Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An office building has three floors of rentable space with a single tenant on each floor. The first floor has 2 0 , 0 0

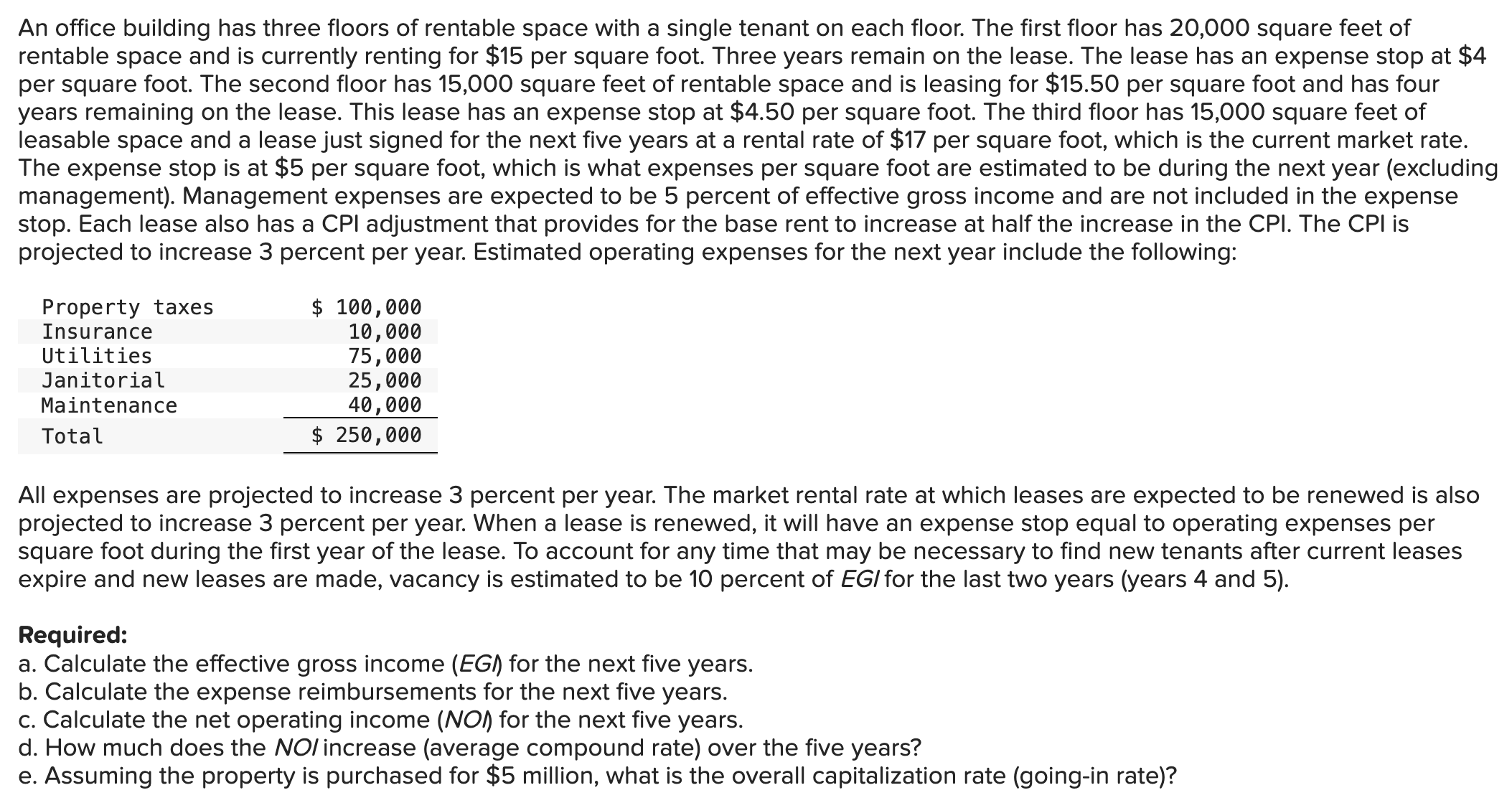

An office building has three floors of rentable space with a single tenant on each floor. The first floor has square feet of

rentable space and is currently renting for $ per square foot. Three years remain on the lease. The lease has an expense stop at $

per square foot. The second floor has square feet of rentable space and is leasing for $ per square foot and has four

years remaining on the lease. This lease has an expense stop at $ per square foot. The third floor has square feet of

leasable space and a lease just signed for the next five years at a rental rate of $ per square foot, which is the current market rate.

The expense stop is at $ per square foot, which is what expenses per square foot are estimated to be during the next year excluding

management Management expenses are expected to be percent of effective gross income and are not included in the expense

stop. Each lease also has a CPI adjustment that provides for the base rent to increase at half the increase in the CPI. The CPI is

projected to increase percent per year. Estimated operating expenses for the next year include the following:

All expenses are projected to increase percent per year. The market rental rate at which leases are expected to be renewed is also

projected to increase percent per year. When a lease is renewed, it will have an expense stop equal to operating expenses per

square foot during the first year of the lease. To account for any time that may be necessary to find new tenants after current leases

expire and new leases are made, vacancy is estimated to be percent of for the last two years years and

Required:

a Calculate the effective gross income EGI for the next five years.

b Calculate the expense reimbursements for the next five years.

c Calculate the net operating income NO for the next five years.

d How much does the increase average compound rate over the five years?

e Assuming the property is purchased for $ million, what is the overall capitalization rate goingin rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started