Answered step by step

Verified Expert Solution

Question

1 Approved Answer

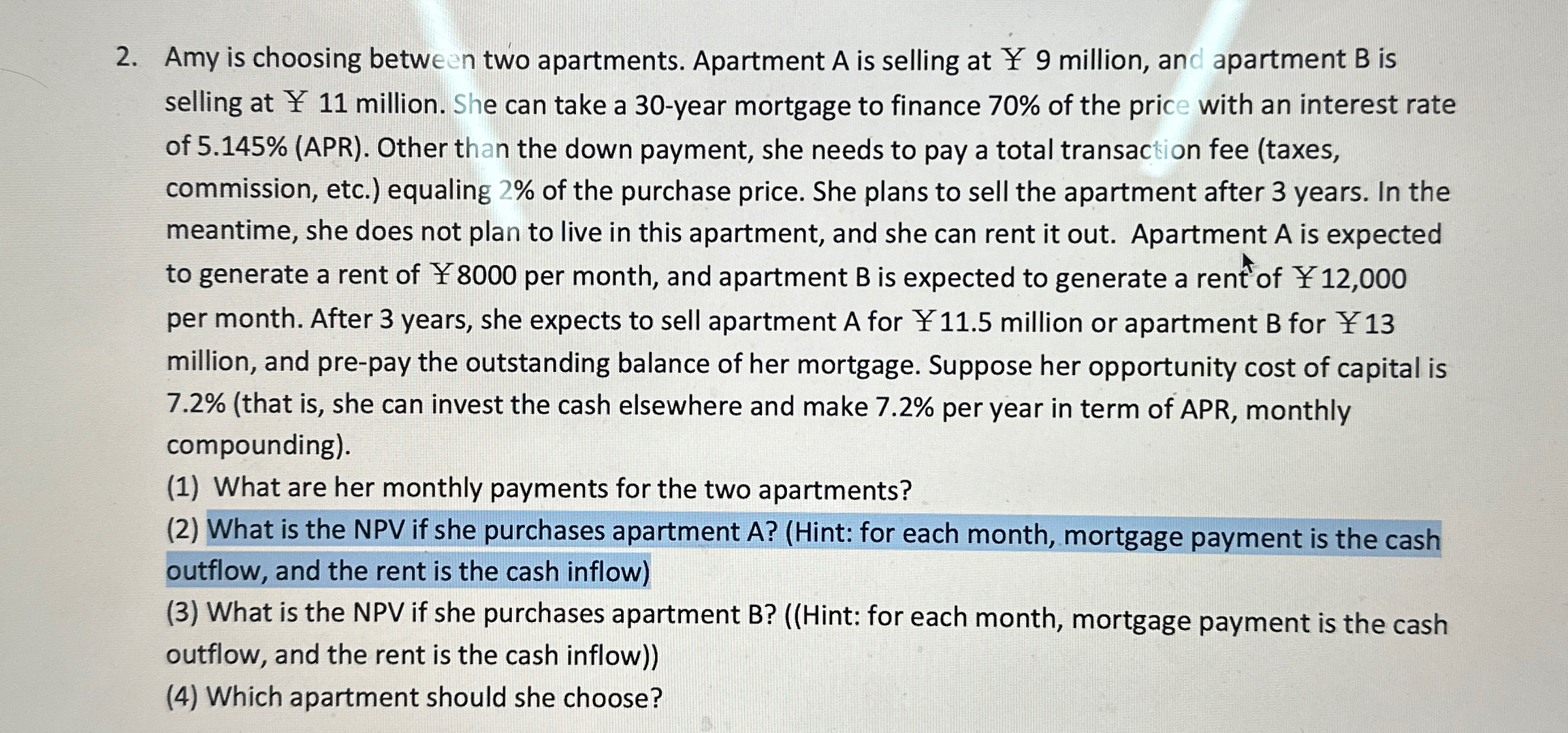

Amy is choosing between two apartments. Apartment A is selling at 9 million, and apartment B is selling at Y 1 1 million. She can

Amy is choosing between two apartments. Apartment A is selling at million, and apartment is selling at million. She can take a year mortgage to finance of the price with an interest rate of APR Other than the down payment, she needs to pay a total transaction fee taxes commission, etc. equaling of the purchase price. She plans to sell the apartment after years. In the meantime, she does not plan to live in this apartment, and she can rent it out. Apartment is expected to generate a rent of per month, and apartment B is expected to generate a rent of per month. After years, she expects to sell apartment A for million or apartment B for million, and prepay the outstanding balance of her mortgage. Suppose her opportunity cost of capital is that is she can invest the cash elsewhere and make per year in term of APR, monthly compounding

What are her monthly payments for the two apartments?

What is the NPV if she purchases apartment AHint: for each month, mortgage payment is the cash outflow, and the rent is the cash inflow

What is the NPV if she purchases apartment BHint: for each month, mortgage payment is the cash outflow, and the rent is the cash inflow

Which apartment should she choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started