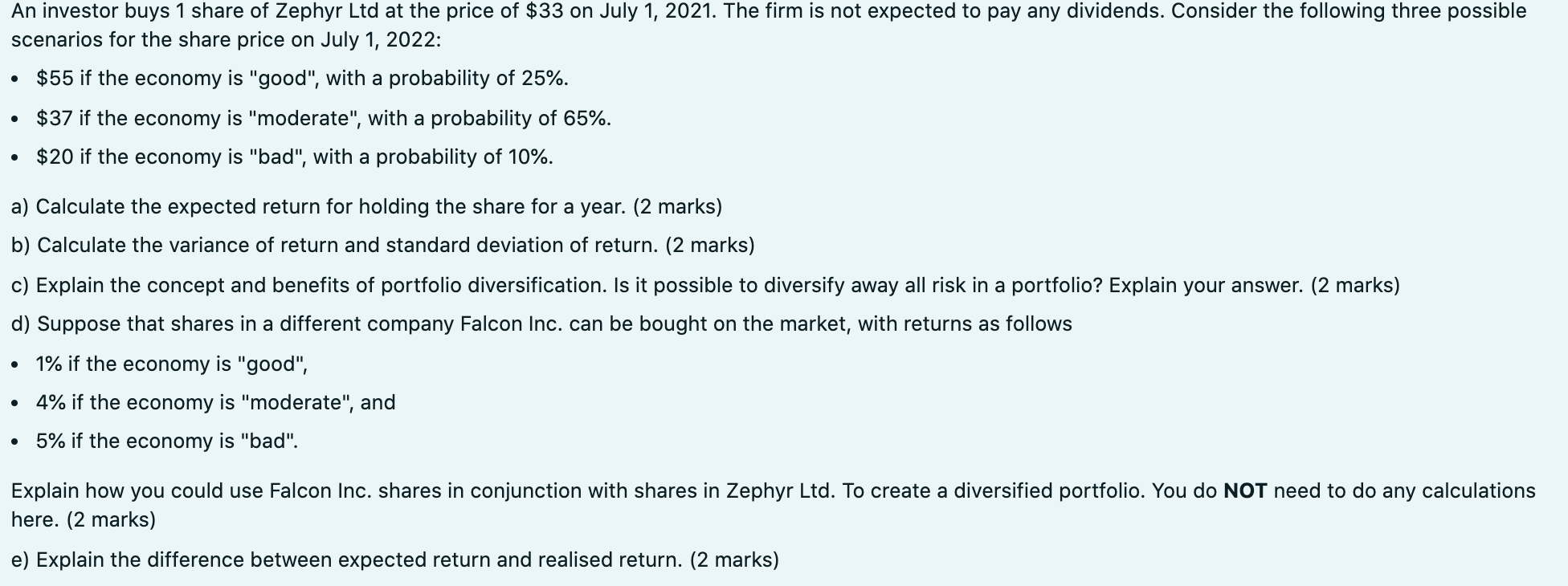

An investor buys 1 share of Zephyr Ltd at the price of $33 on July 1, 2021. The firm is not expected to pay any dividends. Consider the following three possible scenarios for the share price on July 1, 2022: $55 if the economy is "good", with a probability of 25%. $37 if the economy is "moderate", with a probability of 65%. $20 if the economy is "bad", with a probability of 10%. a) Calculate the expected return for holding the share for a year. (2 marks) b) Calculate the variance of return and standard deviation of return. (2 marks) c) Explain the concept and benefits of portfolio diversification. Is it possible to diversify away all risk in a portfolio? Explain your answer. (2 marks) d) Suppose that shares in a different company Falcon Inc. can be bought on the market, with returns as follows 1% if the economy is "good", . 4% if the economy is "moderate", and 5% if the economy is "bad". Explain how you could use Falcon Inc. shares in conjunction with shares in Zephyr Ltd. To create a diversified portfolio. You do NOT need to do any calculations here. (2 marks) e) Explain the difference between expected return and realised return. (2 marks) An investor buys 1 share of Zephyr Ltd at the price of $33 on July 1, 2021. The firm is not expected to pay any dividends. Consider the following three possible scenarios for the share price on July 1, 2022: $55 if the economy is "good", with a probability of 25%. $37 if the economy is "moderate", with a probability of 65%. $20 if the economy is "bad", with a probability of 10%. a) Calculate the expected return for holding the share for a year. (2 marks) b) Calculate the variance of return and standard deviation of return. (2 marks) c) Explain the concept and benefits of portfolio diversification. Is it possible to diversify away all risk in a portfolio? Explain your answer. (2 marks) d) Suppose that shares in a different company Falcon Inc. can be bought on the market, with returns as follows 1% if the economy is "good", . 4% if the economy is "moderate", and 5% if the economy is "bad". Explain how you could use Falcon Inc. shares in conjunction with shares in Zephyr Ltd. To create a diversified portfolio. You do NOT need to do any calculations here. (2 marks) e) Explain the difference between expected return and realised return. (2 marks)