Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment portfolio began at $1,000,000, but has a current value of $782,655.71 with a standard deviation of 5 and a risk free ratio of

An investment portfolio began at $1,000,000, but has a current value of $782,655.71 with a standard deviation of 5 and a risk free ratio of 3.13%.

1. Calculate the Sharpe and Information Ratios and explain your results in detail.

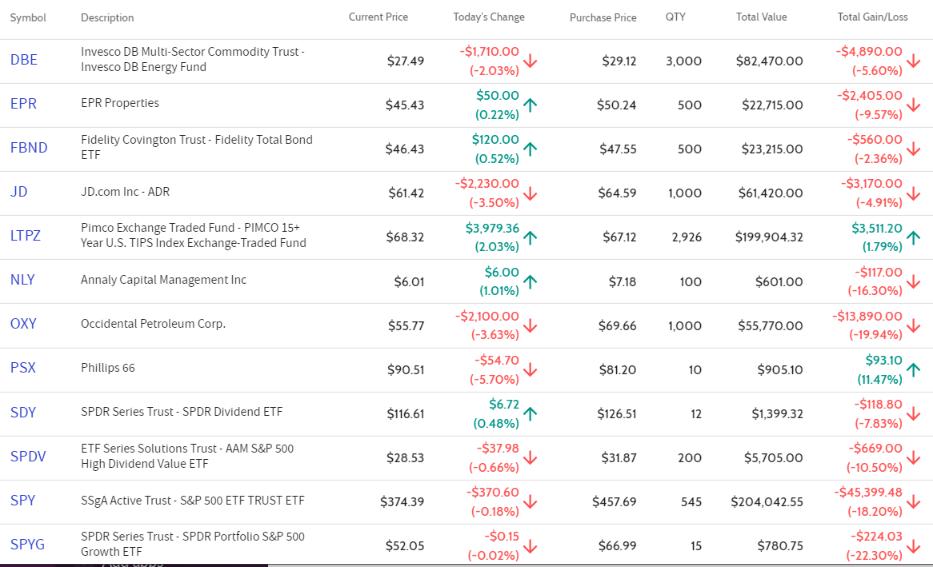

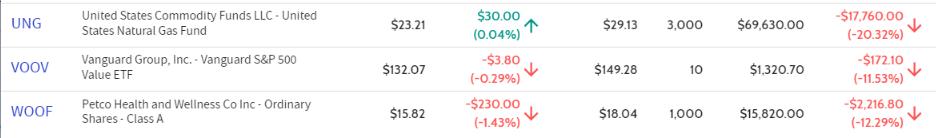

2. Based on the financial market's performance as of June 2022, explain in detail the performance of the portfolio below ( for example: is it too diversified, lacks international exposure, etc.)

Symbol Description Current Price Today's Change Purchase Price QTY Total Value Total Gain/Loss Invesco DB Multi-Sector Commodity Trust- -$1,710.00 -$4,890.00 DBE $27.49 $29.12 3,000 $82,470.00 Invesco DB Energy Fund (-2.03%) $50.00 (-5.60%) -$2,405.00 EPR EPR Properties $45.43 $50.24 500 $22,715.00 (0.22%) (-9.57%) Fidelity Covington Trust - Fidelity Total Bond $120.00 -$560.00 FBND $46.43 $47.55 500 $23,215.00 ETF (0.52%) (-2.36%) -$2,230.00 -$3,170.00 JD JD.com Inc - ADR $61.42 $64.59 1,000 $61,420.00 (-3.50%) (-4.91%) LTPZ Pimco Exchange Traded Fund - PIMCO 15+ $3,979.36 $3,511.20 $68.32 Year U.S. TIPS Index Exchange-Traded Fund $67.12 2,926 $199,904.32 (2.03%) (1.79%) $6.00 -$117.00 NLY Annaly Capital Management Inc $6.01 $7.18 100 $601.00 (1.01%) -$2,100.00 (-16.30%) -$13,890.00 OXY Occidental Petroleum Corp. $55.77 $69.66 1,000 $55,770.00 (-3.63%) (-19.94%) -$54.70 $93.10 PSX Phillips 66 $90.51 $81.20 10 $905.10 (-5.70%) (11.47%) $6.72 -$118.80 SDY SPDR Series Trust - SPDR Dividend ETF $116.61 $126.51 12 $1,399.32 (0.48%) (-7.83%) SPDV ETF Series Solutions Trust - AAM S&P 500 High Dividend Value ETF -$37.98 -$669.00 $28.53 $31.87 200 $5,705.00 (-0.66%) (-10.50%) -$370.60 -$45,399.48 SPY SSgA Active Trust S&P 500 ETF TRUST ETF $374.39 $457.69 545 $204,042.55 (-0.18%) (-18.20%) SPYG SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF -$0.15 -$224.03 $52.05 $66.99 15 $780.75 (-0.02%) (-22.30%)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Sharpe Ratio and Information Ratio Sharpe Ratio The Sharpe Ratio is calculated using the formulaSharpeRatioSharpeRatiopRpRfwhere Rp is the portfolio return Rf is the riskfree rate p i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started