Answered step by step

Verified Expert Solution

Question

1 Approved Answer

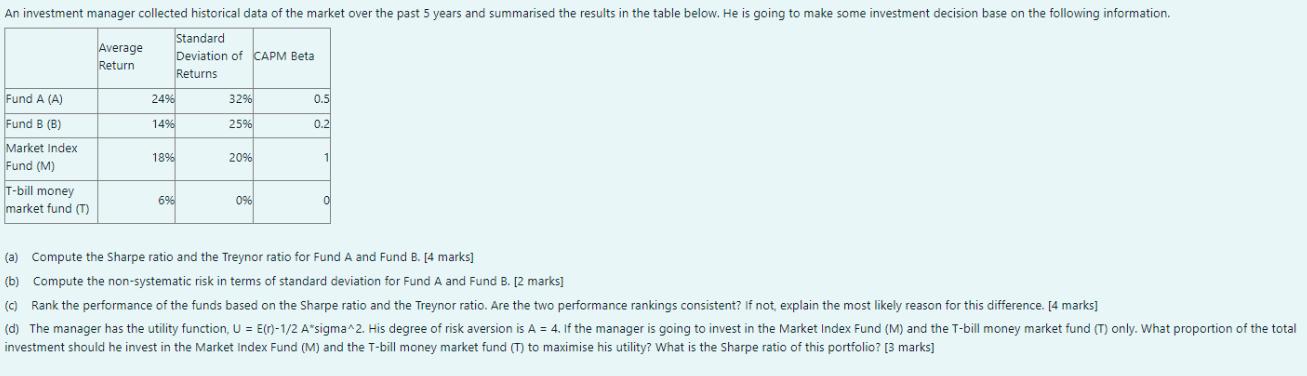

An investment manager collected historical data of the market over the past 5 years and summarised the results in the table below. He is

An investment manager collected historical data of the market over the past 5 years and summarised the results in the table below. He is going to make some investment decision base on the following information. Standard Deviation of CAPM Beta Returns Fund A (A) Fund B (B) Market Index Fund (M) T-bill money market fund (T) Average Return 2496 14% 18% 6% 32% 25% 20% 0% 0.5 0.2 1 0 (a) Compute the Sharpe ratio and the Treynor ratio for Fund A and Fund B. [4 marks] (b) Compute the non-systematic risk in terms of standard deviation for Fund A and Fund B. [2 marks] (c) Rank the performance of the funds based on the Sharpe ratio and the Treynor ratio. Are the two performance rankings consistent? If not, explain the most likely reason for this difference. [4 marks] (d) The manager has the utility function, U = E(r)-1/2 A*sigma^2. His degree of risk aversion is A = 4. If the manager is going to invest in the Market Index Fund (M) and the T-bill money market fund (T) only. What proportion of the total investment should he invest in the Market Index Fund (M) and the T-bill money market fund (T) to maximise his utility? What is the Sharpe ratio of this portfolio? [3 marks]

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer c Based on the Sharpe ratio and the Treynor ratio Fund A has a higher ranking than ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started