Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An upward sloping yield curve is evidence that short-term interest rates for next year are going to be higher than short-term interest rates this year.

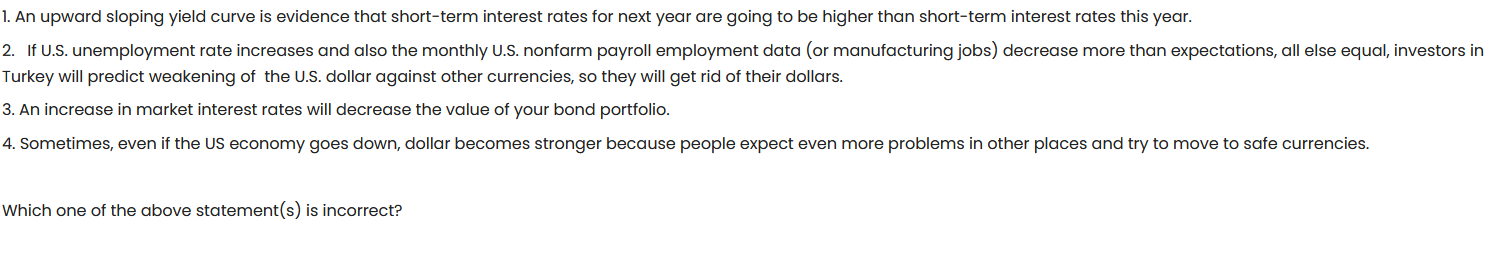

An upward sloping yield curve is evidence that short-term interest rates for next year are going to be higher than short-term interest rates this year. 2. If U.S. unemployment rate increases and also the monthly U.S. nonfarm payroll employment data (or manufacturing jobs) decrease more than expectations, all else equal, investors in urkey will predict weakening of the U.S. dollar against other currencies, so they will get rid of their dollars. 3. An increase in market interest rates will decrease the value of your bond portfolio. 4. Sometimes, even if the US economy goes down, dollar becomes stronger because people expect even more problems in other places and try to move to safe currencies. Which one of the above statement(s) is incorrect

An upward sloping yield curve is evidence that short-term interest rates for next year are going to be higher than short-term interest rates this year. 2. If U.S. unemployment rate increases and also the monthly U.S. nonfarm payroll employment data (or manufacturing jobs) decrease more than expectations, all else equal, investors in urkey will predict weakening of the U.S. dollar against other currencies, so they will get rid of their dollars. 3. An increase in market interest rates will decrease the value of your bond portfolio. 4. Sometimes, even if the US economy goes down, dollar becomes stronger because people expect even more problems in other places and try to move to safe currencies. Which one of the above statement(s) is incorrect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started