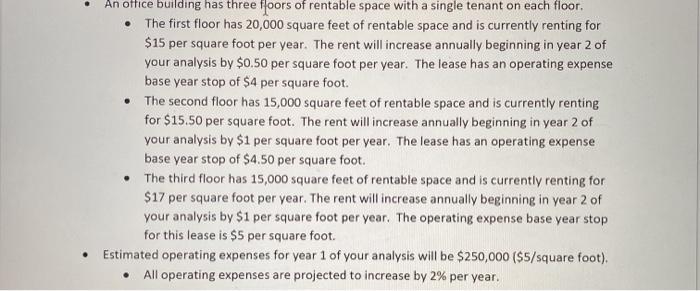

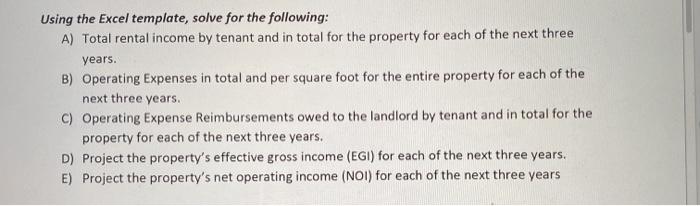

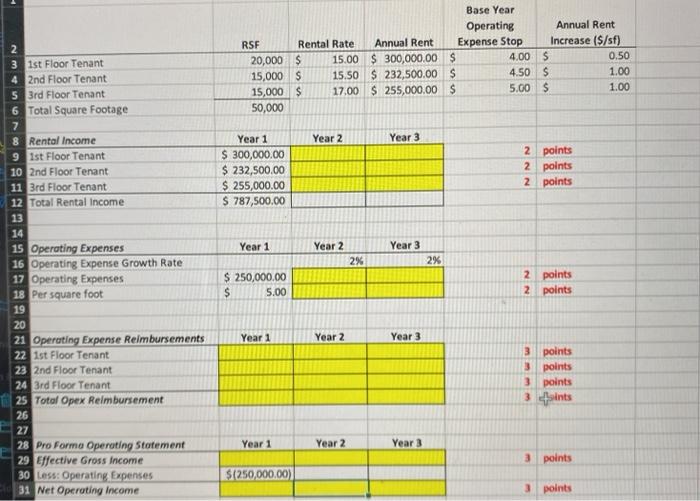

An office building has three foors of rentable space with a single tenant on each floor. The first floor has 20,000 square feet of rentable space and is currently renting for $15 per square foot per year. The rent will increase annually beginning in year 2 of your analysis by $0.50 per square foot per year. The lease has an operating expense base year stop of $4 per square foot. The second floor has 15,000 square feet of rentable space and is currently renting for $15.50 per square foot. The rent will increase annually beginning in year 2 of your analysis by $1 per square foot per year. The lease has an operating expense base year stop of $4.50 per square foot. The third floor has 15,000 square feet of rentable space and is currently renting for $17 per square foot per year. The rent will increase annually beginning in year 2 of your analysis by $1 per square foot per year. The operating expense base year stop for this lease is $5 per square foot. Estimated operating expenses for year 1 of your analysis will be $250,000 ($5/square foot), All operating expenses are projected to increase by 2% per year. . Using the Excel template, solve for the following: A) Total rental income by tenant and in total for the property for each of the next three years. B) Operating Expenses in total and per square foot for the entire property for each of the next three years. C) Operating Expense Reimbursements owed to the landlord by tenant and in total for the property for each of the next three years. D) Project the property's effective gross income (EGI) for each of the next three years. E) Project the property's net operating income (NOI) for each of the next three years Base Year Operating Annual Rent RSF Rental Rate Annual Rent Expense Stop Increase ($/sf) 20,000 $ 15.00 $ 300,000.00 $ 4.00 $ 0.50 15,000 S 15.50 S 232,500.00 $ 4.50 $ 1.00 15,000 S 17.00 $ 255,000.00 $ 5.00 $ 1.00 50,000 Year 2 Year 3 Year 1 $ 300,000.00 $ 232,500.00 $ 255,000.00 $ 787,500.00 2 points 2 points 2 points Year 1 Year 3 Year 2 2% 2% 2 3 1st Floor Tenant 4 2nd Floor Tenant 5 3rd Floor Tenant 6 Total Square Footage 7 8 Rental Income 9 ist Floor Tenant 10 2nd Floor Tenant 11 3rd Floor Tenant 12 Total Rental Income 13 14 15 Operating Expenses 16 Operating Expense Growth Rate 17 Operating Expenses 18 Per square foot 19 20 21 Operating Expense Reimbursements 22 ist Floor Tenant 23 2nd Floor Tenant 24 3rd Floor Tenant T25 Total Opex Reimbursement 26 27 28 Pro Forma Operating Statement 29 Effective Gross Income 30 Less: Operating Expenses 31 Net Operating Income $ 250,000.00 $ 5.00 2 points 2 points Year 1 Year 2 Year 3 3 points 3 points 3 points 3 sints Year 1 Year 2 Year 3 3 points $(250,000.00) 3 points An office building has three foors of rentable space with a single tenant on each floor. The first floor has 20,000 square feet of rentable space and is currently renting for $15 per square foot per year. The rent will increase annually beginning in year 2 of your analysis by $0.50 per square foot per year. The lease has an operating expense base year stop of $4 per square foot. The second floor has 15,000 square feet of rentable space and is currently renting for $15.50 per square foot. The rent will increase annually beginning in year 2 of your analysis by $1 per square foot per year. The lease has an operating expense base year stop of $4.50 per square foot. The third floor has 15,000 square feet of rentable space and is currently renting for $17 per square foot per year. The rent will increase annually beginning in year 2 of your analysis by $1 per square foot per year. The operating expense base year stop for this lease is $5 per square foot. Estimated operating expenses for year 1 of your analysis will be $250,000 ($5/square foot), All operating expenses are projected to increase by 2% per year. . Using the Excel template, solve for the following: A) Total rental income by tenant and in total for the property for each of the next three years. B) Operating Expenses in total and per square foot for the entire property for each of the next three years. C) Operating Expense Reimbursements owed to the landlord by tenant and in total for the property for each of the next three years. D) Project the property's effective gross income (EGI) for each of the next three years. E) Project the property's net operating income (NOI) for each of the next three years Base Year Operating Annual Rent RSF Rental Rate Annual Rent Expense Stop Increase ($/sf) 20,000 $ 15.00 $ 300,000.00 $ 4.00 $ 0.50 15,000 S 15.50 S 232,500.00 $ 4.50 $ 1.00 15,000 S 17.00 $ 255,000.00 $ 5.00 $ 1.00 50,000 Year 2 Year 3 Year 1 $ 300,000.00 $ 232,500.00 $ 255,000.00 $ 787,500.00 2 points 2 points 2 points Year 1 Year 3 Year 2 2% 2% 2 3 1st Floor Tenant 4 2nd Floor Tenant 5 3rd Floor Tenant 6 Total Square Footage 7 8 Rental Income 9 ist Floor Tenant 10 2nd Floor Tenant 11 3rd Floor Tenant 12 Total Rental Income 13 14 15 Operating Expenses 16 Operating Expense Growth Rate 17 Operating Expenses 18 Per square foot 19 20 21 Operating Expense Reimbursements 22 ist Floor Tenant 23 2nd Floor Tenant 24 3rd Floor Tenant T25 Total Opex Reimbursement 26 27 28 Pro Forma Operating Statement 29 Effective Gross Income 30 Less: Operating Expenses 31 Net Operating Income $ 250,000.00 $ 5.00 2 points 2 points Year 1 Year 2 Year 3 3 points 3 points 3 points 3 sints Year 1 Year 2 Year 3 3 points $(250,000.00) 3 points