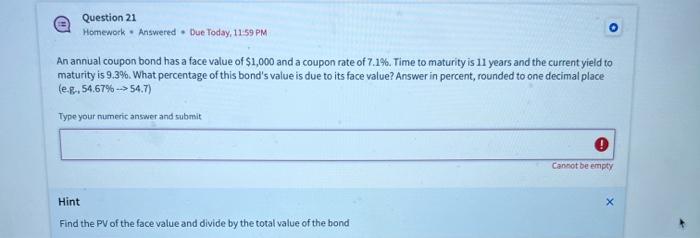

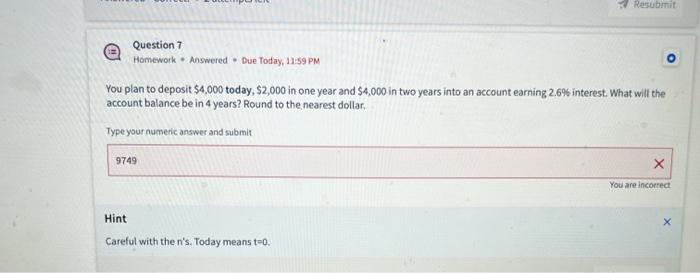

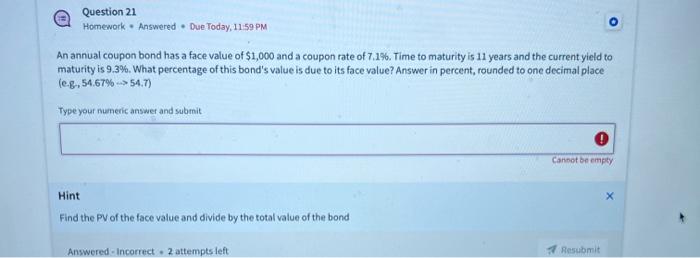

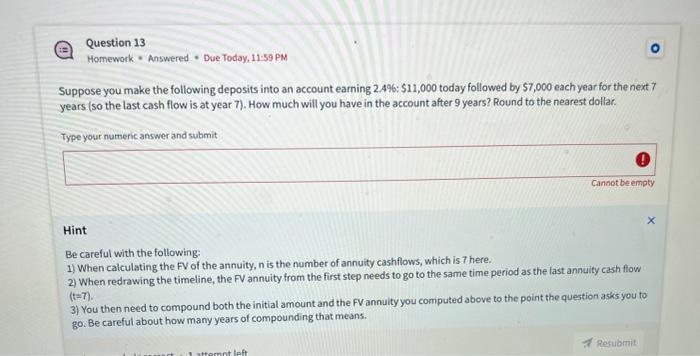

An annual coupon bond has a face value of $1,000 and a coupon rate of 7.1%. Time to maturity is 11 years and the current yield to maturity is 9.3%. What percentage of this bond's value is due to its face value? Answer in percent, rounded to one decimal place: (e.g,54.67%54.7) Tvpe your numeric answer and submit Hint Find the PV of the face value and divide by the total value of the bond Homework * Answered - Due Today, 11:59 PM You plan to deposit $4,000 today, $2,000 in one year and $4,000 in two years into an account earning 2.6% interest. What will the account balance be in 4 years? Round to the, nearest dollar. Type your numeric answer and submit Hint Careful with the n 's. Today means t =0. An annual coupon bond has a face value of $1,000 and a coupon rate of 7,1\%. Time to maturity is 11 years and the current yield to maturity is 9.3%. What percentage of this bond's value is due to its face value? Answer in percent, rounded to one decimal place ( e.g. 54.67%54.7) Type your numeric answer and submit Hint Find the PV of the face value and divide by the total value of the bond Anwwered - Incorrect - 2 attemptsleft Suppose you make the following deposits into an account earning 2.496:$11,000 today followed by $7,000 each year for the next 7 years (so the last cash flow is at year 7 ). How much will you have in the account after 9 years? Round to the nearest dollar. Type your numeric answer and submit. Hint Be careful with the following: 1) When calculating the FV of the annuity, n is the number of annuity cashflows, which is 7 here. 2) When redrawing the timeline, the FV annuity from the first step needs to go to the same time period as the last annuity cash flow (t=7). 3) You then need to compound both the initial amount and the FV annuity you computed above to the point the question asks you to go. Be careful about how many years of compounding that means. An asset is projected to generate 19 annual cash flows of $2,000 starting 7 years from today. If the discount rate is 7%, how much is this asset worth today? Round to the nearest dollar. Hint In the PV annulty formula, n refers to the number of annuity cash flows, regardless of where the annulty begins, Once you find the PV of the annwity, you need to place it at the correct point on the timeline (one period before first annuity cash flow) and discount it back to t=0 using the PV of a single cash flow formula. Answered - Incorrect 2 attempts left