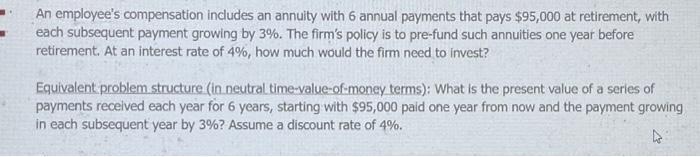

An employee's compensation includes an annuity with 6 annual payments that pays $95,000 at retirement, with each subsequent payment growing by 3%. The firm's

An employee's compensation includes an annuity with 6 annual payments that pays $95,000 at retirement, with each subsequent payment growing by 3%. The firm's policy is to pre-fund such annuities one year before retirement. At an interest rate of 4%, how much would the firm need to invest? Equivalent problem structure (in neutral time-value-of-money terms): What is the present value of a series of payments received each year for 6 years, starting with $95,000 paid one year from now and the payment growing in each subsequent year by 3% ? Assume a discount rate of 4%. 4

Step by Step Solution

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of the annuity we need to find the value of each payment at the time ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started