Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An entity purchased land for C30 000 on 1 January 20X1 and sold it for C40 000 on 1 January 20X3. The profit before

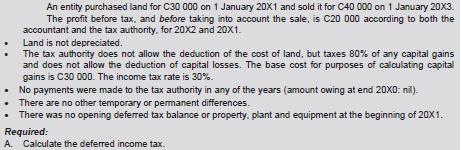

An entity purchased land for C30 000 on 1 January 20X1 and sold it for C40 000 on 1 January 20X3. The profit before tax, and before taking into account the sale, is C20 000 according to both the accountant and the tax authority, for 20X2 and 20X1. Land is not depreciated. The tax authority does not allow the deduction of the cost of land, but taxes 80% of any capital gains and does not allow the deduction of capital losses. The base cost for purposes of calculating capital gains is C30 000. The income tax rate is 30%. No payments were made to the tax authority in any of the years (amount owing at end 20X0: nil)- There are no other temporary or permanent differences. There was no opening deferred tax balance or property, plant and equipment at the beginning of 20X1. Required: A. Calculate the deferred income tax.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Def erred Income Tax Tax able Capital Gain x Income Tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started