Analyse the financial statements of Nestle Ind. for the years 2016 and 2107 for the fair value measurment and state the differences from the values of both years in regards ro the transisition from Ind GAAP to Ind AS 113.

Analyse the financial statements of Nestle Ind. for the years 2016 and 2107 for the fair value measurment and state the differences from the values of both years in regards ro the transisition from Ind GAAP to Ind AS 113.

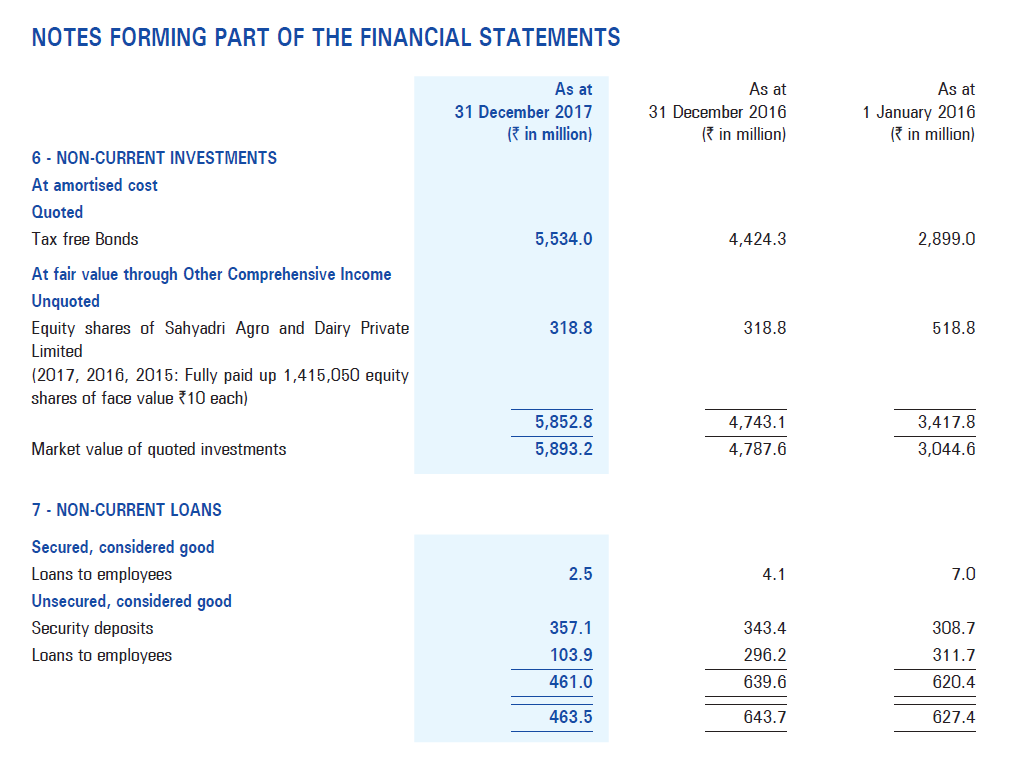

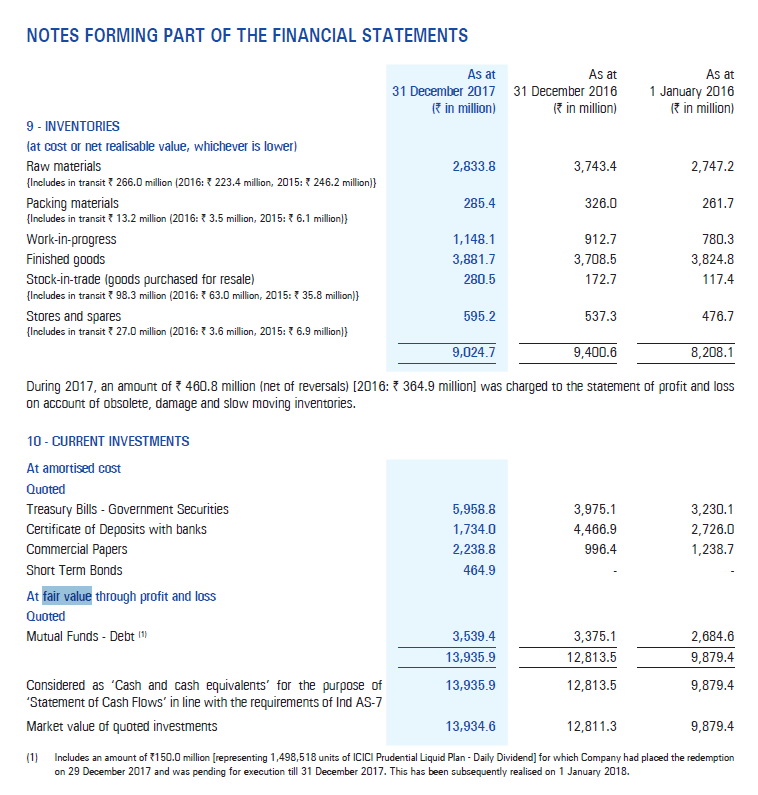

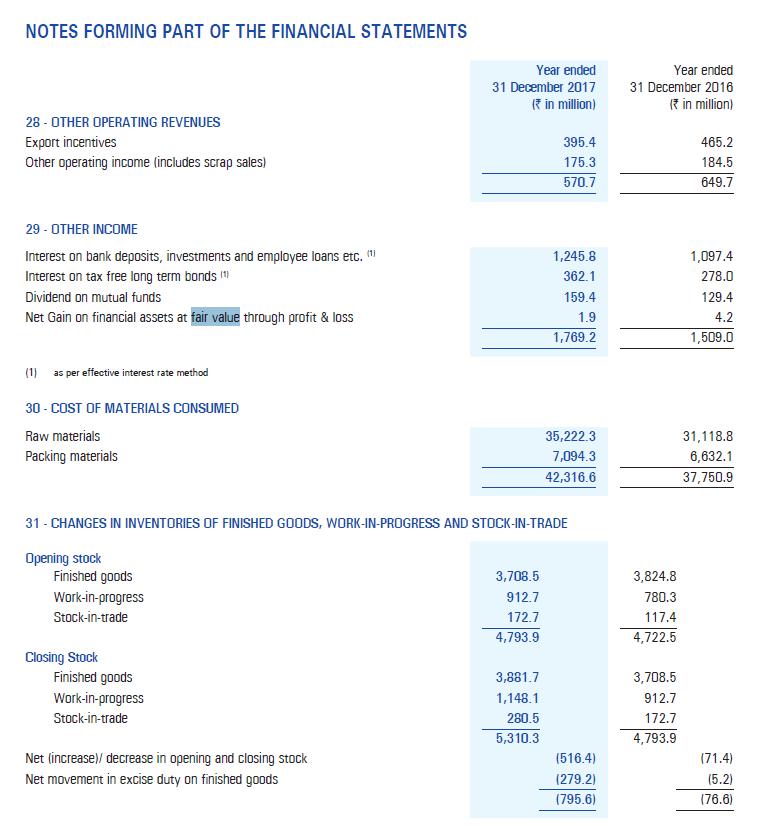

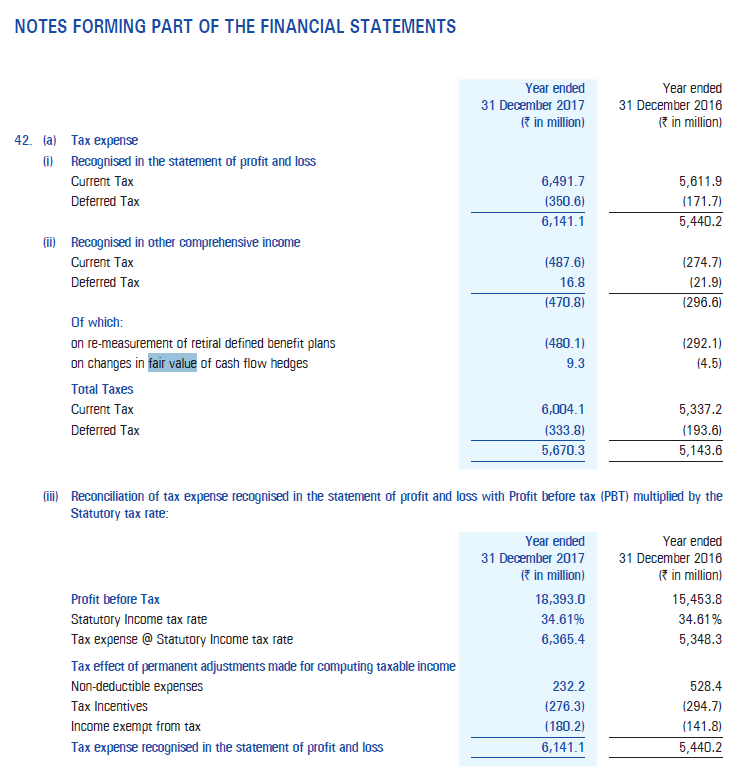

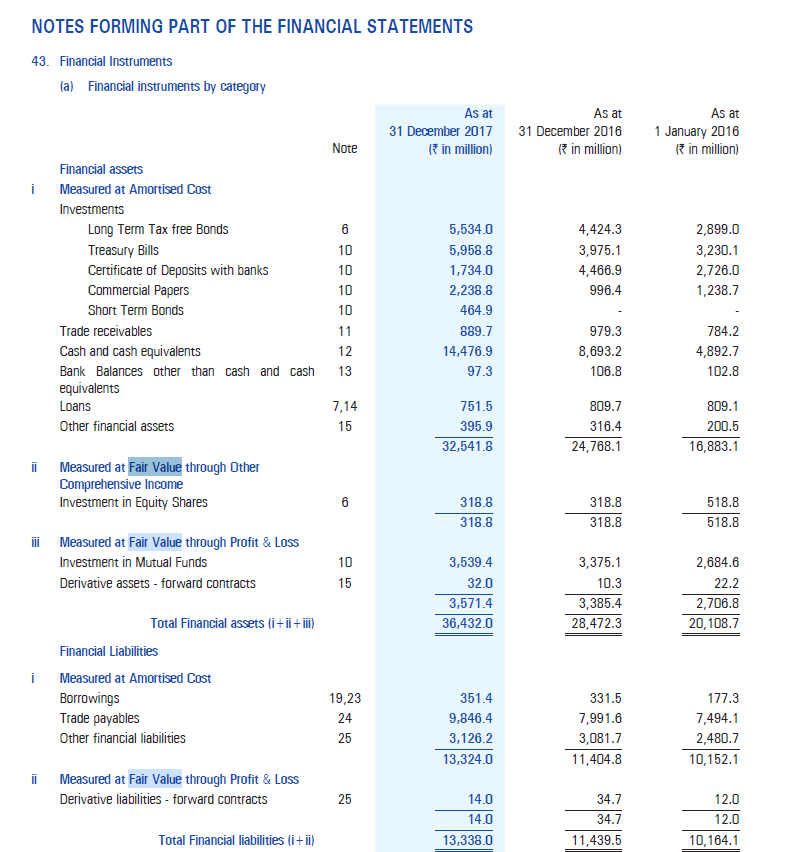

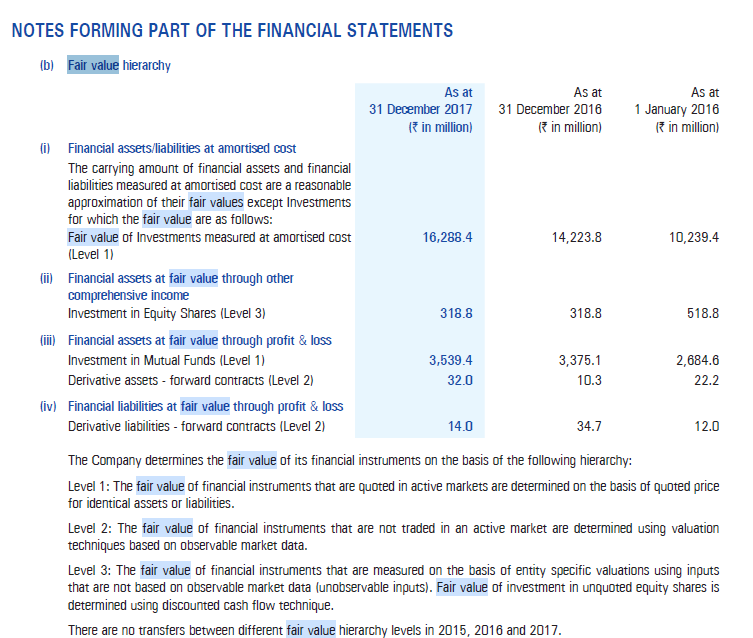

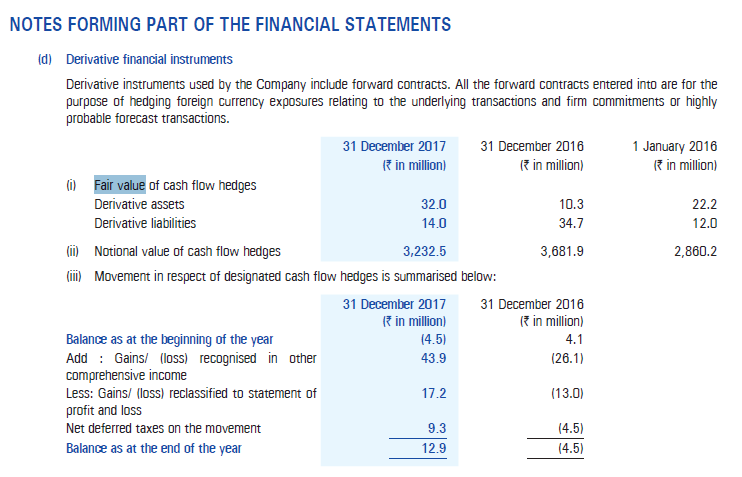

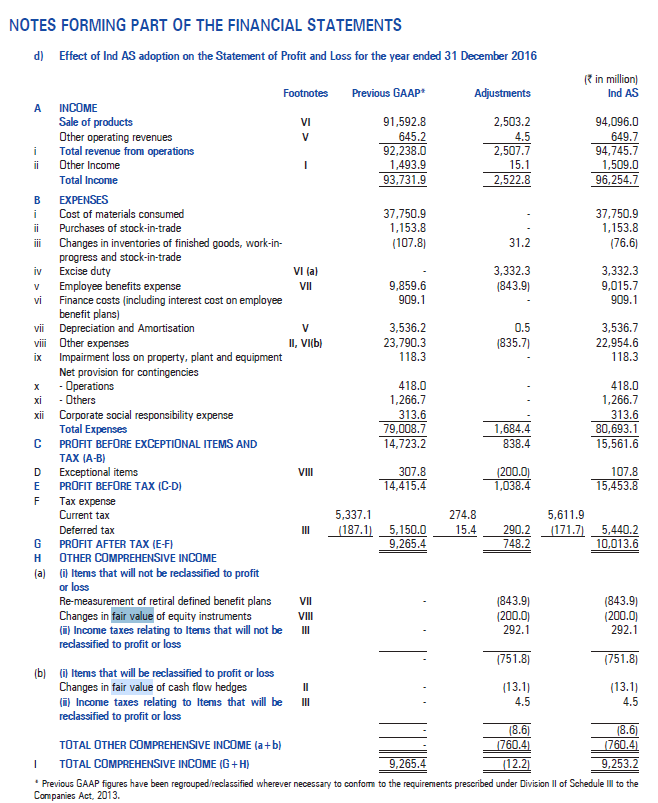

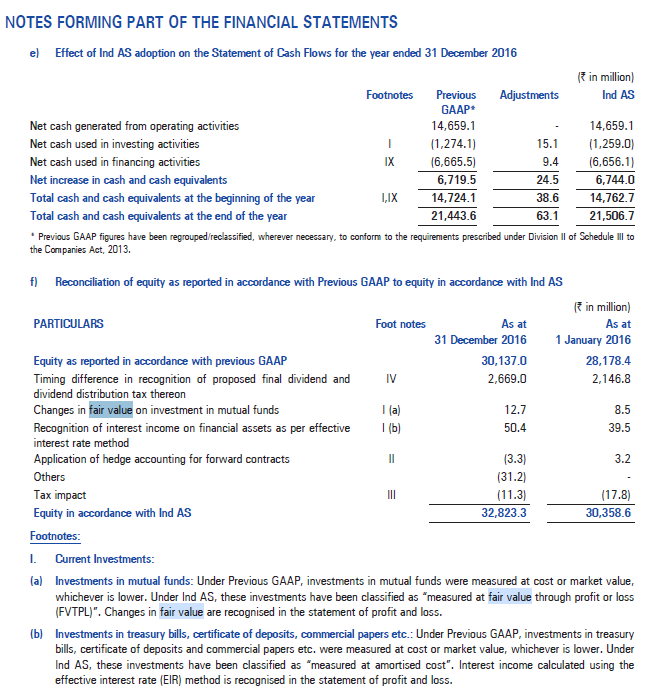

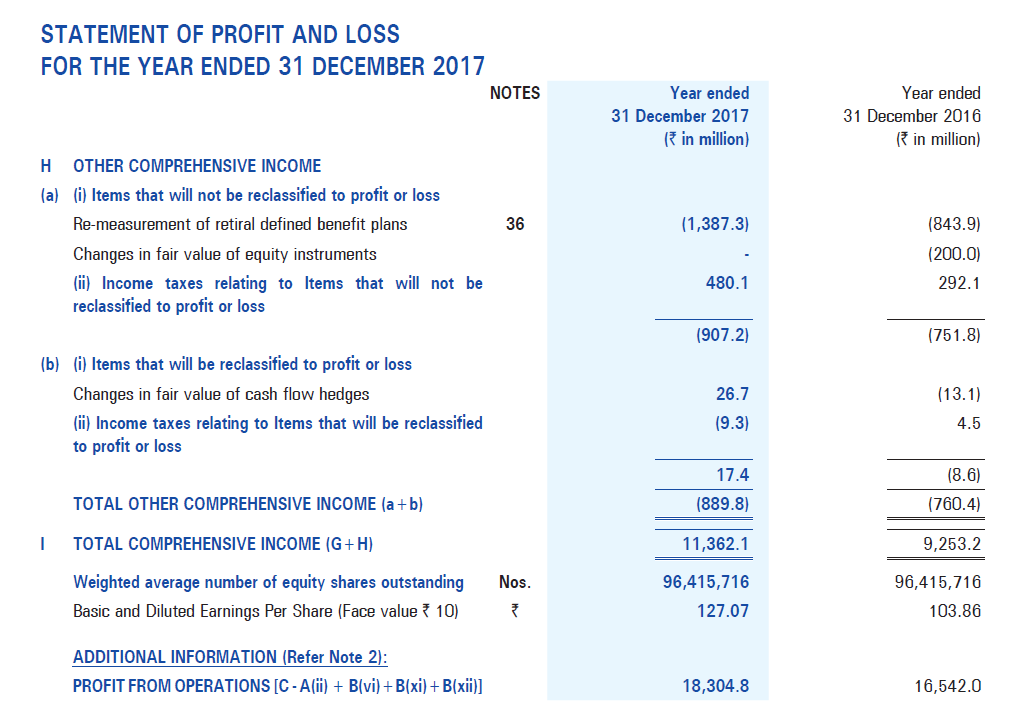

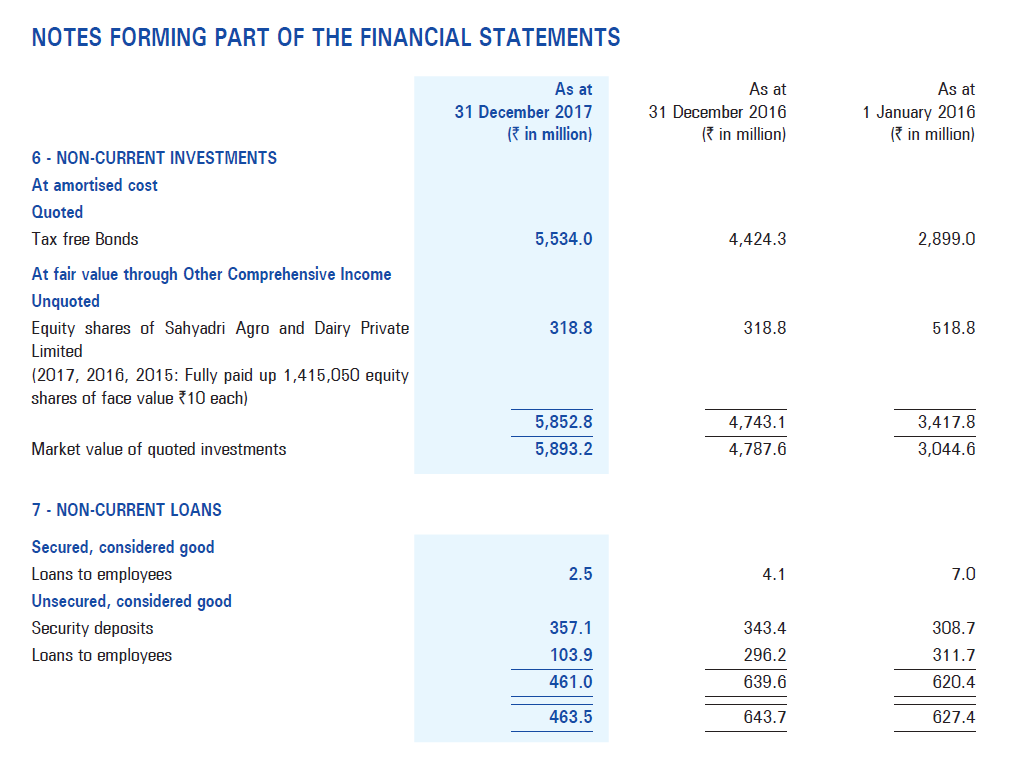

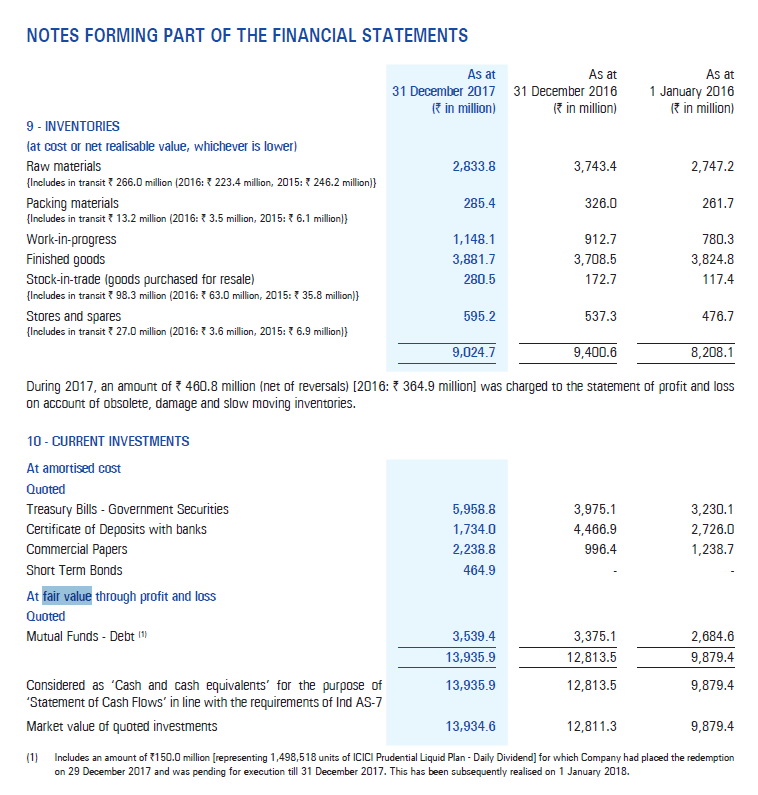

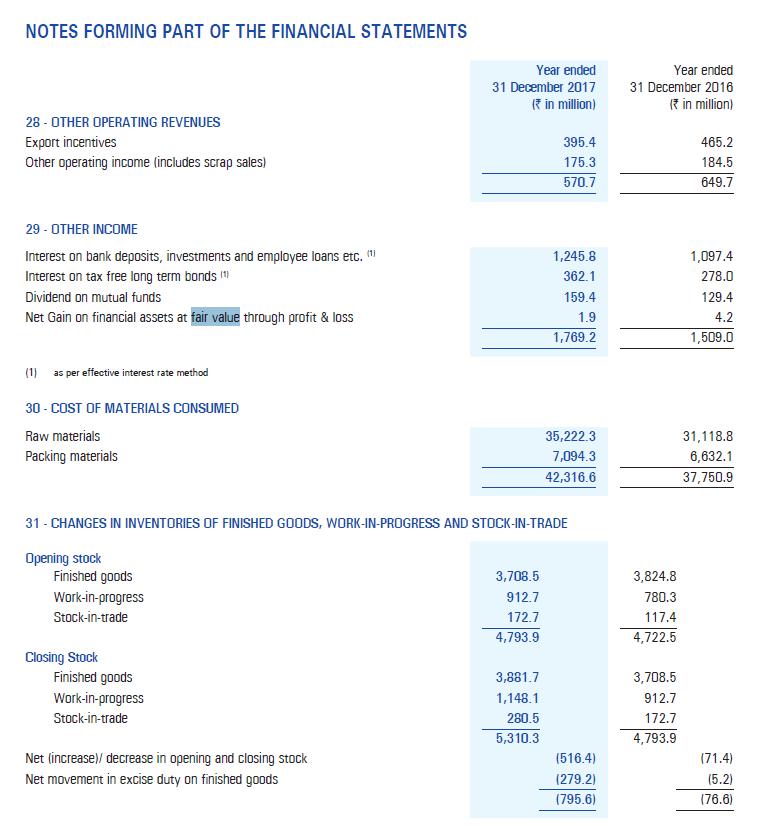

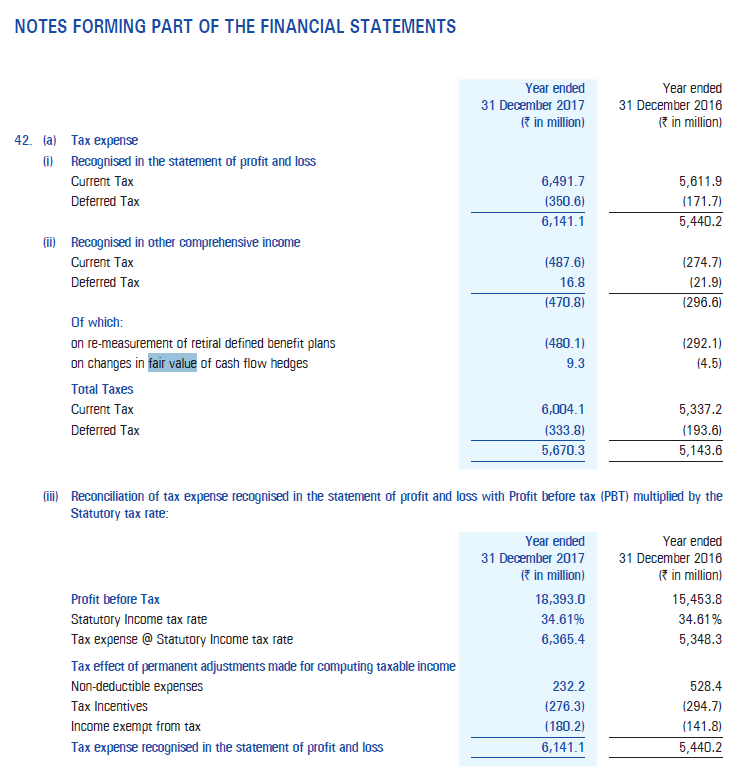

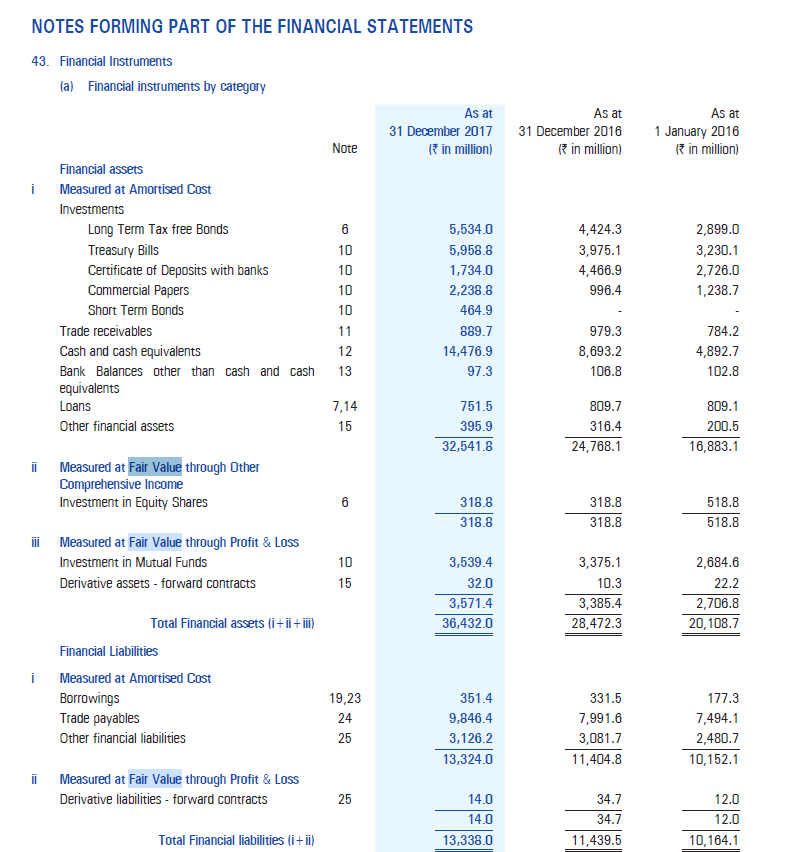

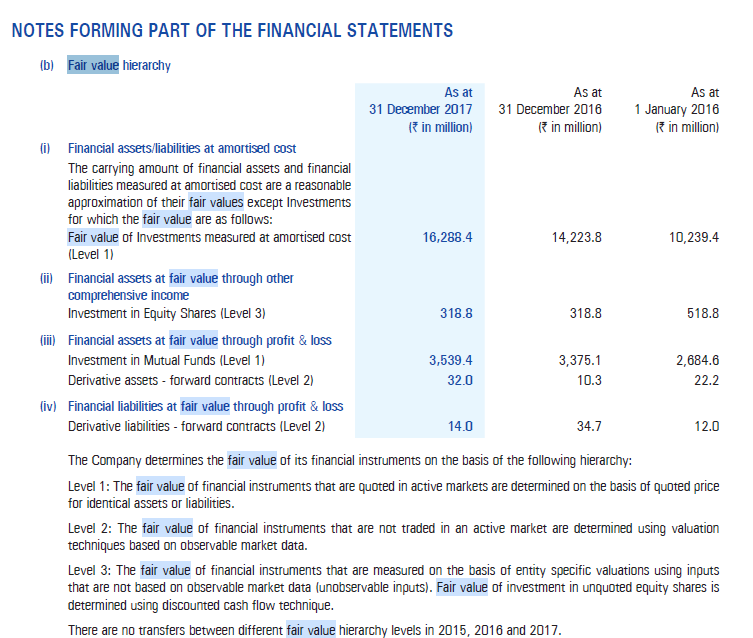

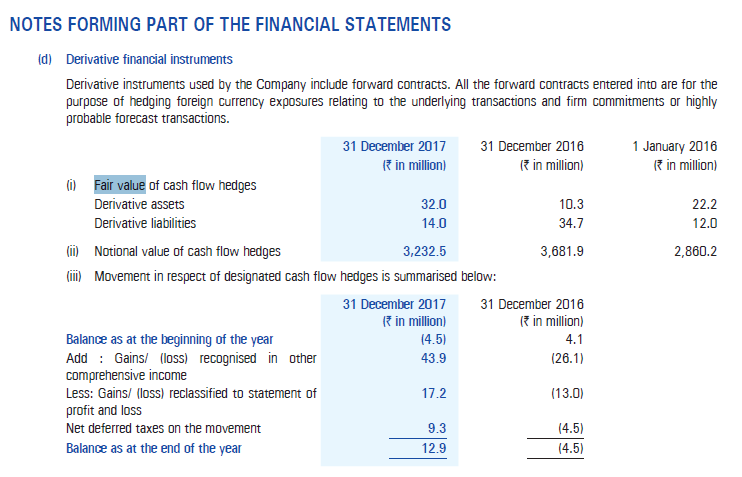

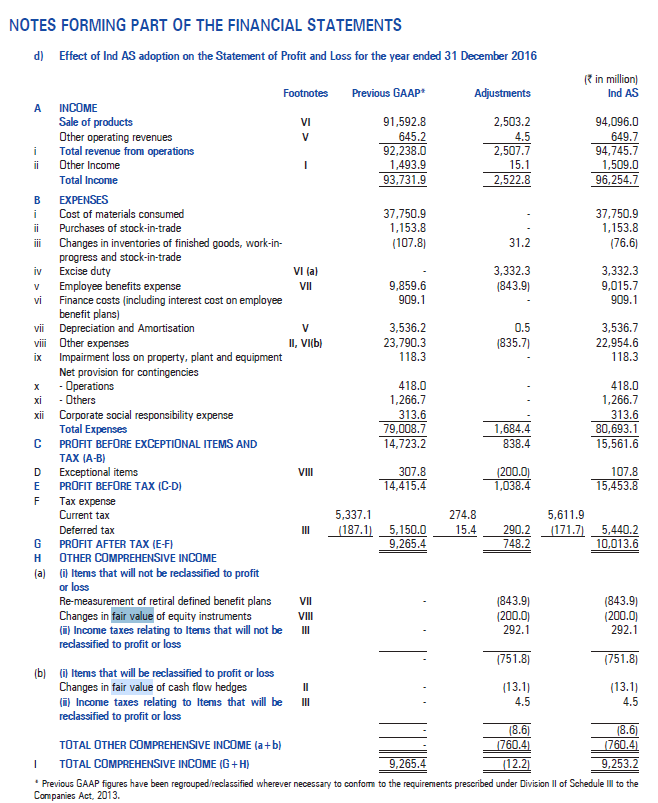

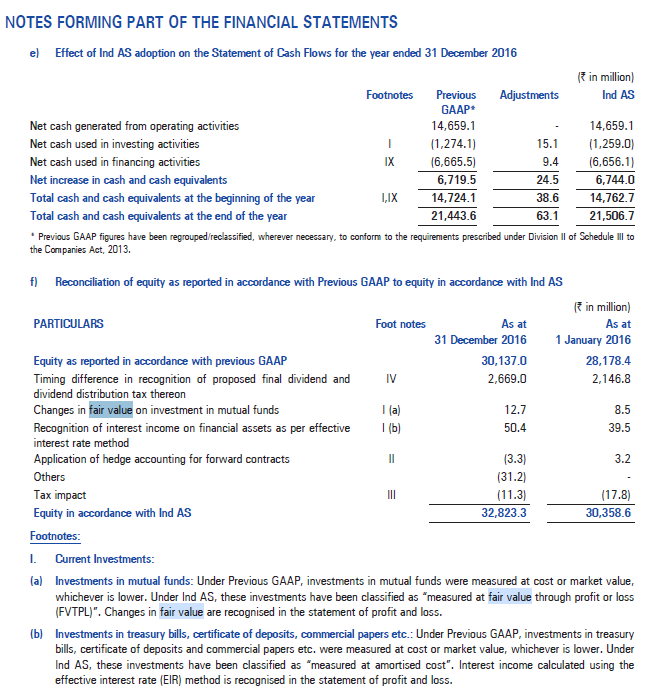

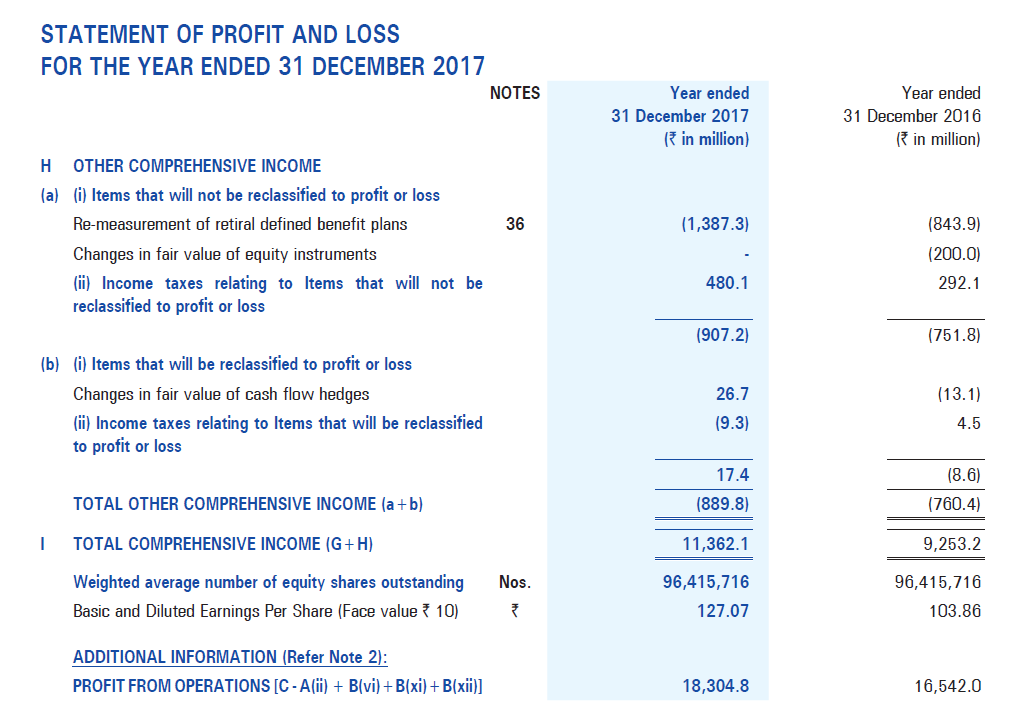

NOTES FORMING PART OF THE FINANCIAL STATEMENTS NOTES FORMING PART OF THE FINANCIAL STATEMENTS During 2017, an amount of 460.8 million (net of reversals) [2016: 364.9 million] was charged to the statement of profit and loss on account of obsolete, damage and slow moving inventories. (1) Includes an amount of 150.0 million [representing 1,498,518 units of ICICI Prudential Liquid Plan - Daily Dividend] for which Company had placed the redemption on 29 December 2017 and was pending for execution till 31 December 2017. This has been subsequently realised on 1 January 2018. NOTES FORMING PART OF THE FINANCIAL STATEMENTS Year ended 31 December 201731 December 2016 ( in million) ( in million) 28 - OTHER OPERATING REVENUES Export incentives Other operating income (includes scrap sales) 395.4175.3570.7 29 - OTHER INCOME Interest on bank deposits, investments and employee loans etc. (11 Interest on tax free long term bonds (1) Dividend on mutual funds Net Gain on financial assets at fair value through profit \& loss \begin{tabular}{rr} 1,245.8 & 1,097.4 \\ 362.1 & 278.0 \\ 159.4 & 129.4 \\ \hline 1.9 & 4.2 \\ \hline 1,769.2 & 1,509.0 \\ \hline \end{tabular} (1) as per effective interest rate method 30 - COST OF MATERIALS CONSUMED Raw materials Packing materials \begin{tabular}{rrr} 35,222.3 & 31,118.8 \\ 7,094.3 & 6,632.1 \\ \hline 42,316.6 & 37,750.9 \\ \hline \end{tabular} 31 - CHANGES IN INVENTORIES OF FINISHED GOODS, WORK-IN-PROGRESS AND STOCK-IN-TRADE Opening stock Finished goods Work-in-progress Stock-in-trade Closing Stock Finished goods Work-in-progress Stock-in-trade Net (increase)/ decrease in opening and closing stock Net movement in excise duty on finished goods NOTES FORMING PART OF THE FINANCIAL STATEMENTS 42. (a) Tax expense (i) Recognised in the statement of profit and loss Current Tax Deferred Tax (ii) Recognised in other comprehensive income Current Tax Deferred Tax Of which: on re-measurement of retiral defined benefit plans on changes in fair value of cash flow hedges Total Taxes Current Tax Deferred Tax (iii) Reconciliation of tax expense recognised in the statement of profit and loss with Profit before tax (PBT) multiplied by the Statutory tax rate: NOTES FORMING PART OF THE FINANCIAL STATEMENTS 43. Financial Instruments (a) Financial instruments hv catennrv NOTES FORMING PART OF THE FINANCIAL STATEMENTS The Company determines the of its financial instruments on the basis of the following hierarchy: Level 1: The fair value of financial instruments that are quoted in active markets are determined on the basis of quoted price for identical assets or liabilities. Level 2: The of financial instruments that are not traded in an active market are determined using valuation techniques based on observable market data. Level 3: The of financial instruments that are measured on the basis of entity specific valuations using inputs that are not based on observable market data (unobservable inputs). of investment in unquoted equity shares is determined using discounted cash flow technique. There are no transfers between different fair value hierarchy levels in 2015,2016 and 2017. NOTES FORMING PART OF THE FINANCIAL STATEMENTS (d) Derivative financial instruments Derivative instruments used by the Company include forward contracts. All the forward contracts entered into are for the purpose of hedging foreign currency exposures relating to the underlying transactions and firm commitments or highly probable forecast transactions. (iii) Movement in respect of designated cash flow hedges is summarised below: NOTES FORMING PART OF THE FINANCIAL STATEMENTS NOTES FORMING PART OF THE FINANCIAL STATEMENTS e) Effect of Ind AS adoption on the Statement of Cash Flows for the year ended 31 December 2016 I in millinnl " Previous GAAP figures have been regrouped/reclassified, wherever necessary, to conform to the requirements prescribed under Division II of Schedule III to the Companies Act, 2013. f) Reconciliation of equity as reported in accordance with Previous GAAP to equity in accordance with Ind AS IF : million tuvituts. I. Current lnvestments: (a) Investments in mutual funds: Under Previous GAAP, investments in mutual funds were measured at cost or market value, whichever is lower. Under Ind AS, these investments have been classified as "measured at fair value through profit or loss (FVTPL)". Changes in fair value are recognised in the statement of profit and loss. (b) Investments in treasury bills, certificate of deposits, commercial papers etc.: Under Previous GAAP, investments in treasury bills, certificate of deposits and commercial papers etc. were measured at cost or market value, whichever is lower. Under Ind AS, these investments have been classified as "measured at amortised cost". Interest income calculated using the effective interest rate (EIR) method is recognised in the statement of profit and loss. STATEMENT OF PROFIT AND LOSS FOR THE YEAR ENDED 31 DECEMBER 2017 NOT H OTHER COMPREHENSIVE INCOME (a) (i) Items that will not be reclassified to profit or loss Re-measurement of retiral defined benefit plans 36 Changes in fair value of equity instruments (ii) Income taxes relating to ltems that will not be reclassified to profit or loss (b) (i) Items that will be reclassified to profit or loss Changes in fair value of cash flow hedges (ii) Income taxes relating to ltems that will be reclassified to profit or loss TOTAL OTHER COMPREHENSIVE INCOME (a+b) I TOTAL COMPREHENSIVE INCOME (G+H) Weighted average number of equity shares outstanding Nos Basic and Diluted Earnings Per Share (Face value 10) ADDITIONAL INFORMATION (Refer Note 2): NOTES FORMING PART OF THE FINANCIAL STATEMENTS NOTES FORMING PART OF THE FINANCIAL STATEMENTS During 2017, an amount of 460.8 million (net of reversals) [2016: 364.9 million] was charged to the statement of profit and loss on account of obsolete, damage and slow moving inventories. (1) Includes an amount of 150.0 million [representing 1,498,518 units of ICICI Prudential Liquid Plan - Daily Dividend] for which Company had placed the redemption on 29 December 2017 and was pending for execution till 31 December 2017. This has been subsequently realised on 1 January 2018. NOTES FORMING PART OF THE FINANCIAL STATEMENTS Year ended 31 December 201731 December 2016 ( in million) ( in million) 28 - OTHER OPERATING REVENUES Export incentives Other operating income (includes scrap sales) 395.4175.3570.7 29 - OTHER INCOME Interest on bank deposits, investments and employee loans etc. (11 Interest on tax free long term bonds (1) Dividend on mutual funds Net Gain on financial assets at fair value through profit \& loss \begin{tabular}{rr} 1,245.8 & 1,097.4 \\ 362.1 & 278.0 \\ 159.4 & 129.4 \\ \hline 1.9 & 4.2 \\ \hline 1,769.2 & 1,509.0 \\ \hline \end{tabular} (1) as per effective interest rate method 30 - COST OF MATERIALS CONSUMED Raw materials Packing materials \begin{tabular}{rrr} 35,222.3 & 31,118.8 \\ 7,094.3 & 6,632.1 \\ \hline 42,316.6 & 37,750.9 \\ \hline \end{tabular} 31 - CHANGES IN INVENTORIES OF FINISHED GOODS, WORK-IN-PROGRESS AND STOCK-IN-TRADE Opening stock Finished goods Work-in-progress Stock-in-trade Closing Stock Finished goods Work-in-progress Stock-in-trade Net (increase)/ decrease in opening and closing stock Net movement in excise duty on finished goods NOTES FORMING PART OF THE FINANCIAL STATEMENTS 42. (a) Tax expense (i) Recognised in the statement of profit and loss Current Tax Deferred Tax (ii) Recognised in other comprehensive income Current Tax Deferred Tax Of which: on re-measurement of retiral defined benefit plans on changes in fair value of cash flow hedges Total Taxes Current Tax Deferred Tax (iii) Reconciliation of tax expense recognised in the statement of profit and loss with Profit before tax (PBT) multiplied by the Statutory tax rate: NOTES FORMING PART OF THE FINANCIAL STATEMENTS 43. Financial Instruments (a) Financial instruments hv catennrv NOTES FORMING PART OF THE FINANCIAL STATEMENTS The Company determines the of its financial instruments on the basis of the following hierarchy: Level 1: The fair value of financial instruments that are quoted in active markets are determined on the basis of quoted price for identical assets or liabilities. Level 2: The of financial instruments that are not traded in an active market are determined using valuation techniques based on observable market data. Level 3: The of financial instruments that are measured on the basis of entity specific valuations using inputs that are not based on observable market data (unobservable inputs). of investment in unquoted equity shares is determined using discounted cash flow technique. There are no transfers between different fair value hierarchy levels in 2015,2016 and 2017. NOTES FORMING PART OF THE FINANCIAL STATEMENTS (d) Derivative financial instruments Derivative instruments used by the Company include forward contracts. All the forward contracts entered into are for the purpose of hedging foreign currency exposures relating to the underlying transactions and firm commitments or highly probable forecast transactions. (iii) Movement in respect of designated cash flow hedges is summarised below: NOTES FORMING PART OF THE FINANCIAL STATEMENTS NOTES FORMING PART OF THE FINANCIAL STATEMENTS e) Effect of Ind AS adoption on the Statement of Cash Flows for the year ended 31 December 2016 I in millinnl " Previous GAAP figures have been regrouped/reclassified, wherever necessary, to conform to the requirements prescribed under Division II of Schedule III to the Companies Act, 2013. f) Reconciliation of equity as reported in accordance with Previous GAAP to equity in accordance with Ind AS IF : million tuvituts. I. Current lnvestments: (a) Investments in mutual funds: Under Previous GAAP, investments in mutual funds were measured at cost or market value, whichever is lower. Under Ind AS, these investments have been classified as "measured at fair value through profit or loss (FVTPL)". Changes in fair value are recognised in the statement of profit and loss. (b) Investments in treasury bills, certificate of deposits, commercial papers etc.: Under Previous GAAP, investments in treasury bills, certificate of deposits and commercial papers etc. were measured at cost or market value, whichever is lower. Under Ind AS, these investments have been classified as "measured at amortised cost". Interest income calculated using the effective interest rate (EIR) method is recognised in the statement of profit and loss. STATEMENT OF PROFIT AND LOSS FOR THE YEAR ENDED 31 DECEMBER 2017 NOT H OTHER COMPREHENSIVE INCOME (a) (i) Items that will not be reclassified to profit or loss Re-measurement of retiral defined benefit plans 36 Changes in fair value of equity instruments (ii) Income taxes relating to ltems that will not be reclassified to profit or loss (b) (i) Items that will be reclassified to profit or loss Changes in fair value of cash flow hedges (ii) Income taxes relating to ltems that will be reclassified to profit or loss TOTAL OTHER COMPREHENSIVE INCOME (a+b) I TOTAL COMPREHENSIVE INCOME (G+H) Weighted average number of equity shares outstanding Nos Basic and Diluted Earnings Per Share (Face value 10) ADDITIONAL INFORMATION (Refer Note 2)

Analyse the financial statements of Nestle Ind. for the years 2016 and 2107 for the fair value measurment and state the differences from the values of both years in regards ro the transisition from Ind GAAP to Ind AS 113.

Analyse the financial statements of Nestle Ind. for the years 2016 and 2107 for the fair value measurment and state the differences from the values of both years in regards ro the transisition from Ind GAAP to Ind AS 113.