Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is considering two savings accounts for a one - year investment. The first account offers an interest rate of 2 . 4 %

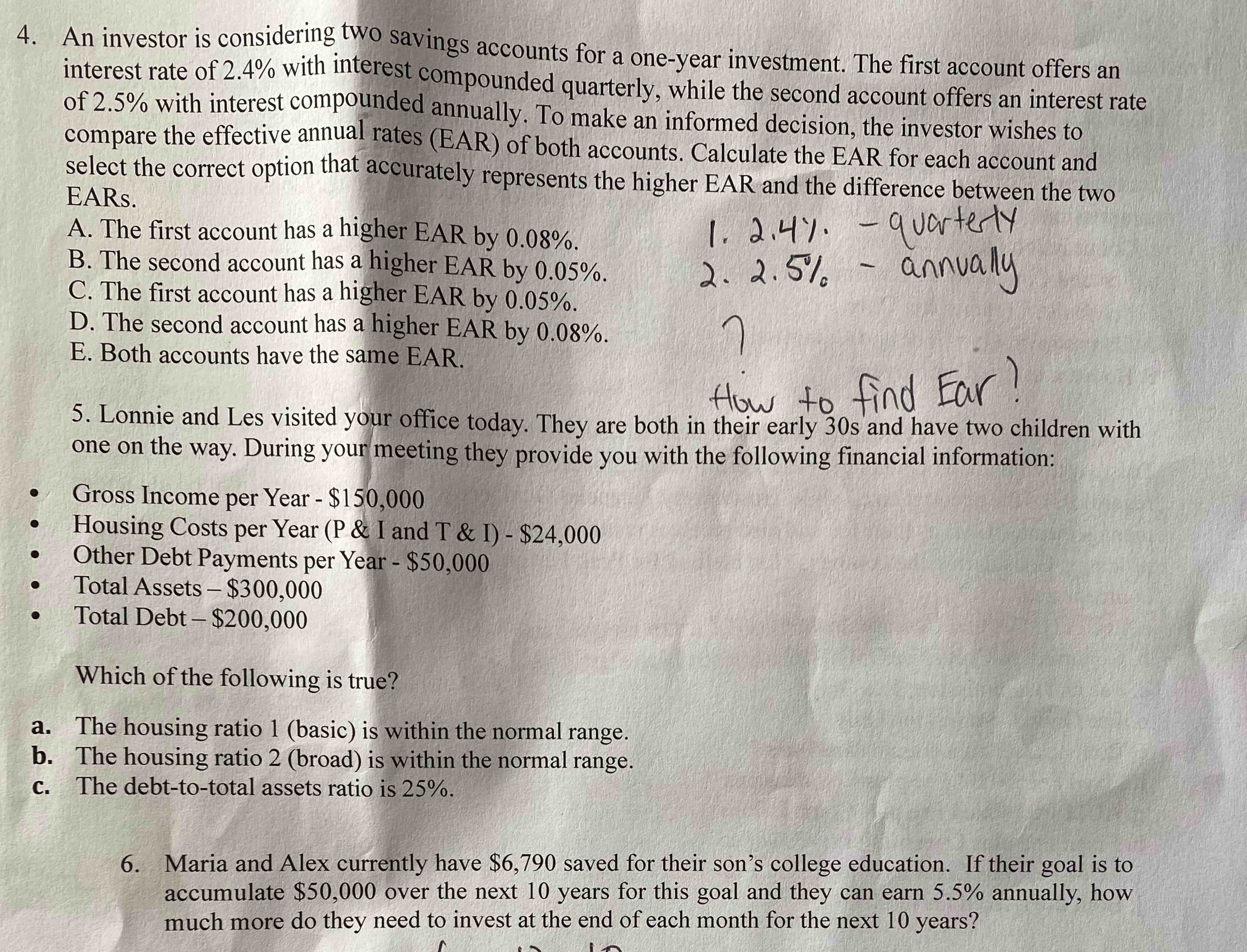

An investor is considering two savings accounts for a oneyear investment. The first account offers an

interest rate of with interest compounded quarterly, while the second account offers an interest rate

of with interest compounded annually. To make an informed decision, the investor wishes to

compare the effective annual rates EAR of both accounts. Calculate the EAR for each account and

select the correct option that accurately represents the higher EAR and the difference between the two

EARs.

A The first account has a higher EAR by

quarterty

B The second account has a higher EAR by

C The first account has a higher EAR by

annually

D The second account has a higher EAR by

E Both accounts have the same EAR.

Lonnie and Les visited your office today. They are both in their early s and have two children with

one on the way. During your meeting they provide you with the following financial information:

Gross Income per Year $

Housing Costs per Year P & I and T & I $

Other Debt Payments per Year $

Total Assets $

Total Debt $

Which of the following is true?

a The housing ratio basic is within the normal range.

b The housing ratio broad is within the normal range.

c The debttototal assets ratio is

Maria and Alex currently have $ saved for their son's college education. If their goal is to

accumulate $ over the next years for this goal and they can earn annually, how

much more do they need to invest at the end of each month for the next years?

AMT

An investor is considering two savings accounts for a oneyear investment. The first account offers an

interest rate of with interest compounded quarterly, while the second account offers an interest rate

of with interest compounded annually. To make an informed decision, the investor wishes to

compare the effective annual rates EAR of both accounts. Calculate the EAR for each account and

select the correct option that accurately represents the higher EAR and the difference between the two

EARs.

A The first account has a higher EAR by

quarterty

B The second account has a higher EAR by

C The first account has a higher EAR by

D The second account has a higher EAR by

E Both accounts have the same EAR.

annually

How to find Ear?

Lonnie and Les visited your office today. They are both in their early s and have two children with

one on the way. During your meeting they provide you with the following financial information:

Gross Income per Year $

Housing Costs per Year P & I and T & I $

Other Debt Payments per Year $

Total Assets $

Total Debt $

Which of the following is true?

a The housing ratio basic is within the normal range.

b The housing ratio broad is within the normal range.

c The debttototal assets ratio is

Maria and Alex currently have $ saved for their son's college education. If their goal is to

accumulate $ over the next years for this goal and they can earn annually, how

much more do they need to invest at the end of each month for the next years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started