Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor has $12,000 invested in General Motors (GM) and is considering building a two-stock portfolio by investing another $9,000 in the Home Depot

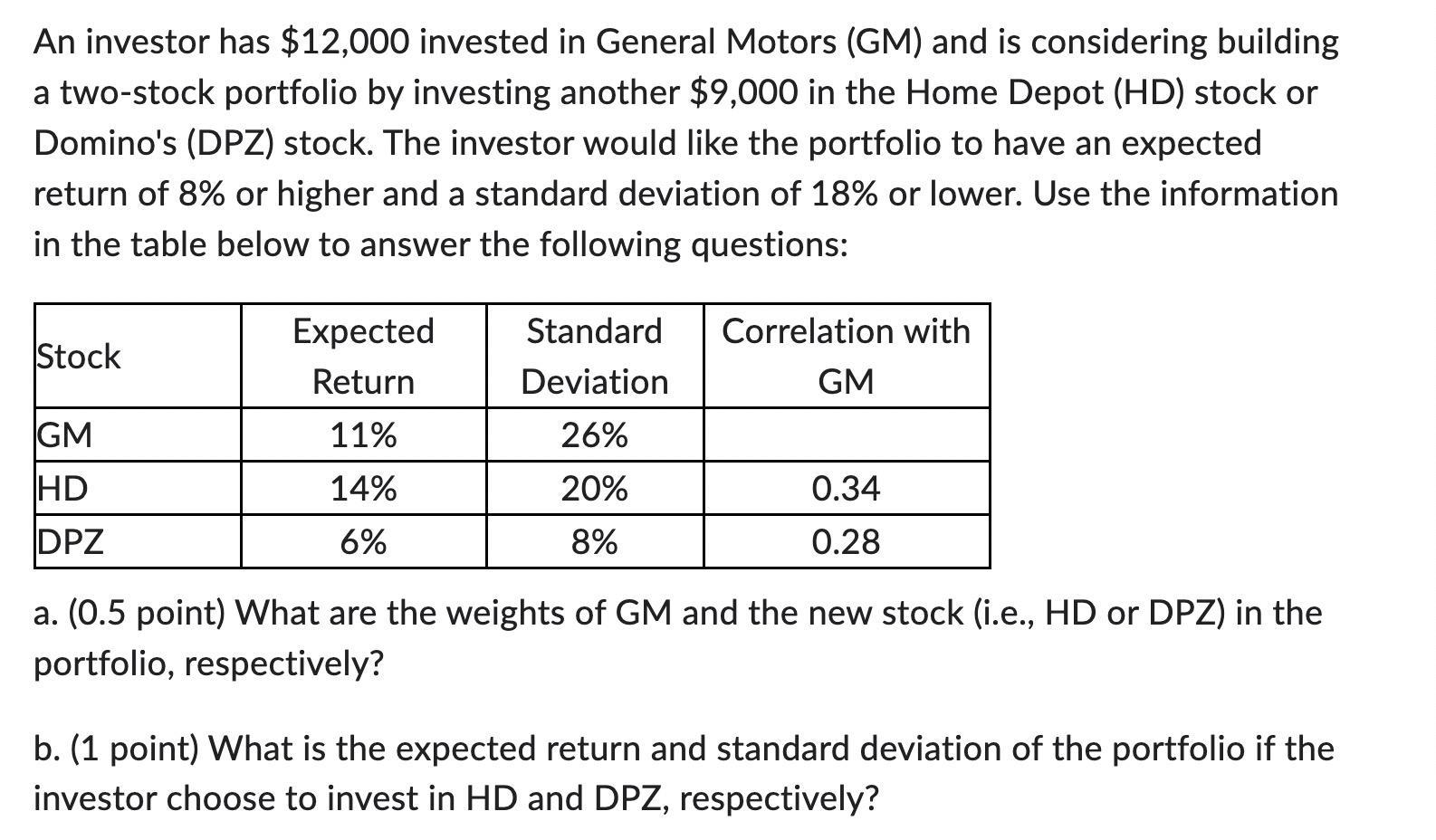

An investor has $12,000 invested in General Motors (GM) and is considering building a two-stock portfolio by investing another $9,000 in the Home Depot (HD) stock or Domino's (DPZ) stock. The investor would like the portfolio to have an expected return of 8% or higher and a standard deviation of 18% or lower. Use the information in the table below to answer the following questions: Expected Stock Return Standard Deviation Correlation with GM GM 11% 26% HD 14% 20% 0.34 DPZ 6% 8% 0.28 a. (0.5 point) What are the weights of GM and the new stock (i.e., HD or DPZ) in the portfolio, respectively? b. (1 point) What is the expected return and standard deviation of the portfolio if the investor choose to invest in HD and DPZ, respectively?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Portfolio Weights and Performance a Portfolio Weights To achieve the desired portfolio characteristics we need to calculate the weights of GM wGM and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started