Answered step by step

Verified Expert Solution

Question

1 Approved Answer

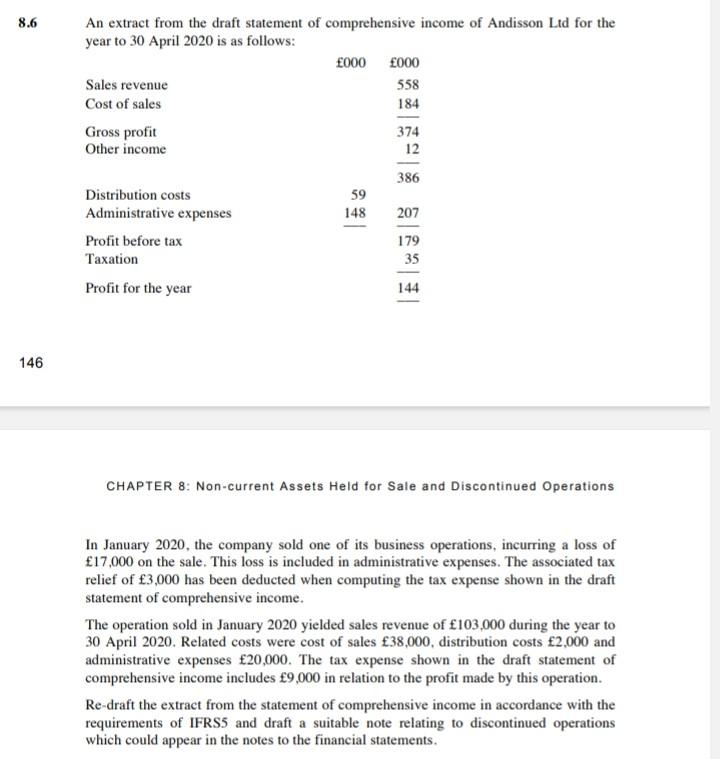

An extract from the draft statement of comprehensive income of Andisson Ltd for the year to 30 April 2020 is as follows: CHAPTER 8: Non-current

An extract from the draft statement of comprehensive income of Andisson Ltd for the year to 30 April 2020 is as follows: CHAPTER 8: Non-current Assets Held for Sale and Discontinued Operations In January 2020 , the company sold one of its business operations, incurring a loss of 17,000 on the sale. This loss is included in administrative expenses. The associated tax relief of 3,000 has been deducted when computing the tax expense shown in the draft statement of comprehensive income. The operation sold in January 2020 yielded sales revenue of f103,000 during the year to 30 April 2020. Related costs were cost of sales 38,000, distribution costs 2,000 and administrative expenses 20,000. The tax expense shown in the draft statement of comprehensive income includes 9,000 in relation to the profit made by this operation. Re-draft the extract from the statement of comprehensive income in accordance with the requirements of IFRS5 and draft a suitable note relating to discontinued operations which could appear in the notes to the financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started