Question

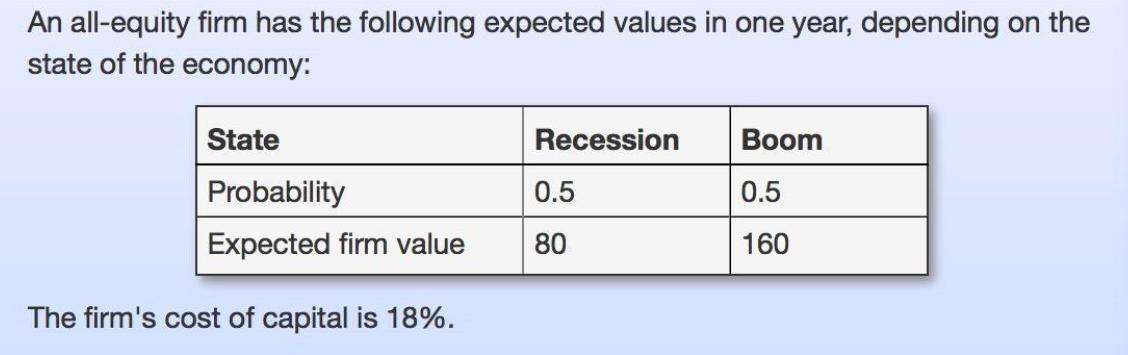

An all-equity firm has the following expected values in one year, depending on the state of the economy: State Recession Boom Probability 0.5 0.5

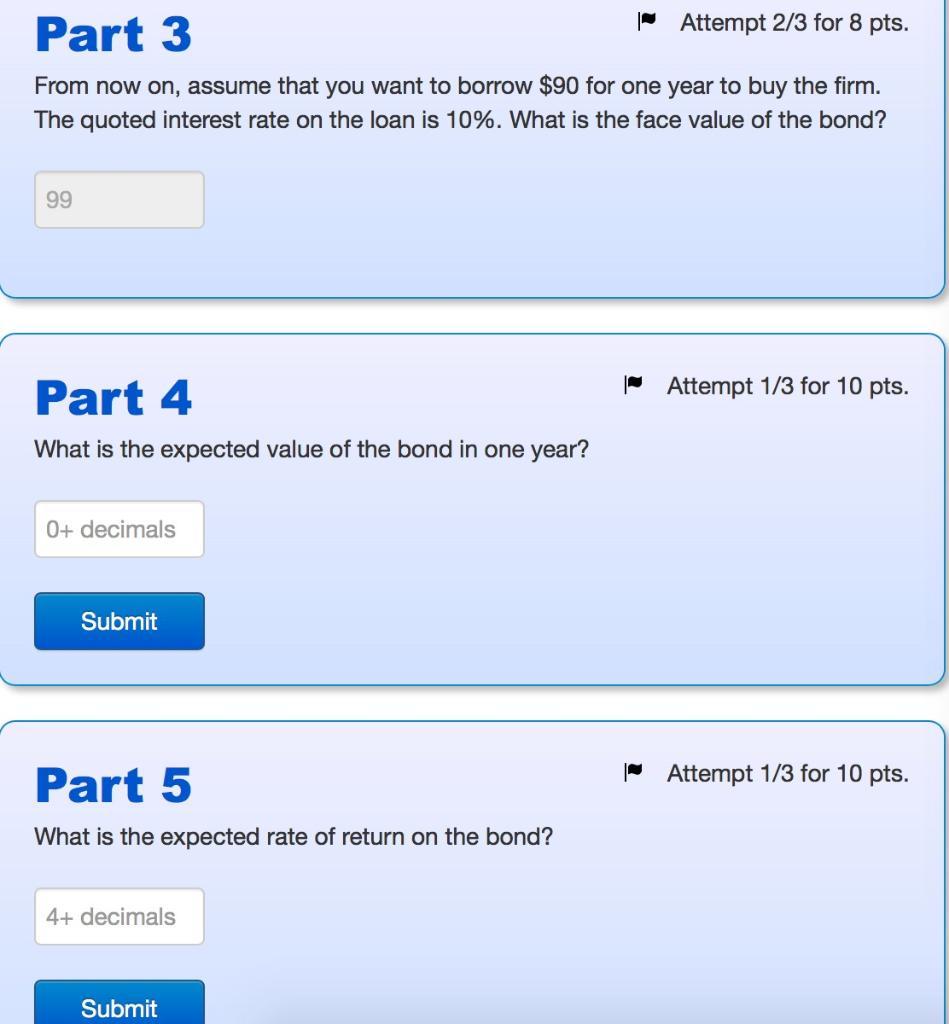

An all-equity firm has the following expected values in one year, depending on the state of the economy: State Recession Boom Probability 0.5 0.5 Expected firm value 80 160 The firm's cost of capital is 18%. Part 3 Attempt 2/3 for 8 pts. From now on, assume that you want to borrow $90 for one year to buy the firm. The quoted interest rate on the loan is 10%. What is the face value of the bond? 99 Part 4 What is the expected value of the bond in one year? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 5 What is the expected rate of return on the bond? | Attempt 1/3 for 10 pts. 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J . chris leach, Ronald w. melicher

4th edition

538478152, 978-0538478151

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App