Answered step by step

Verified Expert Solution

Question

1 Approved Answer

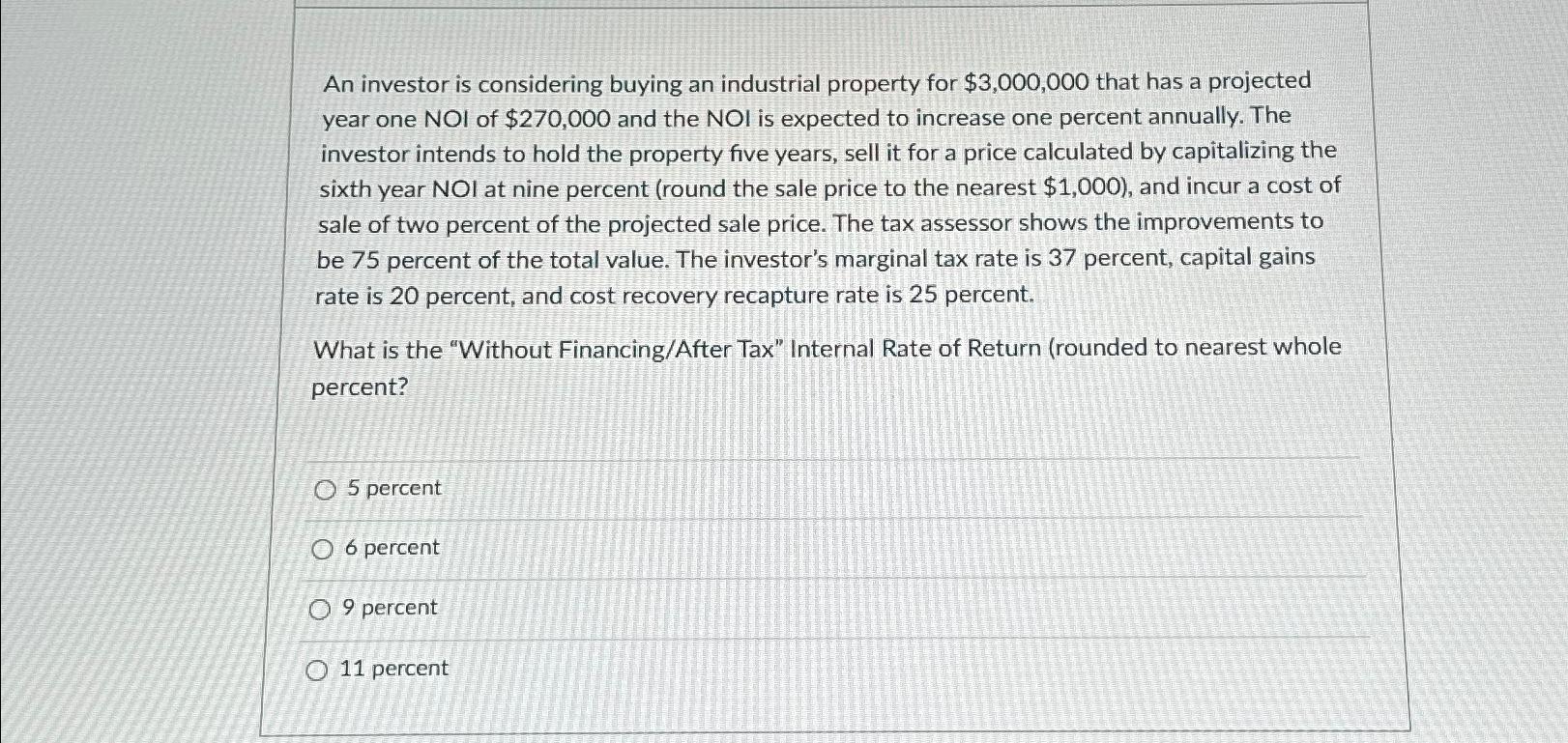

An investor is considering buying an industrial property for $ 3 , 0 0 0 , 0 0 0 that has a projected year one

An investor is considering buying an industrial property for $ that has a projected year one NOI of $ and the NOI is expected to increase one percent annually. The investor intends to hold the property five years, sell it for a price calculated by capitalizing the sixth year NOI at nine percent round the sale price to the nearest $ and incur a cost of sale of two percent of the projected sale price. The tax assessor shows the improvements to be percent of the total value. The investor's marginal tax rate is percent, capital gains rate is percent, and cost recovery recapture rate is percent.

What is the "Without FinancingAfter Tax" Internal Rate of Return rounded to nearest whole percent?

percent

percent

percent

percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started