Answered step by step

Verified Expert Solution

Question

1 Approved Answer

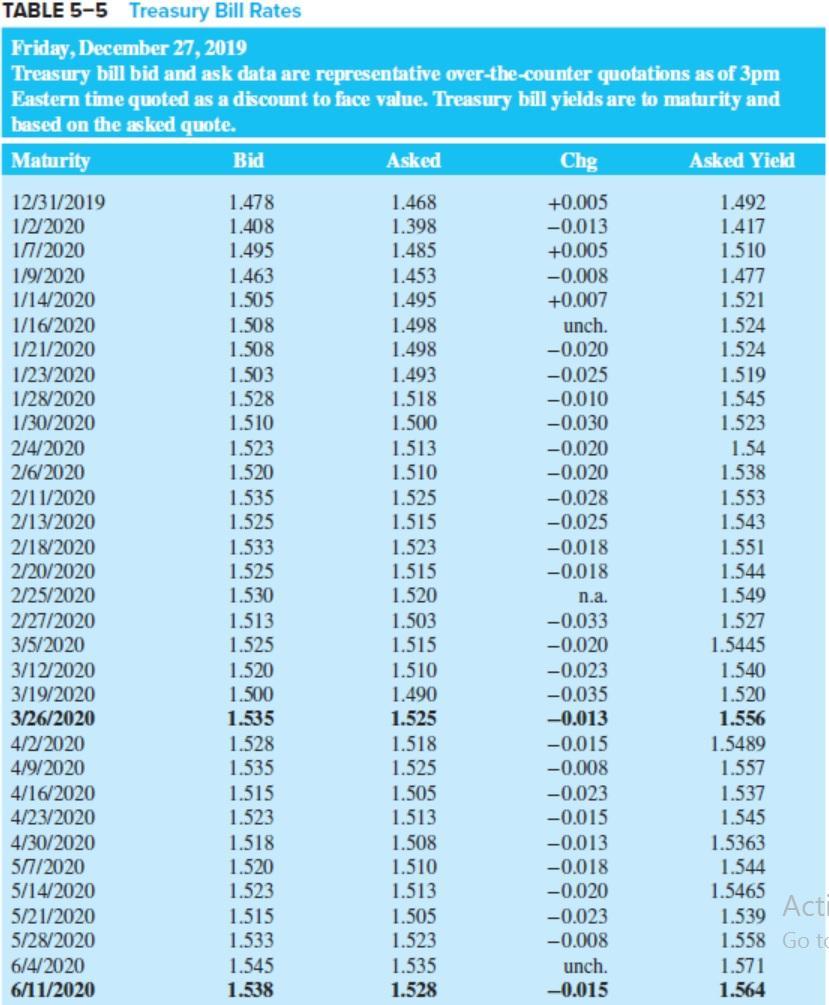

Assume a face value of $10,000. a. Calculate the asking price of the Treasury bill maturing on 30 January 2020, as of December 27, 2019.

Assume a face value of $10,000.

a. Calculate the asking price of the Treasury bill maturing on 30 January 2020, as of December 27, 2019.

b. Calculate the bid price of the Treasury bill maturing on 23 April 2020, as of December 27, 2019.

(For all requirements, use 360 days in a year. Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))

TABLE 5-5 Treasury Bill Rates Friday, December 27, 2019 Treasury bill bid and ask data are representative over-the-counter quotations as of 3pm Eastern time quoted as a discount to face value. Treasury bill yields are to maturity and based on the asked quote. Maturity 12/31/2019 1/2/2020 1/7/2020 1/9/2020 1/14/2020 1/16/2020 1/21/2020 1/23/2020 1/28/2020 1/30/2020 2/4/2020 2/6/2020 2/11/2020 2/13/2020 2/18/2020 2/20/2020 2/25/2020 2/27/2020 3/5/2020 3/12/2020 3/19/2020 3/26/2020 4/2/2020 4/9/2020 4/16/2020 4/23/2020 4/30/2020 5/7/2020 5/14/2020 5/21/2020 5/28/2020 6/4/2020 6/11/2020 Bid 1.478 1.408 1.495 1.463 1.505 1.508 1.508 1.503 1.528 1.510 1.523 1.520 1.535 1.525 1.533 1.525 1.530 1.513 1.525 1.520 1.500 1.535 1.528 1.535 1.515 1.523 1.518 1.520 1.523 1.515 1.533 1.545 1.538 Asked 1.468 1.398 1.485 1.453 1.495 1.498 1.498 1.493 1.518 1.500 1.513 1.510 1.525 1.515 1.523 1.515 1.520 1.503 1.515 1.510 1.490 1.525 1.518 1.525 1.505 1.513 1.508 1.510 1.513 1.505 1.523 1.535 1.528 Chg +0.005 -0.013 +0.005 -0.008 +0.007 unch. -0.020 -0.025 -0.010 -0.030 -0.020 -0.020 -0.028 -0.025 -0.018 -0.018 n.a. -0.033 -0.020 -0.023 -0.035 -0.013 -0.015 -0.008 -0.023 -0.015 -0.013 -0.018 -0.020 -0.023 -0.008 unch. -0.015 Asked Yield 1.492 1.417 1.510 1.477 1.521 1.524 1.524 1.519 1.545 1.523 1.54 1.538 1.553 1.543 1.551 1.544 1.549 1.527 1.5445 1.540 1.520 1.556 1.5489 1.557 1.537 1.545 1.5363 1.544 1.5465 1.539 Acti 1.558 Go to 1.571 1.564

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the asking price and bid price of Treasury bills we need to use the quoted yields and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started