Question

An Ethics Case Study As the new CFO, you are meeting with the management team to discuss the impact of the following policy changes. Part

An Ethics Case Study

As the new CFO, you are meeting with the management team to discuss the impact of the following policy changes.

Part 1

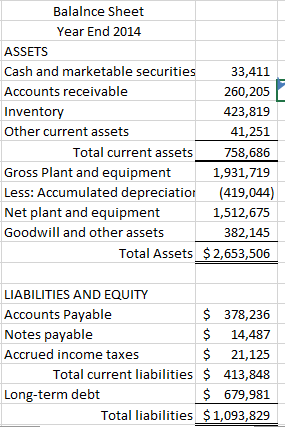

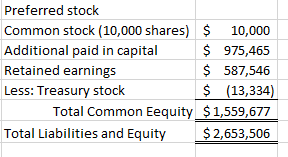

Consider the impact of these scenarios on both the (non-tax) in house income statement and balance sheet. Review the Balance Sheet for specific information about your company.

A new policy for Allowance for Doubtful Accounts (ADA)-Accounts Receivable write downs. For example, decreasing ADA by 20%. Justify your decision. To what extent is this legal issue? To what extent is this ethical issue? Make note of accounting principles in your response. Apply the data values in the balance sheet.

A new policy for writing down older inventory. For example, decreasing inventory write-downs by 10%. Justify your decision. To what extent is this legal issue? To what extent is this ethical issue? Make note of accounting principles in your response. Apply the data values in the attached balance sheet.

A new policy for depreciation expense. For example, depreciate per straight-line versus accelerated depreciation. Thus decreasing depreciation expense by 10%. Justify your decision. To what extent is this legal issue? To what extent is this ethical issue? Make note of accounting principles in your response. Apply the data values in the attached balance sheet.

A new policy of delaying accounts payable payments due by 20 extra days. While accounts payable will increase, what will happen to the cash balances of your company? What happens to your suppliers cash balance when your new policy is in place? To what extent is this legal issue? To what extent is this ethical issue? Apply the data values in the attached balance sheet.

Part 2

These policy changes can have an impact on a variety of different departments in your company. Discuss how you can work with the heads of each department to help these policies be accepted by the company as a whole.

Please Answer this ASAP.

Thanks

Balalnce Sheet Year End 2014 ASSETS Cash and marketable securities Accounts receivable Invento Other current assets 33,411 260,205 423,819 41,251 758,686 1,931,719 Less: Accumulated depreciatior (419,044) 1,512,675 382,145 Total Assets $2,653,506 Total current assets Gross Plant and equipment Net plant and equipment Goodwill and other assets LIABILITIES AND EQUITY Accounts Payable Notes payable Accrued income taxes $ 378,236 $ 14,487 $ 21,125 Total current liabilities$413,848 679,981 Total liabilities $1,093,829 Long-term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started