Question

An insurance company can insure two types of drivers: risky drivers and safe drivers. The cost to insure a risky driver is $350, while the

An insurance company can insure two types of drivers: risky drivers and safe drivers. The cost to insure a risky driver is $350, while the cost to insure a safe driver is only $50. A risky driver is willing to pay up to $500 for insurance, while a safe driver is willing to pay up to $100 for insurance. Explain and analyze the market outcomes under different informational scenarios (full information, asymmetric information, and incomplete but symetric information).

For each case, state who gets to purchase insurance, at what price, and what are the resulting surpluses (for buyers, seller, and in total). Assume there is only one insurance company in town (so it gets to price its insurance as high as it wants without any competition and consumers can either take it or leave it). Also assume there are 300 drivers in total - 100 of them are risky and 200 are safe.

Note: Following the step-by-step questions below, you should be able to solve this problem and also start understanding the main logic behind adverse selection problems in general. It is important you start developing the intuition needed to solving these types of problems without having these types of directional questions. Refer to the lecture notes as well as the questions below and try to see the "big patterns" of adverse selection problems so you can ask these intermediate questions yourselves and be able to solve other problems such as the second and third problem included in this assignment.

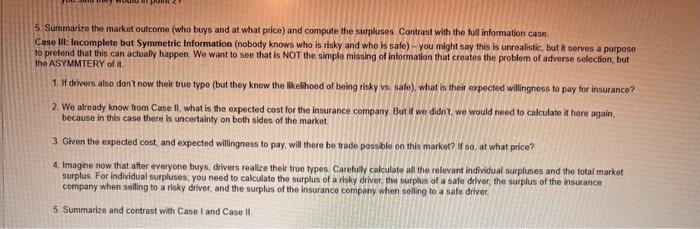

5. Summarize the market outcome (who buys and at what price) and compute the surpluses. Contrast with the full information case.

Case III: Incomplete but Symmetric Information (nobody knows who is risky and who is safe) - you might say this is unrealistic, but it serves a purpose to pretend that this can actually happen. We want to see that is NOT the simple missing of information that creates the problem of adverse selection, but the ASYMMTERY of it.

- If drivers also don't now their true type (but they know the likelihood of being risky vs. safe), what is their expected willingness to pay for insurance?

- We already know from Case Il, what is the expected cost for the insurance company. But if we didn't, we would need to calculate it here again, because in this case there is uncertainty on both sides of the market.

- Given the expected cost, and expected willingness to pay, will there be trade possible on this market? If so, at what price?

- Imagine now that after everyone buys, drivers realize their true types. Carefully calculate all the relevant individual surpluses and the total market surplus. For individual surpluses, you need to calculate the surplus of a risky driver, the surplus of a safe driver, the surplus of the insurance company when selling to a risky driver, and the surplus of the insurance company when selling to a safe driver.

- Summarize and contrast with Case I and Case Il

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started