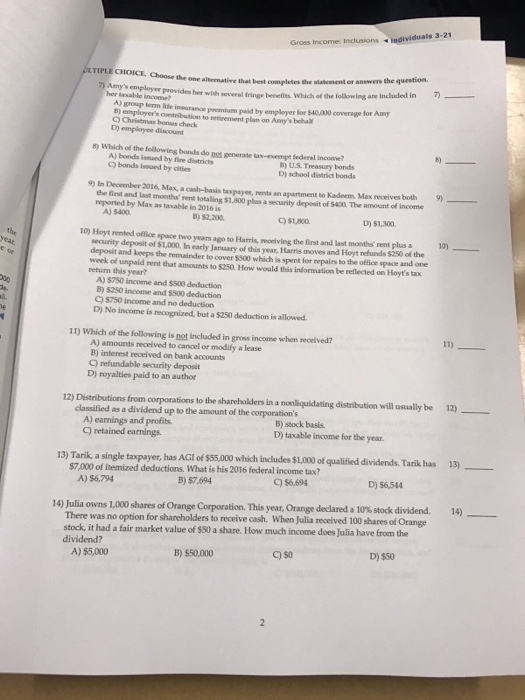

Amy's employer provides her with several fringe benefits. Which of the following are included in her income? A) group term life insurance premium paid by employer for $40,000 coverage for Amy B) employer's contribution to retirement plan on Amy's behalf C) Christmas bones check D) employer discount Which of the following bonds do not generate tax- federal income? A) bonds issued by fire districts B) U.S. Treasury bonds C) bonds issued by cities D) school districts bonds In December 2016, Max, a cash-basis taxpayer, rents an apartment to Kadeem. Max receive both the first and last months' rent totaling $1,800 plus a security deposit of $400. The amount of income reported by Max as taxable in 2016 is A) $400 B) $2,200. C) $1,800 D) $1,300 Hoyt rented office two years ago to Harris receiving the first and last month's rent plus a security deposit of $1,000. In early January of this year. Harris moves and Hoyt refunds $250 of the deposit and keeps the remainder to cover $500 which is spent for repairs to the office space and one week of unpaid rent that amounts to $250. How would this information be reflected on Hoyt's tax return this year? A) $750 income and $500 deduction B) $250 income and $500 deduction C) $750 income and no deduction D) No income is recognized, but a $250 deduction is allowed. Which of the following is not included in gross income when received? A) amounts received to cancel or modify a lease B) interest received on bank accounts C) refundable security deposit D) royalties paid to an author Distribution from corporations to the shareholders in a nonliquidating distribution will usually be classified as a dividend up to the amount of the corporation's A) earnings and profits. B) stock basis. C) retained earnings. D) taxable income for the year. Tarik, a single taxpayer, has AGI of $55,000 which includes $1,000 of qualified dividends. Tarik has $7,000 of itemized deductions. What is his 2016 federal income tax? A) $6,794 B) $7,694 C) $6,694 D) $6,544 Julia owns 1,000 shares of Orange Corporation. This year, Orange declared a 10% stock dividend There was no option for shareholders to receive cash. When Julia received 100 shares of Orange stock, it had a fair market value of $50 a share. How much income does Julia have from the dividend? A) $5,000 B) $50,000 C) $0 D) $50 Amy's employer provides her with several fringe benefits. Which of the following are included in her income? A) group term life insurance premium paid by employer for $40,000 coverage for Amy B) employer's contribution to retirement plan on Amy's behalf C) Christmas bones check D) employer discount Which of the following bonds do not generate tax- federal income? A) bonds issued by fire districts B) U.S. Treasury bonds C) bonds issued by cities D) school districts bonds In December 2016, Max, a cash-basis taxpayer, rents an apartment to Kadeem. Max receive both the first and last months' rent totaling $1,800 plus a security deposit of $400. The amount of income reported by Max as taxable in 2016 is A) $400 B) $2,200. C) $1,800 D) $1,300 Hoyt rented office two years ago to Harris receiving the first and last month's rent plus a security deposit of $1,000. In early January of this year. Harris moves and Hoyt refunds $250 of the deposit and keeps the remainder to cover $500 which is spent for repairs to the office space and one week of unpaid rent that amounts to $250. How would this information be reflected on Hoyt's tax return this year? A) $750 income and $500 deduction B) $250 income and $500 deduction C) $750 income and no deduction D) No income is recognized, but a $250 deduction is allowed. Which of the following is not included in gross income when received? A) amounts received to cancel or modify a lease B) interest received on bank accounts C) refundable security deposit D) royalties paid to an author Distribution from corporations to the shareholders in a nonliquidating distribution will usually be classified as a dividend up to the amount of the corporation's A) earnings and profits. B) stock basis. C) retained earnings. D) taxable income for the year. Tarik, a single taxpayer, has AGI of $55,000 which includes $1,000 of qualified dividends. Tarik has $7,000 of itemized deductions. What is his 2016 federal income tax? A) $6,794 B) $7,694 C) $6,694 D) $6,544 Julia owns 1,000 shares of Orange Corporation. This year, Orange declared a 10% stock dividend There was no option for shareholders to receive cash. When Julia received 100 shares of Orange stock, it had a fair market value of $50 a share. How much income does Julia have from the dividend? A) $5,000 B) $50,000 C) $0 D) $50