Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment specialist claims that if one holds a portfolio that moves in opposite direction to the market index like the All Ordinaries Index, then

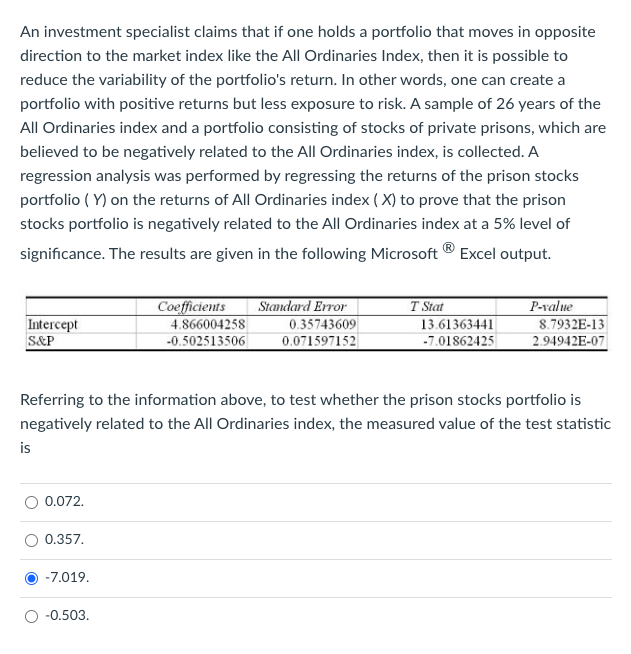

An investment specialist claims that if one holds a portfolio that moves in opposite direction to the market index like the All Ordinaries Index, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk. A sample of years of the All Ordinaries index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the All Ordinaries index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio on the returns of All Ordinaries index to prove that the prison stocks portfolio is negatively related to the All Ordinaries index at a level of significance. The results are given in the following Microsoft Excel output. Referring to the information above, to test whether the prison stocks portfolio is negatively related to the All Ordinaries index, the measured value of the test statistic is

An investment specialist claims that if one holds a portfolio that moves in opposite

direction to the market index like the All Ordinaries Index, then it is possible to

reduce the variability of the portfolio's return. In other words, one can create a

portfolio with positive returns but less exposure to risk. A sample of years of the

All Ordinaries index and a portfolio consisting of stocks of private prisons, which are

believed to be negatively related to the All Ordinaries index, is collected. A

regression analysis was performed by regressing the returns of the prison stocks

portfolio on the returns of All Ordinaries index to prove that the prison

stocks portfolio is negatively related to the All Ordinaries index at a level of

significance. The results are given in the following Microsoft Excel output.

Referring to the information above, to test whether the prison stocks portfolio is

negatively related to the All Ordinaries index, the measured value of the test statistic

is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started