Question

An all-equity firm wants to raise $50M to fund a new investment project. If things go well following the new investment, the present value of

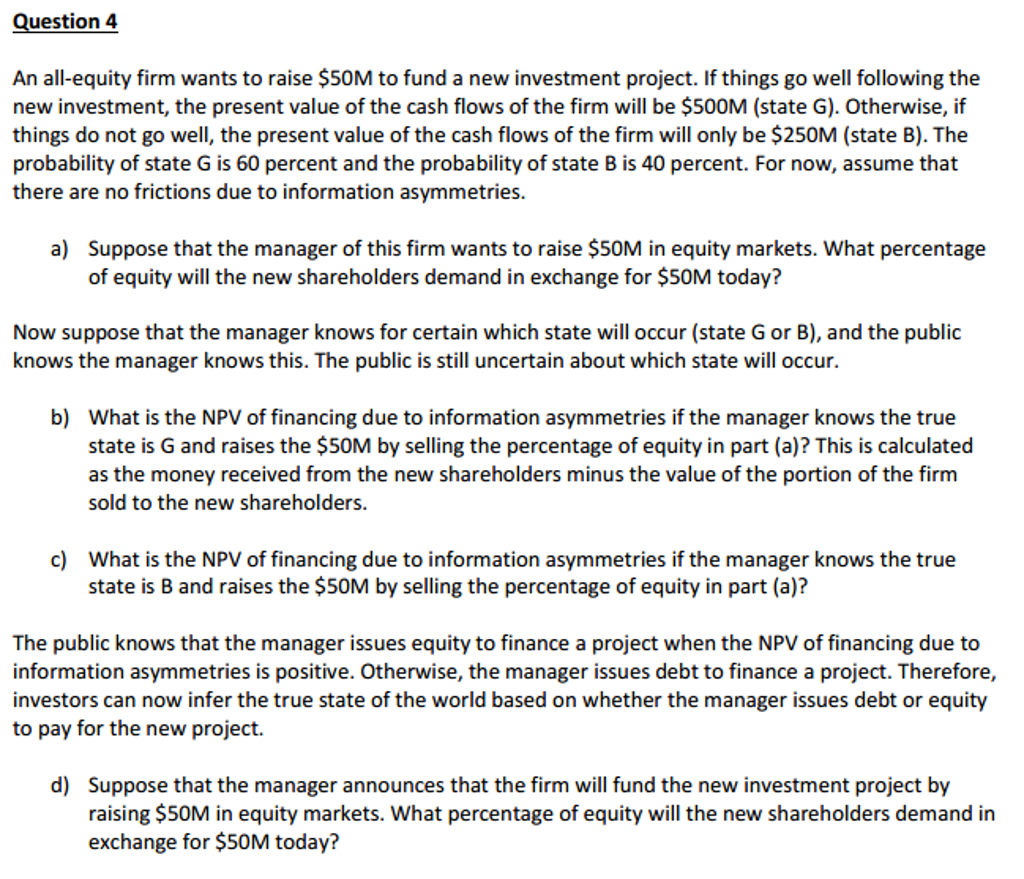

An all-equity firm wants to raise $50M to fund a new investment project. If things go well following the new investment, the present value of the cash flows of the firm will be $500M (state G). Otherwise, if things do not go well, the present value of the cash flows of the firm will only be $250M (state B). The probability of state G is 60 percent and the probability of state B is 40 percent. For now, assume that there are no frictions due to information asymmetries.

a) Suppose that the manager of this firm wants to raise $50M in equity markets. What percentage of equity will the new shareholders demand in exchange for $50M today? Now suppose that the manager knows for certain which state will occur (state G or B), and the public knows the manager knows this. The public is still uncertain about which state will occur

. b) What is the NPV of financing due to information asymmetries if the manager knows the true state is G and raises the $50M by selling the percentage of equity in part (a)? This is calculated as the money received from the new shareholders minus the value of the portion of the firm sold to the new shareholders.

c) What is the NPV of financing due to information asymmetries if the manager knows the true state is B and raises the $50M by selling the percentage of equity in part (a)? The public knows that the manager issues equity to finance a project when the NPV of financing due to information asymmetries is positive. Otherwise, the manager issues debt to finance a project. Therefore, investors can now infer the true state of the world based on whether the manager issues debt or equity to pay for the new project.

d) Suppose that the manager announces that the firm will fund the new investment project by raising $50M in equity markets. What percentage of equity will the new shareholders demand in exchange for $50M today?

step by step work without excel please

Question 4 An all-equity firm wants to raise $50M to fund a new investment project. If things go well following the new investment, the present value of the cash flows of the firm will be $500M (state G). Otherwise, if things do not go well, the present value of the cash flows of the firm will only be $250M (state B). The probability of state G is 60 percent and the probability of state B is 40 percent. For now, assume that there are no frictions due to information asymmetries. a) Suppose that the manager of this firm wants to raise $50M in equity markets. What percentage of equity will the new shareholders demand in exchange for $50M today? Now suppose that the manager knows for certain which state will occur (state G or B), and the public knows the manager knows this. The public is still uncertain about which state will occur. b) What is the NPV of financing due to information asymmetries if the manager knows the true state is G and raises the $50M by selling the percentage of equity in part (a)? This is calculated as the money received from the new shareholders minus the value of the portion of the firm sold to the new shareholders. c) What is the NPV of financing due to information asymmetries if the manager knows the true state is B and raises the $50M by selling the percentage of equity in part (a)? The public knows that the manager issues equity to finance a project when the NPV of financing due to information asymmetries is positive. Otherwise, the manager issues debt to finance a project. Therefore, investors can now infer the true state of the world based on whether the manager issues debt or equity o pay for the new project. Suppose that the manager announces that the firm will fund the new investment project by raising $50M in equity markets. What percentage of equity will the new shareholders demand in exchange for $50M today? d)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started