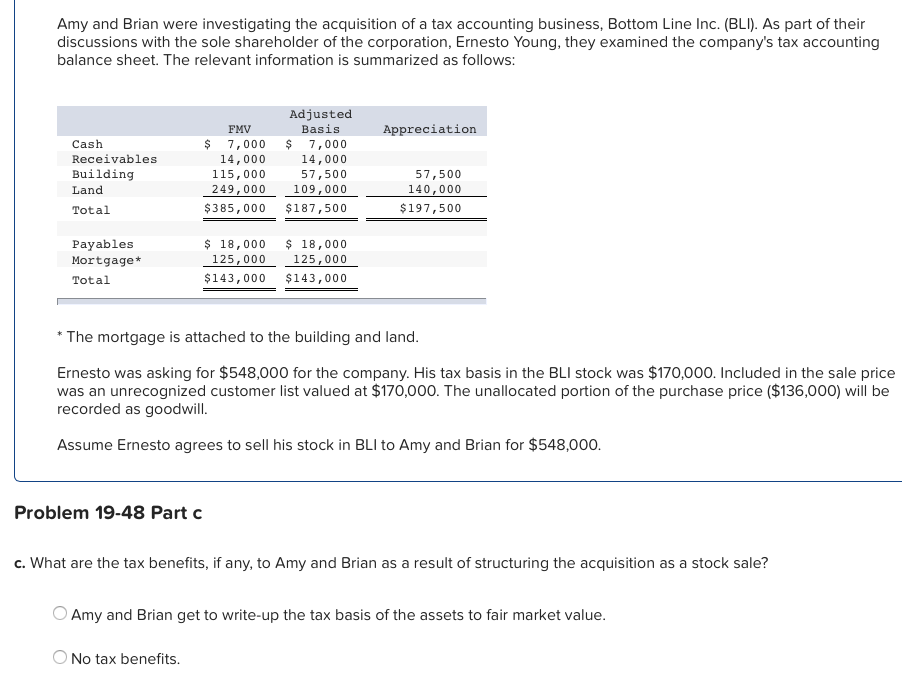

Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc. (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: Appreciation Cash Receivables Building Land FMV $ 7,000 14,000 115,000 249,000 $385,000 Adjusted Basis $ 7,000 14,000 57,500 109,000 $187,500 57,500 140,000 $ 197,500 Total Payables Mortgage* Total $ 18,000 125,000 $143,000 $ 18,000 125,000 $143,000 * The mortgage is attached to the building and land. Ernesto was asking for $548,000 for the company. His tax basis in the BLI stock was $170,000. Included in the sale price was an unrecognized customer list valued at $170,000. The unallocated portion of the purchase price ($136,000) will be recorded as goodwill. Assume Ernesto agrees to sell his stock in BLI to Amy and Brian for $548,000. Problem 19-48 Part c. What are the tax benefits, if any, to Amy and Brian as a result of structuring the acquisition as a stock sale? O Amy and Brian get to write-up the tax basis of the assets to fair market value. O No tax benefits. Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc. (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: Appreciation Cash Receivables Building Land FMV $ 7,000 14,000 115,000 249,000 $385,000 Adjusted Basis $ 7,000 14,000 57,500 109,000 $187,500 57,500 140,000 $ 197,500 Total Payables Mortgage* Total $ 18,000 125,000 $143,000 $ 18,000 125,000 $143,000 * The mortgage is attached to the building and land. Ernesto was asking for $548,000 for the company. His tax basis in the BLI stock was $170,000. Included in the sale price was an unrecognized customer list valued at $170,000. The unallocated portion of the purchase price ($136,000) will be recorded as goodwill. Assume Ernesto agrees to sell his stock in BLI to Amy and Brian for $548,000. Problem 19-48 Part c. What are the tax benefits, if any, to Amy and Brian as a result of structuring the acquisition as a stock sale? O Amy and Brian get to write-up the tax basis of the assets to fair market value. O No tax benefits