Answered step by step

Verified Expert Solution

Question

1 Approved Answer

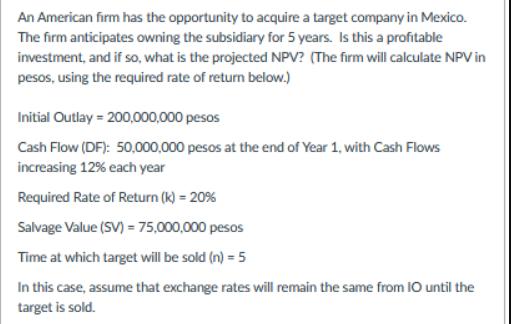

An American firm has the opportunity to acquire a target company in Mexico. The firm anticipates owning the subsidiary for 5 years. Is this

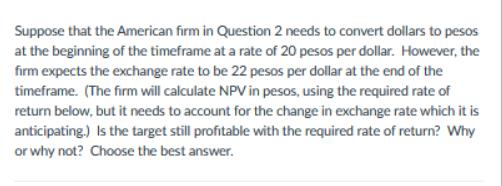

An American firm has the opportunity to acquire a target company in Mexico. The firm anticipates owning the subsidiary for 5 years. Is this a profitable investment, and if so, what is the projected NPV? (The firm will calculate NPV in pesos, using the required rate of return below.) Initial Outlay = 200,000,000 pesos Cash Flow (DF): 50,000,000 pesos at the end of Year 1, with Cash Flows increasing 12% each year Required Rate of Return (k) = 20% Salvage Value (SV) = 75,000,000 pesos Time at which target will be sold (n) = 5 In this case, assume that exchange rates will remain the same from IO until the target is sold. Suppose that the American firm in Question 2 needs to convert dollars to pesos at the beginning of the timeframe at a rate of 20 pesos per dollar. However, the firm expects the exchange rate to be 22 pesos per dollar at the end of the timeframe. (The firm will calculate NPV in pesos, using the required rate of return below, but it needs to account for the change in exchange rate which it is anticipating.) Is the target still profitable with the required rate of return? Why or why not? Choose the best answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started