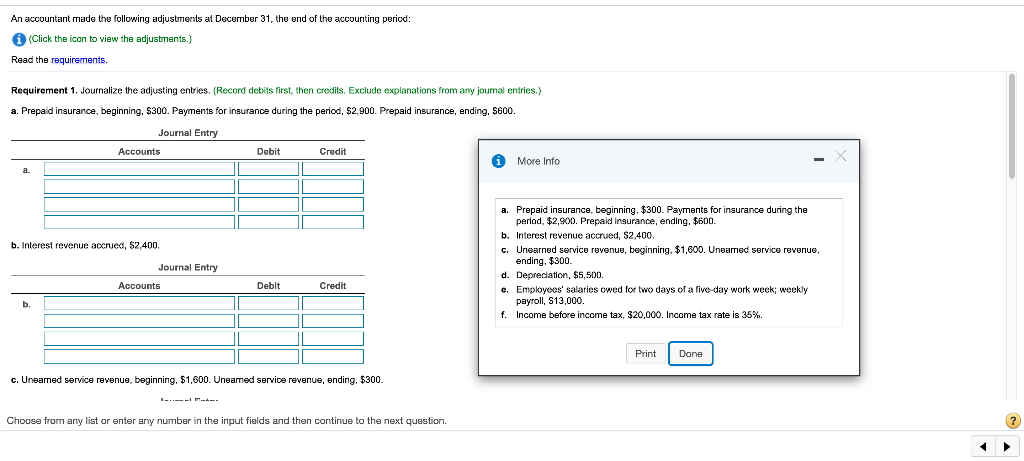

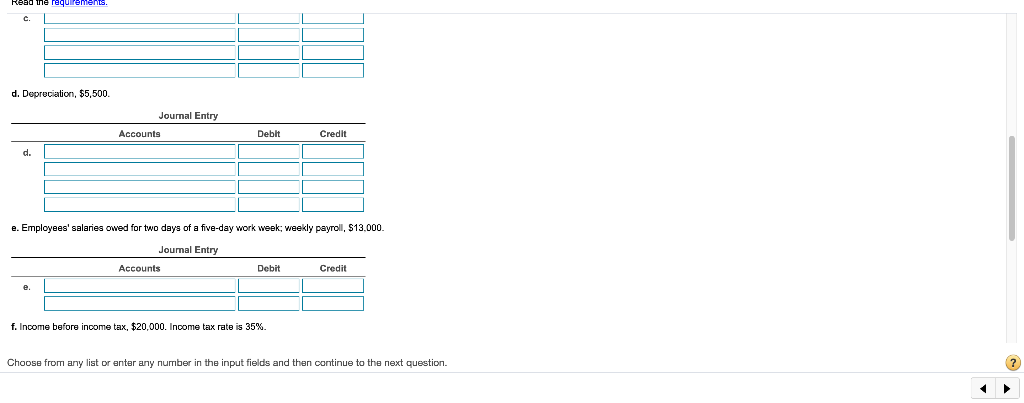

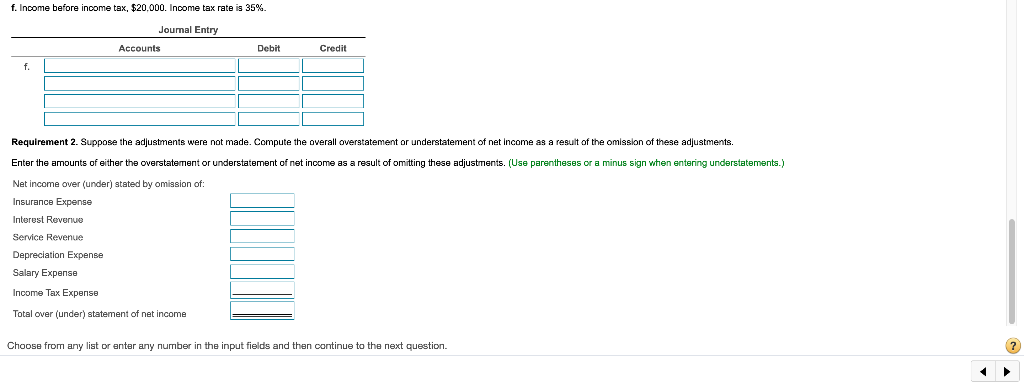

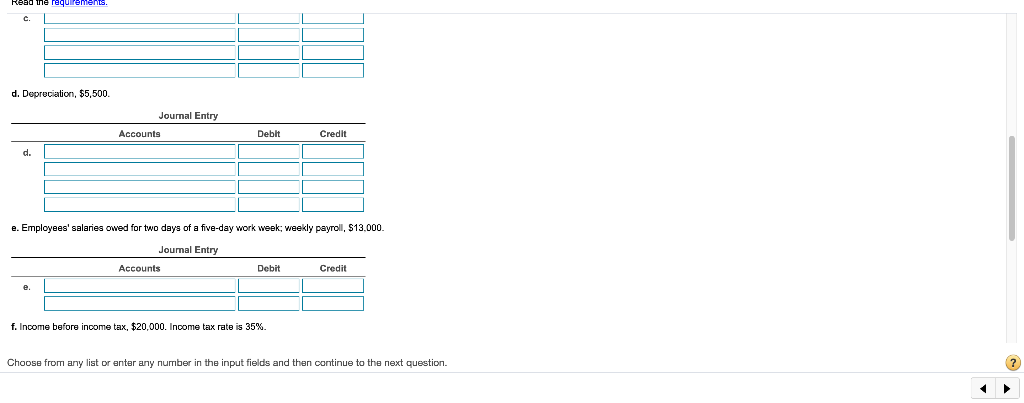

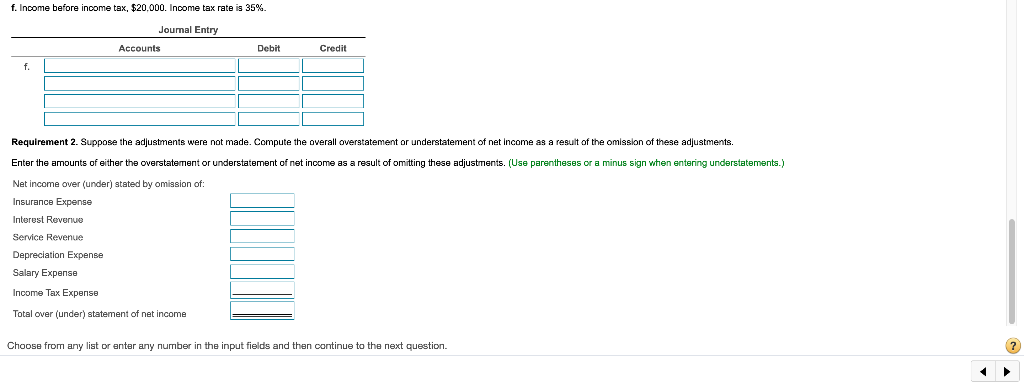

An accountant made the following adjustments at December 31, the end of the accounting period: (Click the icon to view the adjustments.) Read the requirements. Requirement 1. Journalize the adjusting entries. (Record debits first, then credits. Exclude explanations from any joumal entries.) a. Prepaid insurance, beginning. $300. Payments for insurance during the period, $2,900. Prepaid insurance, ending. S600. Journal Entry Accounts Debit Credit More Info b. Interest revenue accrued, $2.400. Journal Entry Accounts a. Prepaid insurance, beginning. $300. Payments for insurance during the period, $2,900. Prepaid insurance, ending. $600. b. Interest revenue accrued, $2,400. C. Unearned service revenue, beginning. $1,600. Uneamed service revenue, ending. $300 d. Depreciation, $5,500. c. Employees' salaries owed for two days of a five-day work week; weekly payroll, S13,000. f. Income before income tax, $20,000. Income tax rate is 35%. Debit Credit b Print Done c. Uneared service revenue, beginning, $1,600. Uneamed service revenue, ending. $300 I------- Choose from any list or enter any number in the input fields and then continue to the next question. ? the requirements c. d. Depreciation, $5,500 Journal Entry Accounts Debit Credit d. e. Employees' salaries owed for two days of a five-day work week: Weekly payroll, $13,000 Journal Entry Accounts Debit Credit e. f. Income before income tax, $20,000. Income tax rate is 35%. Choose from any list or enter any number in the input fields and then continue to the next question. ? f. Income before income tax, $20,000. Income tax rate is 35%. Journal Entry Accounts Debit Credit f. Requirement 2. Suppose the adjustments were not made. Compute the overall overstatement or understatement of net income as a result of the omission of these adjustments. Enter the amounts of either the overstatement or understatement of net income as a result of omitting these adjustments. (Use parentheses or a minus sign when entering understatements.) Net income over (under) stated by omission of Insurance Expense Interest Revenue Service Revenue Depreciation Expense Salary Expense Income Tax Expense Total over (under) statement of net income Choose from any list or enter any number in the input fields and then continue to the next