Answered step by step

Verified Expert Solution

Question

1 Approved Answer

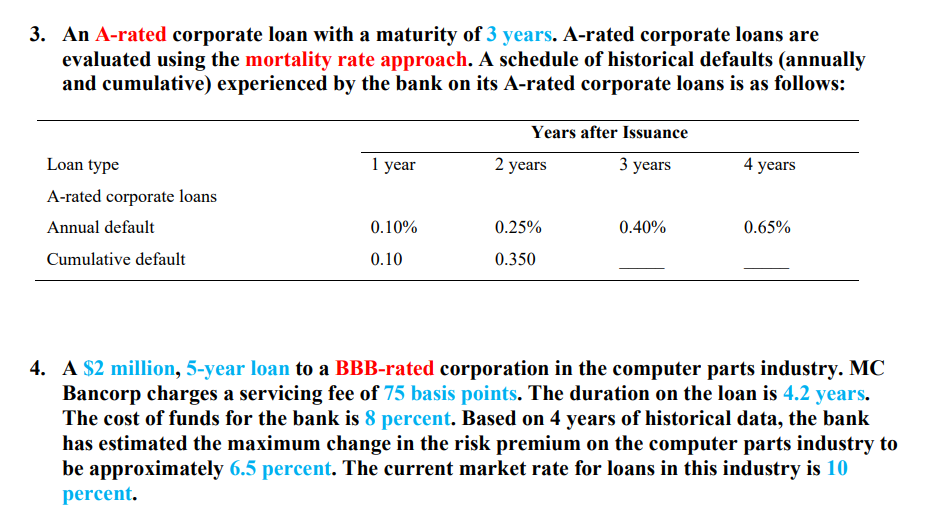

An A - rated corporate loan with a maturity of 3 years. A - rated corporate loans are evaluated using the mortality rate approach. A

An Arated corporate loan with a maturity of years. Arated corporate loans are

evaluated using the mortality rate approach. A schedule of historical defaults annually

and cumulative experienced by the bank on its Arated corporate loans is as follows:

A $ million, year loan to a BBBrated corporation in the computer parts industry. MC

Bancorp charges a servicing fee of basis points. The duration on the loan is years.

The cost of funds for the bank is percent. Based on years of historical data, the bank

has estimated the maximum change in the risk premium on the computer parts industry to

be approximately percent. The current market rate for loans in this industry is

percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started