Question

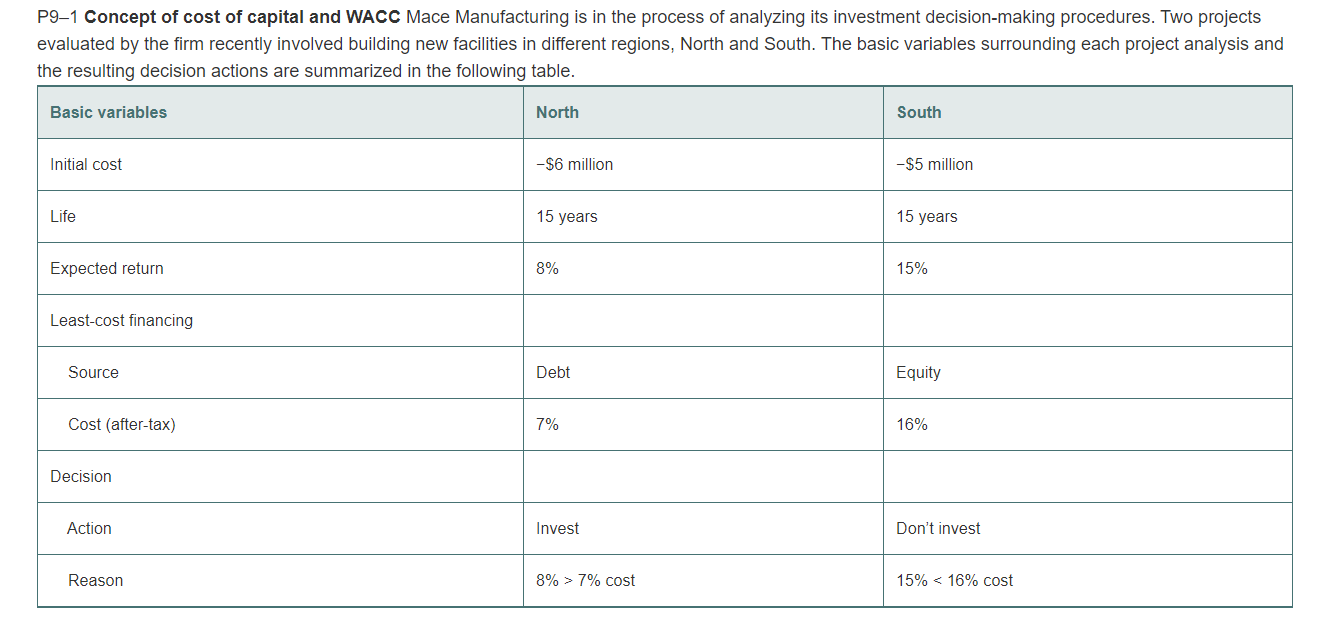

An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 7%. What recommendation do you think

-

An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 7%. What recommendation do you think this analyst will make regarding the investment opportunity?

-

Another analyst assigned to study the South facility believes that funding for that project will come from the firms retained earnings at a cost of 16%. What recommendation do you expect this analyst to make regarding the investment?

-

Explain why the decisions in parts a and b may not be in the best interests of the firms investors.

-

If the firm maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost of capital (WACC) using the data in the table.

-

If both analysts had used the WACC calculated in part d, what recommendations would they have made regarding the North and South facilities?

-

Compare and contrast the analysts initial recommendations with your findings in part e. Which decision method seems more appropriate? Explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started