Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An institution expects to collect $100 million in receivables in 4 months (March 19) and plans to invest that money at LIBID for the

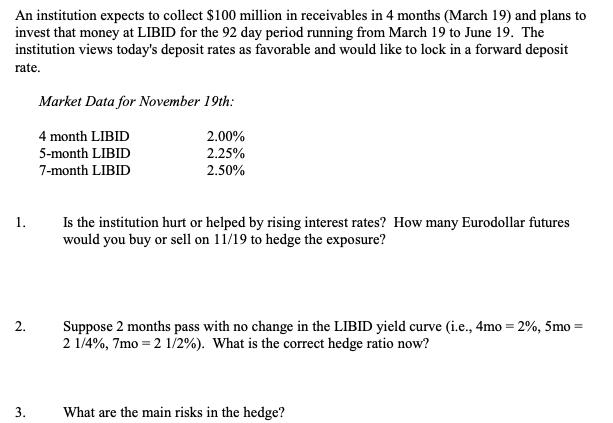

An institution expects to collect $100 million in receivables in 4 months (March 19) and plans to invest that money at LIBID for the 92 day period running from March 19 to June 19. The institution views today's deposit rates as favorable and would like to lock in a forward deposit rate. Market Data for November 19th: 1. 2. 4 month LIBID 2.00% 5-month LIBID 2.25% 7-month LIBID 2.50% Is the institution hurt or helped by rising interest rates? How many Eurodollar futures would you buy or sell on 11/19 to hedge the exposure? Suppose 2 months pass with no change in the LIBID yield curve (i.e., 4mo = 2%, 5mo = 2 1/4%, 7mo = 2 1/2%). What is the correct hedge ratio now? What are the main risks in the hedge?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Rising interest rates would hurt the institution because it plans to invest its receivables at a fixed LIBID rate As interest rates rise the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started