Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor was expecting an 16.80% return on his portfolio with beta of 1.70 before the market risk premium increased from 6.60% to 14.70%.

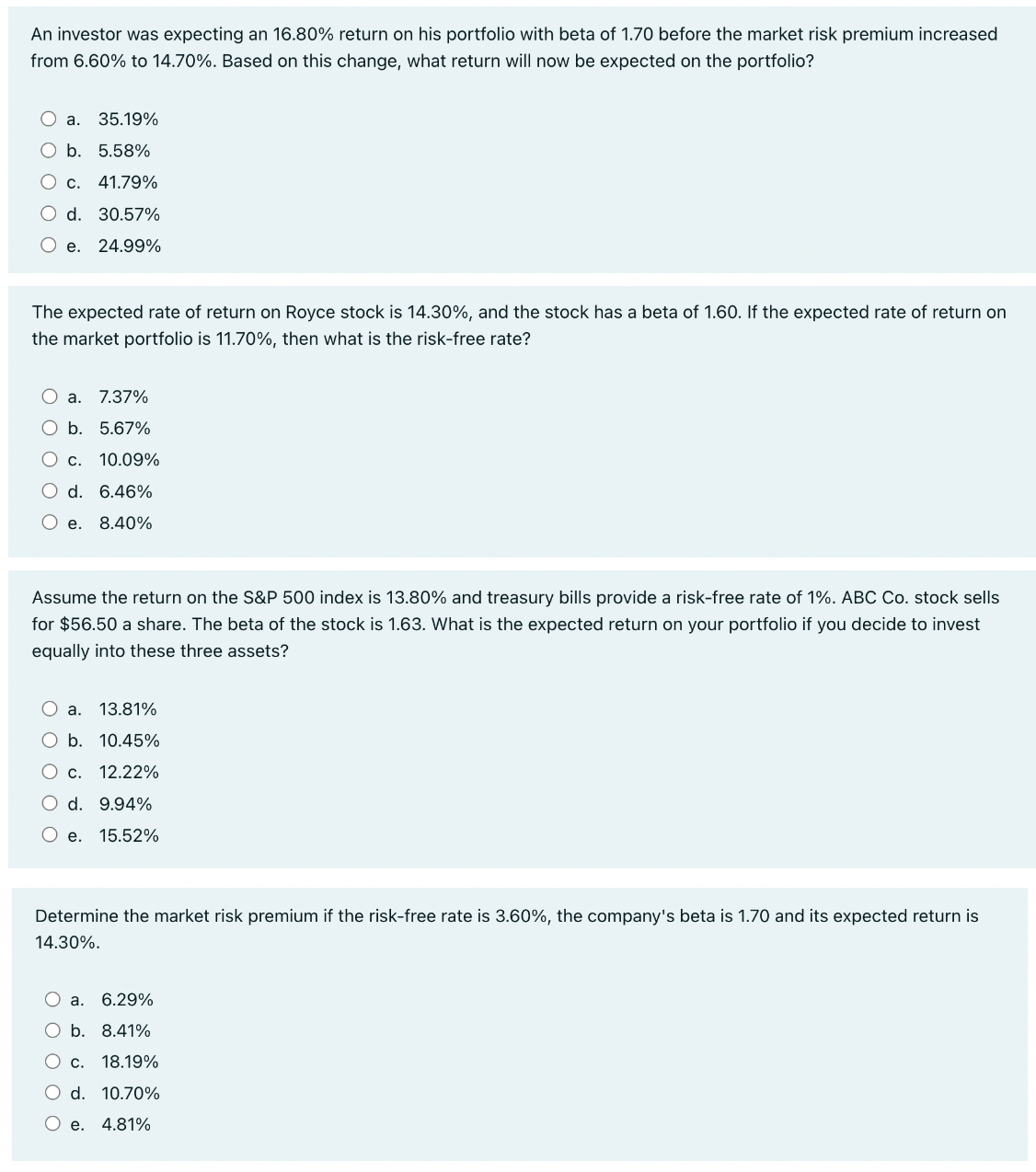

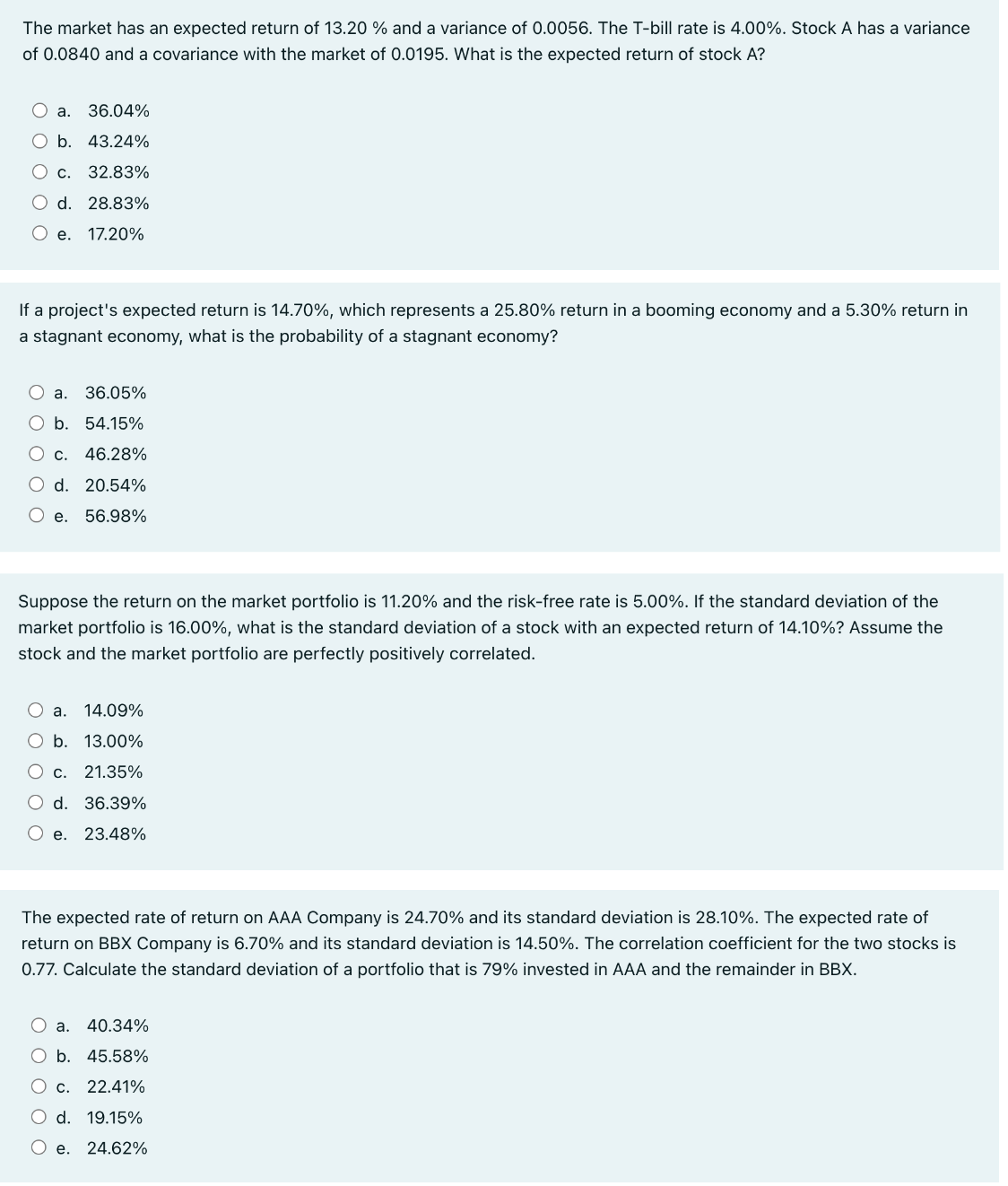

An investor was expecting an 16.80% return on his portfolio with beta of 1.70 before the market risk premium increased from 6.60% to 14.70%. Based on this change, what return will now be expected on the portfolio? a. 35.19% O b. 5.58% O c. 41.79% O d. 30.57% O e. 24.99% The expected rate of return on Royce stock is 14.30%, and the stock has a beta of 1.60. If the expected rate of return on the market portfolio is 11.70%, then what is the risk-free rate? O a. 7.37% O b. 5.67% O c. 10.09% O d. 6.46% O e. 8.40% Assume the return on the S&P 500 index is 13.80% and treasury bills provide a risk-free rate of 1%. ABC Co. stock sells for $56.50 a share. The beta of the stock is 1.63. What is the expected return on your portfolio if you decide to invest equally into these three assets? Oa. 13.81% O b. 10.45% O c. 12.22% O d. 9.94% e. 15.52% Determine the market risk premium if the risk-free rate is 3.60%, the company's beta is 1.70 and its expected return is 14.30%. O a. 6.29% O b. 8.41% 18.19% d. 10.70% 4.81% C. e. The market has an expected return of 13.20 % and a variance of 0.0056. The T-bill rate is 4.00%. Stock A has a variance of 0.0840 and a covariance with the market of 0.0195. What is the expected return of stock A? O a. 36.04% O b. 43.24% O c. 32.83% O d. 28.83% O e. 17.20% If a project's expected return is 14.70%, which represents a 25.80% return in a booming economy and a 5.30% return in a stagnant economy, what is the probability of a stagnant economy? O a. 36.05% O b. 54.15% O c. 46.28% d. 20.54% 56.98% e. Suppose the return on the market portfolio is 11.20% and the risk-free rate is 5.00%. If the standard deviation of the market portfolio is 16.00%, what is the standard deviation of a stock with an expected return of 14.10%? Assume the stock and the market portfolio are perfectly positively correlated. a. 14.09% O b. 13.00% C. 21.35% O d. 36.39% 23.48% e. The expected rate of return on AAA Company is 24.70% and its standard deviation is 28.10%. The expected rate of return on BBX Company is 6.70% and its standard deviation is 14.50%. The correlation coefficient for the two stocks is 0.77. Calculate the standard deviation of a portfolio that is 79% invested in AAA and the remainder in BBX. O a. 40.34% O b. 45.58% C. 22.41% d. 19.15% e. 24.62%

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Compute the expected return on the portfolio The expected return on the portfolio is the we...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started