Question

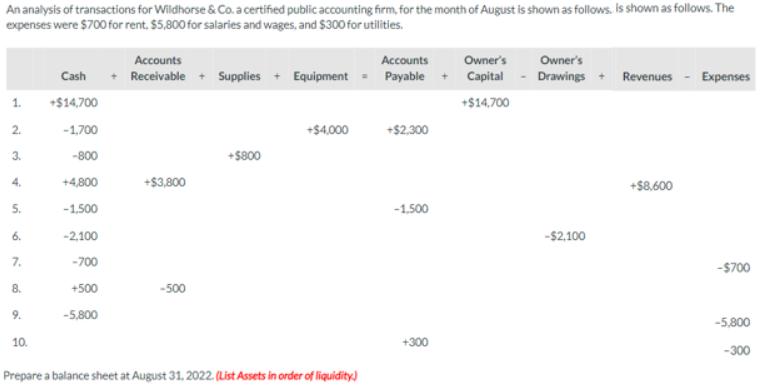

An analysis of transactions for Wildhorse & Co. a certified public accounting firm, for the month of August is shown as follows. is shown

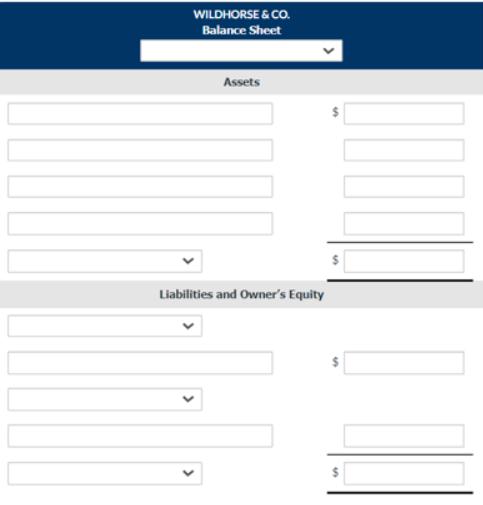

An analysis of transactions for Wildhorse & Co. a certified public accounting firm, for the month of August is shown as follows. is shown as follows. The expenses were $700 for rent, $5,800 for salaries and wages, and $300 for utilities. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Accounts Accounts Owner's Owner's Cash + Receivable + Supplies + Equipment Payable + Capital - Drawings + Revenues Expenses +$14,700 +$14,700 -1,700 -800 +4,800 -1.500 -2,100 -700 +500 -5,800 +$3,800 -500 +$800 +$4,000 Prepare a balance sheet at August 31, 2022. (List Assets in order of liquidity) +$2,300 -1.500 +300 -$2,100 +$8,600 -$700 -5,800 -300 WILDHORSE & CO. Balance Sheet Assets Liabilities and Owner's Equity

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

10 Balance Sheet Assets Cash Accounts recievable Spplie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso

12th edition

1119132223, 978-1-119-0944, 1118875052, 978-1119132226, 978-1118875056

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App