Answered step by step

Verified Expert Solution

Question

1 Approved Answer

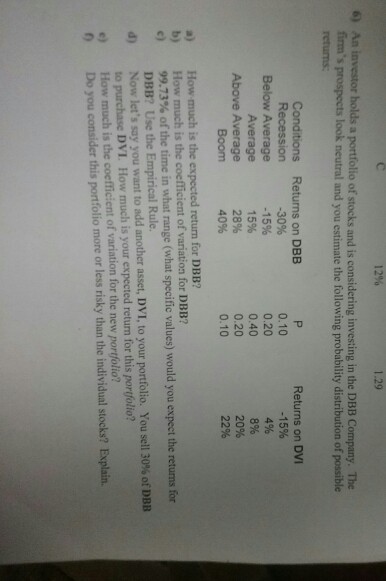

An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm's prospects look neutral and you estimate the following

An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm's prospects look neutral and you estimate the following probability distribution of possible returns: a) How much is the expected return for DBB? b) How much is the coefficient of variation for DBB? c) 99.73% of the time in what range (what specific values) would you expect the returns for DBB? Use the Empirical Rule. d) Now let's say you want to add another asset. DVI, to your portfolio. You sell 30% of DBB to purchase DVI. How much is your expected return for this portfolio? e) How much is the coefficient of variation for the new portfolio? f) Do you consider this portfolio more or less risky than the individual stocks? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started