Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An annual coupon bond has a maturity of eleven years, a face value of $1000, and a coupon rate of 2%. The current market

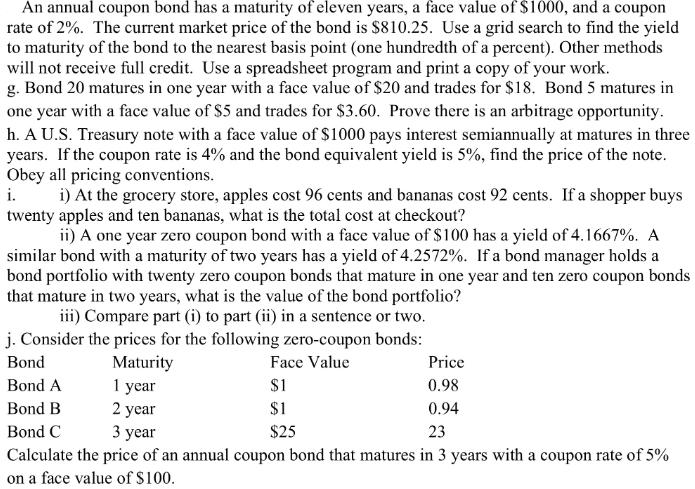

An annual coupon bond has a maturity of eleven years, a face value of $1000, and a coupon rate of 2%. The current market price of the bond is $810.25. Use a grid search to find the yield to maturity of the bond to the nearest basis point (one hundredth of a percent). Other methods will not receive full credit. Use a spreadsheet program and print a copy of your work. g. Bond 20 matures in one year with a face value of $20 and trades for $18. Bond 5 matures in one year with a face value of $5 and trades for $3.60. Prove there is an arbitrage opportunity. h. A U.S. Treasury note with a face value of $1000 pays interest semiannually at matures in three years. If the coupon rate is 4% and the bond equivalent yield is 5%, find the price of the note. Obey all pricing conventions. i. i) At the grocery store, apples cost 96 cents and bananas cost 92 cents. If a shopper buys twenty apples and ten bananas, what is the total cost at checkout? ii) A one year zero coupon bond with a face value of $100 has a yield of 4.1667%. A similar bond with a maturity of two years has a yield of 4.2572%. If a bond manager holds a bond portfolio with twenty zero coupon bonds that mature in one year and ten zero coupon bonds that mature in two years, what is the value of the bond portfolio? iii) Compare part (i) to part (ii) in a sentence or two. j. Consider the prices for the following zero-coupon bonds: Bond Maturity Face Value Price Bond A 1 year 0.98 Bond B 2 year 0.94 Bond C 3 year 23 Calculate the price of an annual coupon bond that matures in 3 years with a coupon rate of 5% on a face value of $100. $1 $1 $25

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To find the price of an annual coupon bond that matures in 3 years with a coupon rate of 5 and a fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started