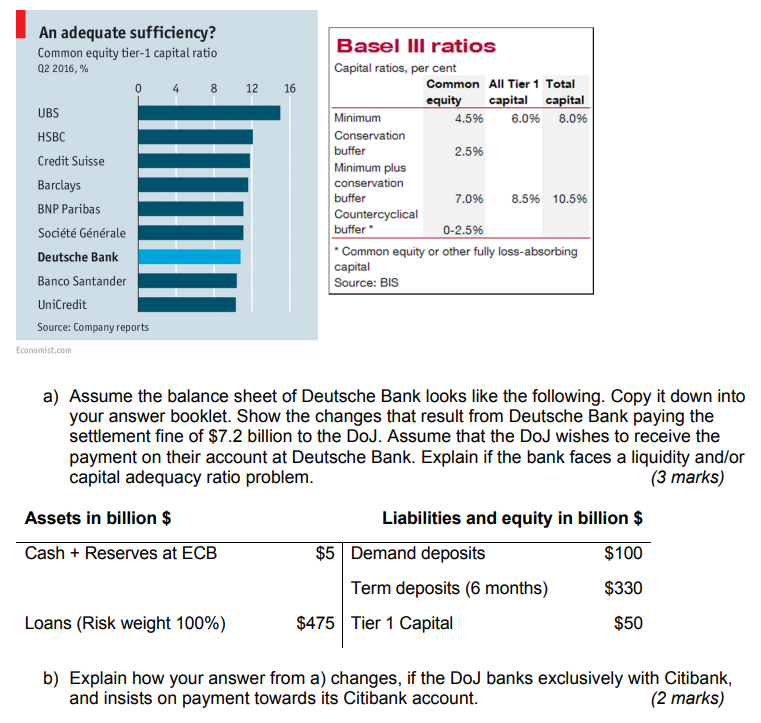

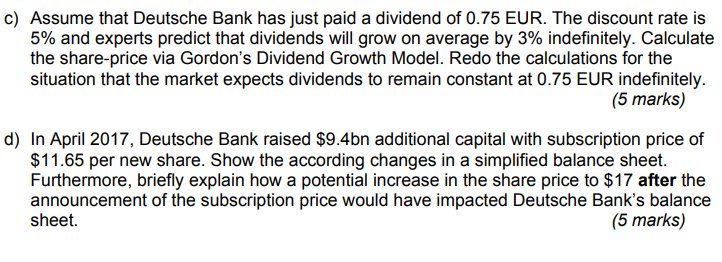

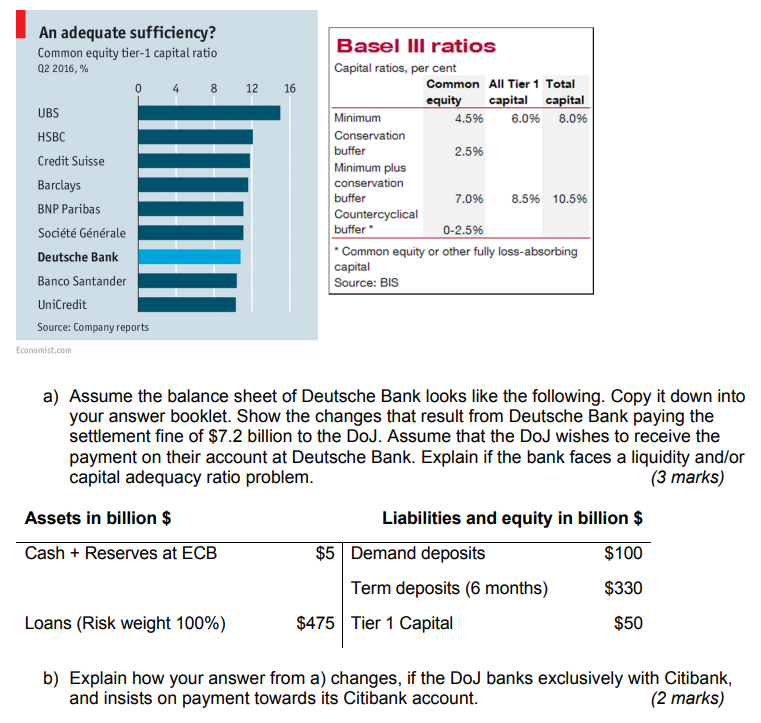

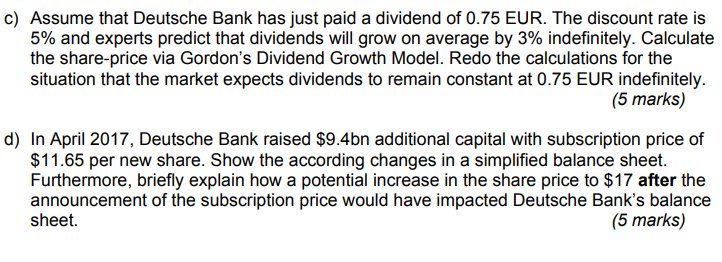

An adequate sufficiency? Common equity tier-1 capital ratio Q2 2016, % Basel III ratios Capital ratios, per cent Common All Tier 1 Total 8 12 16 capital ital 6.0% 8.0% UBS HSBC Credit Suisse Barclays BNP Paribas Socit Gnrale Deutsche Bank Banco Santander UniCredit Source: Company reports 4.5% Conservation 2.5% Minimum plus conservation buffer 7.0% 8.5% 10.5% buffer 0-2.5% Common equity or other fully loss-absorbing capital Source: BIS a) Assume the balance sheet of Deutsche Bank looks like the following. Copy it down into your answer booklet. Show the changes that result from Deutsche Bank paying the settlement fine of $7.2 billion to the DoJ. Assume that the DoJ wishes to receive the payment on their account at Deutsche Bank. Explain if the bank faces a liquidity and/or capital adequacy ratio problem (3 marks) Assets in billion $ Liabilities and equity in billion $ $100 $330 $50 Cash Reserves at ECE $5 Demand deposits Term deposits (6 months) Loans (Risk weight 100%) $475 Tier 1 Capital b) Explain how your answer from a) changes, if the DoJ banks exclusively with Citibank, (2 marks) and insists on payment towards its Citibank account. c) Assume that Deutsche Bank has just paid a dividend of 0.75 EUR. The discount rate is 5% and experts predict that dividends will grow on average by 3% indefinitely. Calculate the share-price via Gordon's Dividend Growth Model. Redo the calculations for the situation that the market expects dividends to remain constant at 0.75 EUR indefinitely. (5 marks) d) In April 2017, Deutsche Bank raised $9.4bn additional capital with subscription price of $11.65 per new share. Show the according changes in a simplified balance sheet. Furthermore, briefly explain how a potential increase in the share price to $17 after the announcement of the subscription price would have impacted Deutsche Bank's balance sheet (5 marks) An adequate sufficiency? Common equity tier-1 capital ratio Q2 2016, % Basel III ratios Capital ratios, per cent Common All Tier 1 Total 8 12 16 capital ital 6.0% 8.0% UBS HSBC Credit Suisse Barclays BNP Paribas Socit Gnrale Deutsche Bank Banco Santander UniCredit Source: Company reports 4.5% Conservation 2.5% Minimum plus conservation buffer 7.0% 8.5% 10.5% buffer 0-2.5% Common equity or other fully loss-absorbing capital Source: BIS a) Assume the balance sheet of Deutsche Bank looks like the following. Copy it down into your answer booklet. Show the changes that result from Deutsche Bank paying the settlement fine of $7.2 billion to the DoJ. Assume that the DoJ wishes to receive the payment on their account at Deutsche Bank. Explain if the bank faces a liquidity and/or capital adequacy ratio problem (3 marks) Assets in billion $ Liabilities and equity in billion $ $100 $330 $50 Cash Reserves at ECE $5 Demand deposits Term deposits (6 months) Loans (Risk weight 100%) $475 Tier 1 Capital b) Explain how your answer from a) changes, if the DoJ banks exclusively with Citibank, (2 marks) and insists on payment towards its Citibank account. c) Assume that Deutsche Bank has just paid a dividend of 0.75 EUR. The discount rate is 5% and experts predict that dividends will grow on average by 3% indefinitely. Calculate the share-price via Gordon's Dividend Growth Model. Redo the calculations for the situation that the market expects dividends to remain constant at 0.75 EUR indefinitely. (5 marks) d) In April 2017, Deutsche Bank raised $9.4bn additional capital with subscription price of $11.65 per new share. Show the according changes in a simplified balance sheet. Furthermore, briefly explain how a potential increase in the share price to $17 after the announcement of the subscription price would have impacted Deutsche Bank's balance sheet