Question

An investor had $500,000 security in maturity with the then Britz Security Fund Management and could not redeem the security before the fund management was

An investor had $500,000 security in maturity with the then Britz Security Fund Management and could not redeem the security before the fund management was closed down. The Government provided an option of paying the locked money in 5 years from now at zero coupon rate (option1). The Bank of America (BoA) provided a second option of buying the $500,000 from the investor today at a discount rate consistent with the 20 April 2020 treasury bill rate (91-day rate).

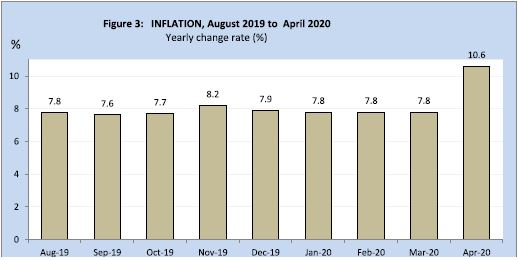

a. Use the inflation data presented in Figure 1 to compute the average inflation rate during the period. If the average inflation rate increases by 1.5 % each year, based on this and that of the treasury bill rate in Table 1, which of the options would you advice the investor to take? Provide all calculations to back your recommendation.

Figure1: Year on Year inflation rate, Statistical Service, August,2020

Table 1: Bank of Ghana Bill rates

| Issue Date | Security Type | Discount Rate | Interest Rate |

| 20 April 2020 | 91 day | 13.39 | 13.86 |

| 27 April 2020 | 182 day | 13.11 | 14.03 |

| 27 April 2020 | 91 day | 13.55 | 14.03 |

b. Explain how payback period, NPV, and IRR criteria are used in decision making and provide example in which each is most appropriate as an appraisal tool.

Figure 3: INFLATION, August 2019 to April 2020 Yearly change rate (%) % 10.6 10 8.2 7.8 7.6 7.7 7.9 7.8 7.8 7.8 8 6 III II Aug 19 Sep-19 Oct-19 Nov-19 Dec 19 Jan-20 Feb-20 Mar 20 Apr-20 Figure 3: INFLATION, August 2019 to April 2020 Yearly change rate (%) % 10.6 10 8.2 7.8 7.6 7.7 7.9 7.8 7.8 7.8 8 6 III II Aug 19 Sep-19 Oct-19 Nov-19 Dec 19 Jan-20 Feb-20 Mar 20 Apr-20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started