Question

An analyst is evaluating two companies, A and B. Company A has a debt ratio of 50% and Company B has a debt ratio

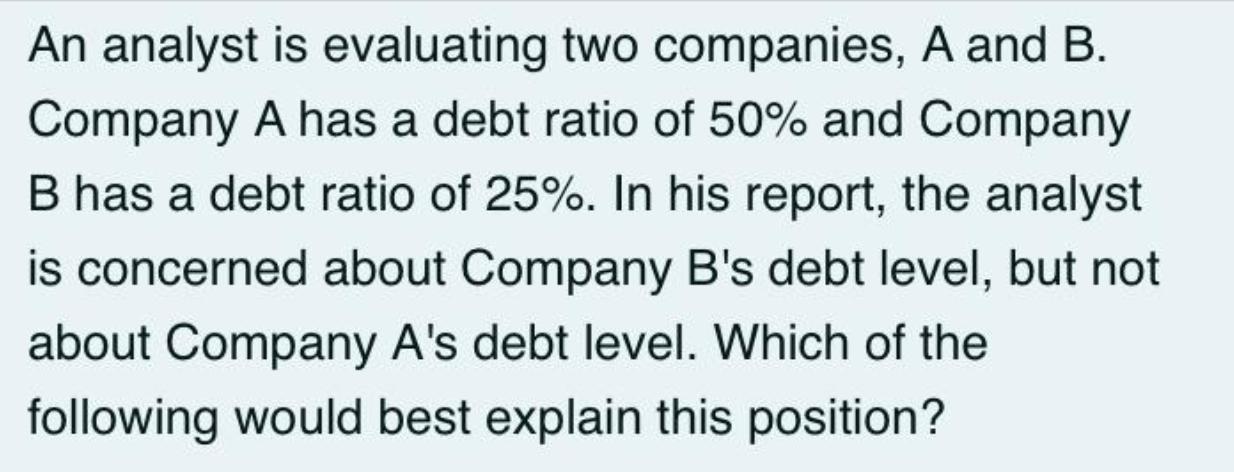

An analyst is evaluating two companies, A and B. Company A has a debt ratio of 50% and Company B has a debt ratio of 25%. In his report, the analyst is concerned about Company B's debt level, but not about Company A's debt level. Which of the following would best explain this position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The analysts concern about Company Bs debt level 25 compared to Company As 50 likely stems from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Engineering Economics

Authors: Chan S. Park

5th edition

136118488, 978-8120342095, 8120342097, 978-0136118480

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App