Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor owns 2,000 shares of ARP Ltd which are currently trading at $9.00 per share. There are put and call options traded on shares

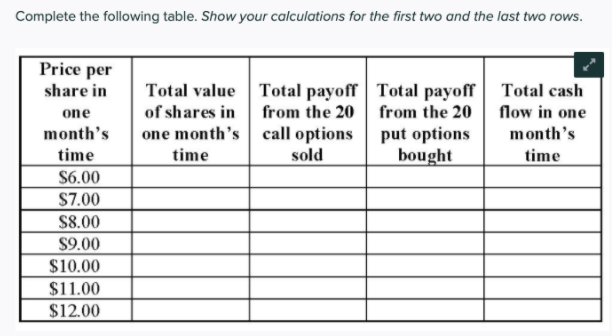

An investor owns 2,000 shares of ARP Ltd which are currently trading at $9.00 per share. There are put and call options traded on shares with each option contract covering 100 shares. The investor sells 20 one-month call options with an exercise price of $10.00 per share and buys 20 one-month put options with an exercise price of $8.00 per share. The investor intends to sell these shares in one months time.

Complete the following table. Show your calculations for the first two and the last two rows. Total value Total payoff Total payoff Total cash of shares in from the 20 from the 20 flow in one one month's call options put options month's time sold bought time Price per share in one month's time S6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started