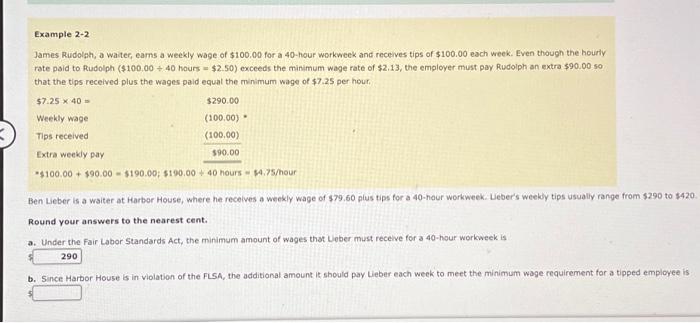

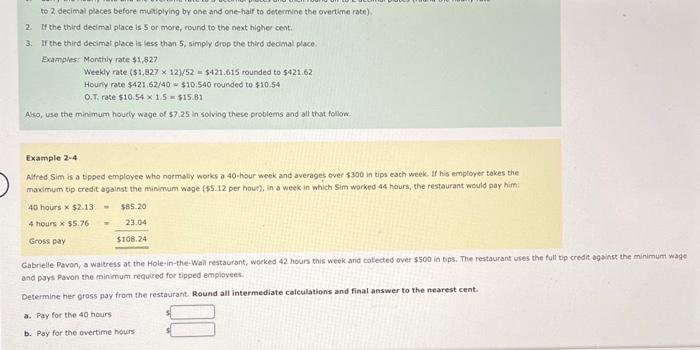

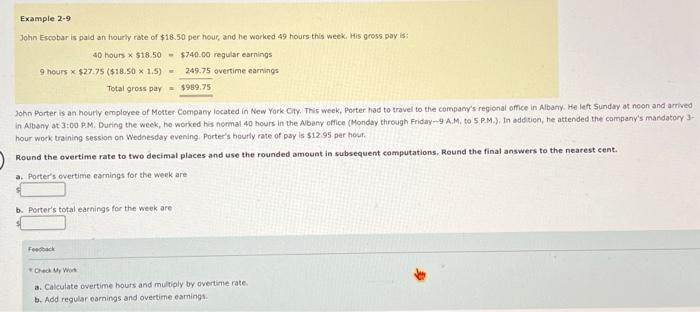

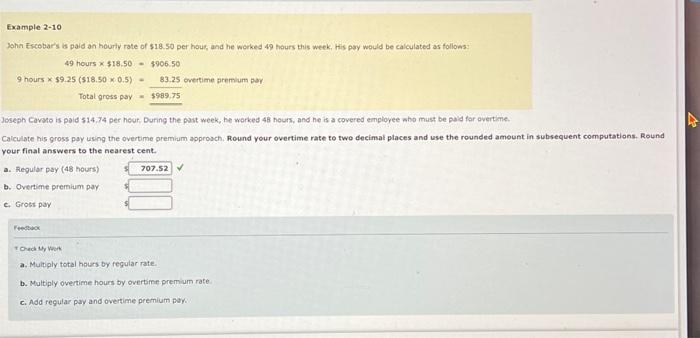

James Rudolah, a water, earns a weekly wage of $100,00 for a 40 -hour workweek and receives tips of $100.00 each week. Even though the hourly rate paid to Rudolph ($100.0040 hours =$2.50 ) exceeds the minimum wage rate of $2.13, the employer must pay Rudolph an extra $90.00 so that the tips received plus the wages paid equat the minimum wage of $7.25 per hour. $100.00+$90.00=$190.00;$190.0040hours=$4.75/hour Ben Leber is a water at Harbor House, where he recelves a wekly wage of $79.60 plus tips for a 40-hour workweek. Leber's weeky tips usually range from $290 to $420. Round your answers to the nearest cent. a. Under the Fair Labor Standards Act, the minimum amount of wages that Leber must receive for a 40 -hour workweek is 4 b. Since Harbor House is in violation of the FLSA, the additional amount it should pay Lieber each week to meet the minimum wage requirement for a tipped employee is John Porter is an hourly employee of Motter Company located in New York Cty. This week, Porter had to travel to the company's regional office in Albarty. He left Sunday at noon and arrived hour wock training session on Wednesday evening. Porter's hourly rate of pay is $12.95 per houf. Round the overtime rate to two decimal places and use the rounded amount in subsequent computations, Round the final answers to the nearest cent. a. Porter's cvertime earnings for the week are s b. Porter's total earnings for the week are 1 John Escobar's is paid an hourly rate of $18.50 per hour, and he worked 49 hours this week, his pary would be calculated as follons? 49hours$18.50=$906.509hours59.25(518.500.5)=83.25overtimepremiumparTotalgrosspay=$$89.75 Joseph Cavato is poid 514,74 per hour, Durng the past week, he worked 48 nours, and he is a covered employee who must be pald for overtime. your final answers to the nearest cent. a. Regular pay (48 hours) b. Overtime premium pay. c. Gross pay 3 $ 5 Feedtura t Orach Gy werk a. Multiply total hours by regular rate. b. Multiply overtime hours by overtime premum rate c. Add regular pay and overtime premium par: to 2. decimal places before mustiplying by one and one-haif to determine the overtime rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than 5, simply drop the third decimal place. Examples: Monthly rate $1,827 Weekly rate ($1,82712)/52=$421.615 rounded to $421.62 Hourly rote $421.52/40=$10,540 rounded to $10.54 O.T. rate $10.541.5=$15.81 Aso, use the minimum hourly wage of 57.25 in solving these problems and all thot follow. Example 2-4 Afred Sim is a bpped employee who normaly works a 40 -hour week and averages over $300 in tips each week. It his employer takes the maximum tip credit against the minimum wage ( $5.12 per hout), in o week in which Sim warked 44 hours, the restaurant would pay him: 40hours$2.13=$85.204hours$5.76=$108.2423.04Grosspary Gabrelle Pavon, a watress at the Hole-in-the-Wail restaurant, worked 42 hours this week and colected over $500 in tips. The restaurant ubes the full tip credit against the minimum wage and pays Pavon the minimum required for tipped employees. Determine her cross pay from the restaurant. Round all intermediate calculations and final answer to the nearest cent