Question

An analyst has estimated an equity beta of 1.2 for the company MultiTask Inc. The current return on a T-bond is 2%, and the equity

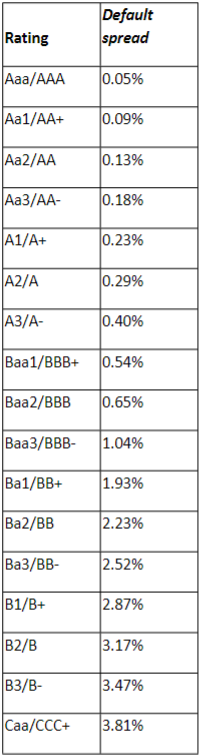

An analyst has estimated an equity beta of 1.2 for the company MultiTask Inc. The current return on a T-bond is 2%, and the equity risk premium is 4%. MultiTask has outstanding bonds, but they are rarely traded. However, the companys bonds have recently been rated and were assigned a rating grade of BBB. MultiTask has 500,000 outstanding shares and they currently trade at 140. The book value of the equity is 35 mill., whereas the book value of the debt is 40 mill. You can assume that the book value of the debt is equal to the market value of the debt. The tax rate is 40%. The association between the rating grade of bonds and the default spread is given in the following table:

a) Compute the cost of equity of MultiTask. b) Compute the after tax cost of debt of MultiTask. c) Compute the Weighted Average Cost of Capital (WACC) of MultiTask

a) Compute the cost of equity of MultiTask. b) Compute the after tax cost of debt of MultiTask. c) Compute the Weighted Average Cost of Capital (WACC) of MultiTask

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started