Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An exporting company in Europe has been contacted by an importer in South America. The South American company has proposed that they can set up

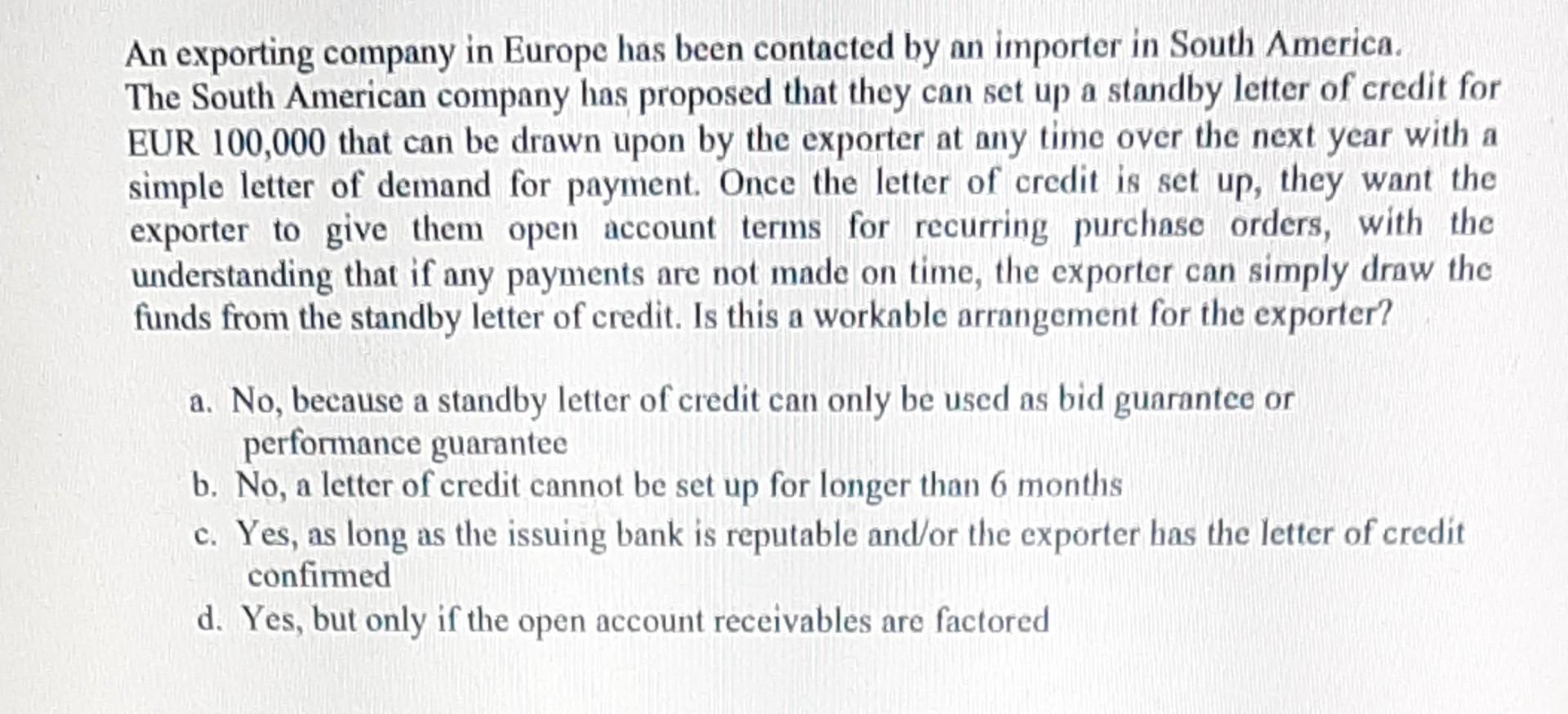

An exporting company in Europe has been contacted by an importer in South America. The South American company has proposed that they can set up a standby letter of credit for EUR 100,000 that can be drawn upon by the exporter at any time over the next year with a simple letter of demand for payment. Once the letter of credit is set up, they want the exporter to give them open account terms for recurring purchase orders, with the understanding that if any payments are not made on time, the exporter can simply draw the funds from the standby letter of credit. Is this a workable arrangement for the exporter? a. No, because a standby letter of credit can only be used as bid guarantee or performance guarantee b. No, a letter of credit cannot be set up for longer than 6 months c. Yes, as long as the issuing bank is reputable and/or the exporter has the letter of credit confirmed d. Yes, but only if the open account receivables are factored

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started