Question

An institution has just sold a European put option contract on 600,000 British pounds. The strike price of the option is 1.26 and the time

An institution has just sold a European put option contract on 600,000 British pounds. The strike price of the option is 1.26 and the time to maturity is 26 weeks. The current exchange rate for pounds is $1.263 per pounds. The U.S. interest rate is 1.5%, and the U.K. interest rate is 2.5%. The volatility of the USD/Pound exchange rate is 16%. All the rates quoted are annualized and continuous compounding.

(a) What is the current value of the option contract according to the Black-Scholes-Merton formula?

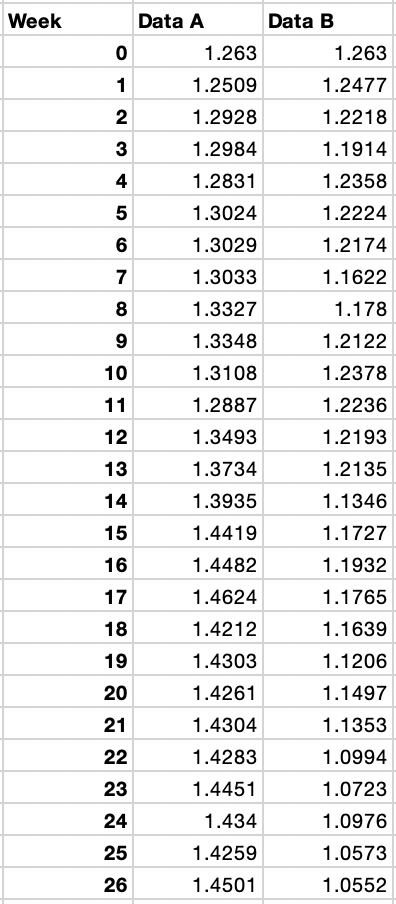

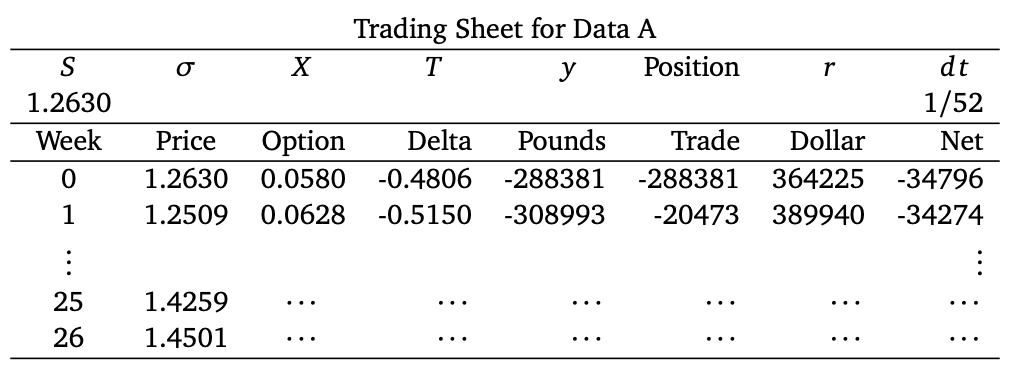

(b) The Data A in the accompanying Excel file gives the USD/Pound exchange rate (price) at the end of the each week. Suppose you delta hedge the put option position by trading British pounds at the end of each week. Calculate the hedging cost by constructing a trading sheet like the one below. The first two rows are given.

(c) What are the hedging cost and the performance ratio of the trading strategy for the exchange rates in Data A?

(d) For the exchange rates in Data B in the accompanying Excel file, calculate the hedging cost and performance ratio by constructing a similar dynamic delta hedging strategy sheet. What is the performance ratio of the hedging strategy for this set of exchange rates.

Week 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Data A 1.263 1.2509 1.2928 1.2984 1.2831 1.3024 1.3029 1.3033 1.3327 1.3348 1.3108 1.2887 1.3493 1.3734 1.3935 1.4419 1.4482 1.4624 1.4212 1.4303 1.4261 1.4304 1.4283 1.4451 1.434 1.4259 1.4501 Data B 1.263 1.2477 1.2218 1.1914 1.2358 1.2224 1.2174 1.1622 1.178 1.2122 1.2378 1.2236 1.2193 1.2135 1.1346 1.1727 1.1932 1.1765 1.1639 1.1206 1.1497 1.1353 1.0994 1.0723 1.0976 1.0573 1.0552

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the value of the European put option using BlackScholesMerton formula S ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started