Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An employer in Ontario has 4 employees (A,B,C,D)paid $40000 annually. A is paid monthly B is paid semi monthly, C is paid bi weekly

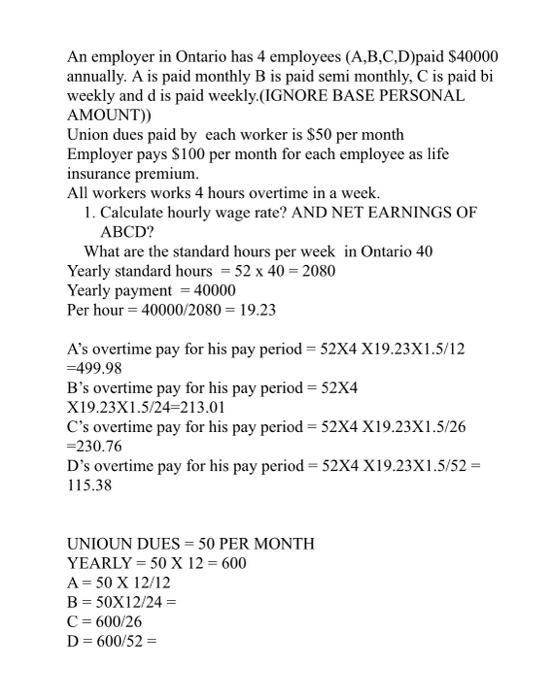

An employer in Ontario has 4 employees (A,B,C,D)paid $40000 annually. A is paid monthly B is paid semi monthly, C is paid bi weekly and d is paid weekly.(IGNORE BASE PERSONAL AMOUNT)) Union dues paid by each worker is $50 per month Employer pays $100 per month for each employee as life insurance premium. All workers works 4 hours overtime in a week. 1. Calculate hourly wage rate? AND NET EARNINGS OF ABCD? What are the standard hours per week in Ontario 40 Yearly standard hours = 52 x 40=2080 Yearly payment = 40000 Per hour = 40000/2080 = 19.23 A's overtime pay for his pay period=52X4 X19.23X1.5/12 =499.98 B's overtime pay for his pay period=52X4 X19.23X1.5/24-213.01 C's overtime pay for his pay period=52X4 X19.23X1.5/26 =230.76 D's overtime pay for his pay period=52X4 X19.23X1.5/52 = 115.38 UNIOUN DUES = 50 PER MONTH YEARLY = 50 X 12 = 600 A = 50 X 12/12 B = 50X12/24 = C = 600/26 D = 600/52 =

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Hourly wage rate 1923 NET EARNINGS A 40000 49998 600 4109998 B 40000 21301 300 4051301 C 40000 23076 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started