Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor has decided to invest at most $ 1 0 0 , 0 0 0 in securities in the form of corporate stocks. He

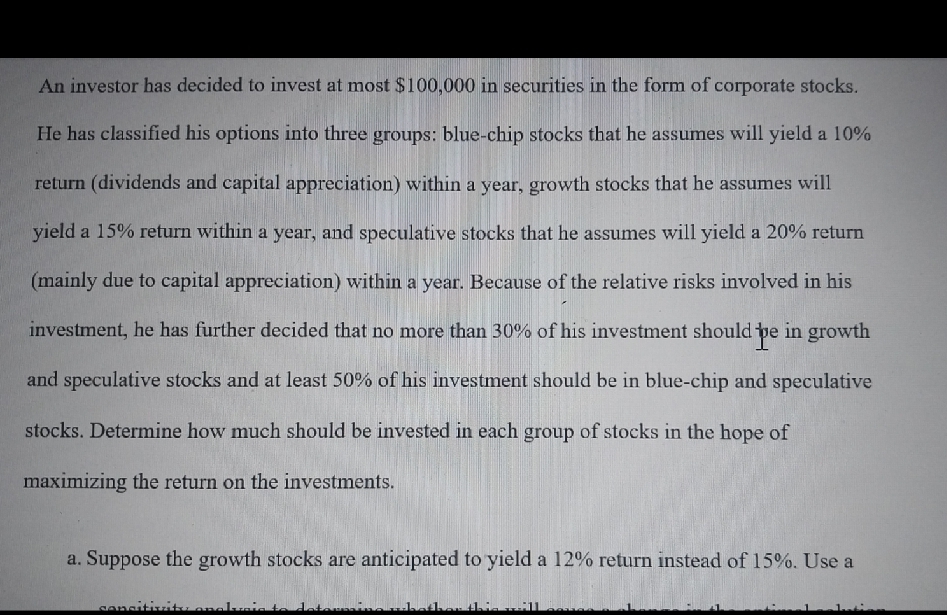

An investor has decided to invest at most $ in securities in the form of corporate stocks.

He has classified his options into three groups: bluechip stocks that he assumes will yield a return dividends and capital appreciation within a year, growth stocks that he assumes will yield a return within a year, and speculative stocks that he assumes will yield a return mainly due to capital appreciation within a year. Because of the relative risks involved in his investment, he has further decided that no more than of his investment should pe in growth and speculative stocks and at least of his investment should be in bluechip and speculative stocks. Determine how much should be invested in each group of stocks in the hope of maximizing the return on the investments.

a Suppose the growth stocks are anticipated to yield a return instead of Use a i just need help with solver the objective formula, I put D but it not working

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started