Answered step by step

Verified Expert Solution

Question

1 Approved Answer

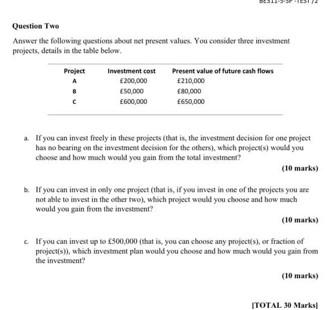

solve using excel or word formate, no hand written Question Twe Answer the following equestions about net present values. You consider thece invediment projects, details

solve using excel or word formate, no hand written

Question Twe Answer the following equestions about net present values. You consider thece invediment projects, details in the table beken: a. If you can invel frocly in these projects (that is, the investment docision for one project has ea bearing on the investment seckion for the others), which prejecti(s) would you chocne and how much would you gain from the lotal imestrent? (10 marks) b. If you can invest in celly eene project (that is, if you invest in ene of the projects you are not able to invest in the echer tuo), which project weuld you choose and how much would yoa rain from the investment? (10 marks) c. If you can invest sp io $500,000 ithat is, you can choose any propectis), er fraction of projcct(s)), which invcatment plan would you choose and bow mach would you gain from the investment? Question Twe Answer the following equestions about net present values. You consider thece invediment projects, details in the table beken: a. If you can invel frocly in these projects (that is, the investment docision for one project has ea bearing on the investment seckion for the others), which prejecti(s) would you chocne and how much would you gain from the lotal imestrent? (10 marks) b. If you can invest in celly eene project (that is, if you invest in ene of the projects you are not able to invest in the echer tuo), which project weuld you choose and how much would yoa rain from the investment? (10 marks) c. If you can invest sp io $500,000 ithat is, you can choose any propectis), er fraction of projcct(s)), which invcatment plan would you choose and bow mach would you gain from the investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started