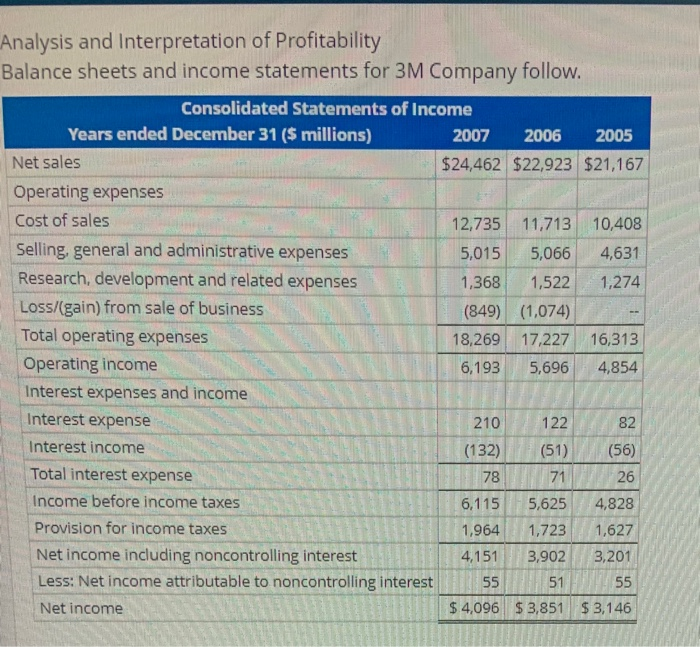

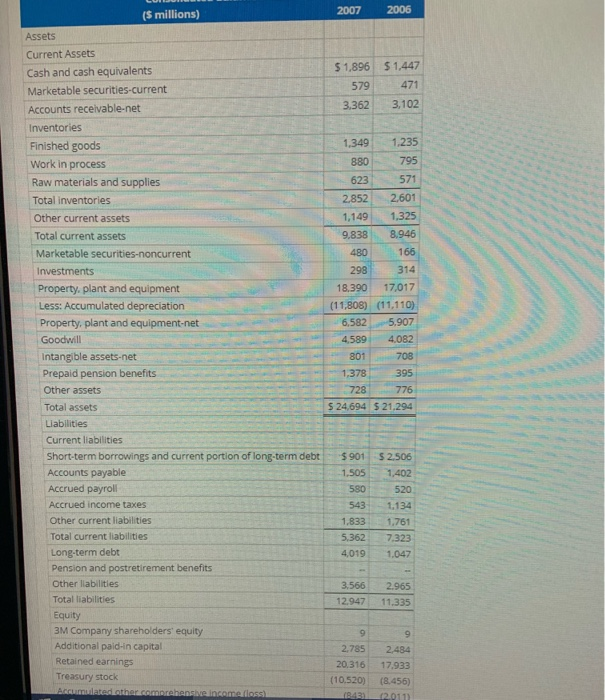

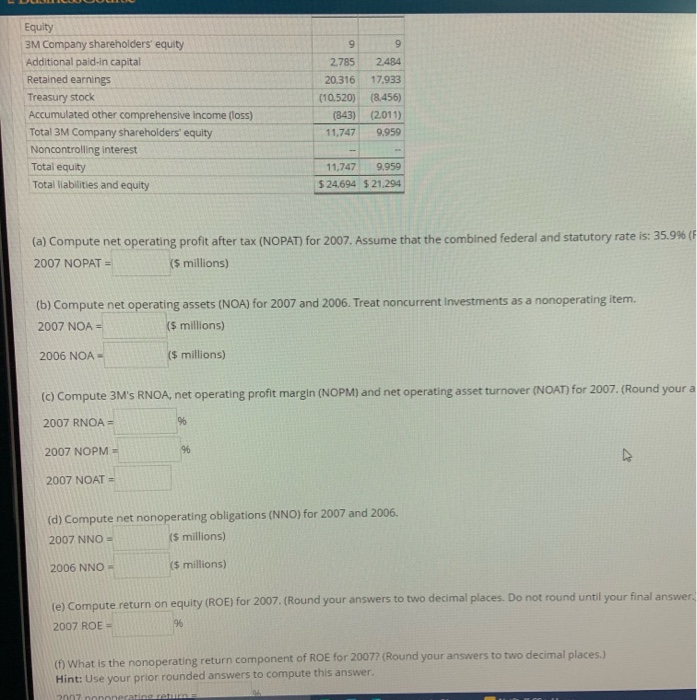

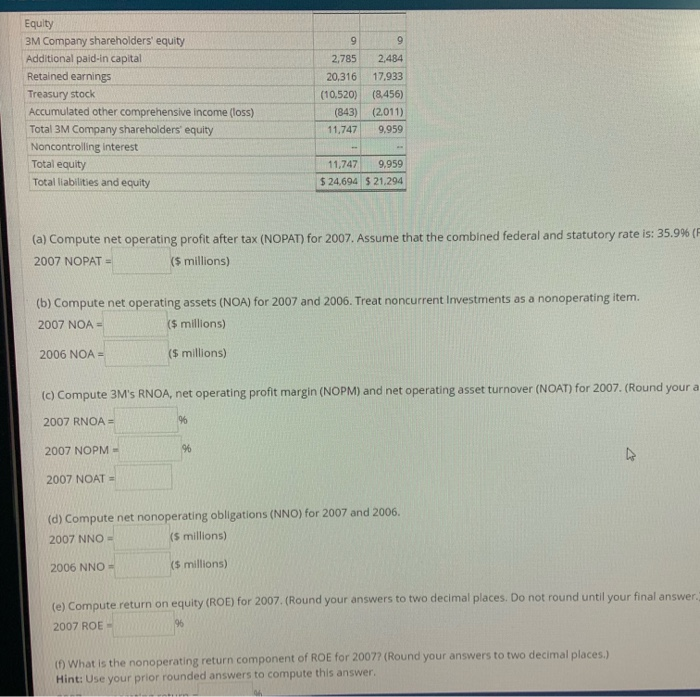

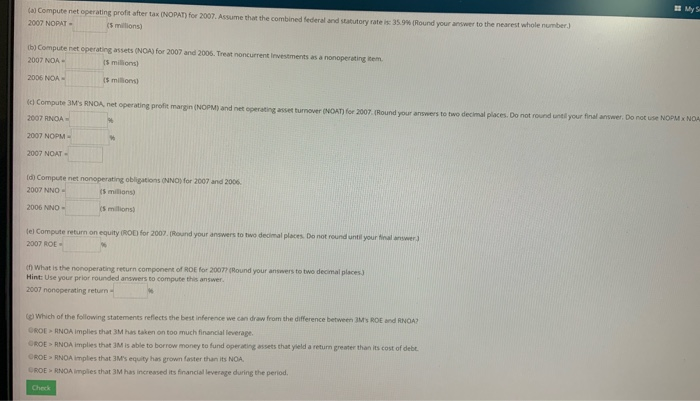

Analysis and Interpretation of Profitability Balance sheets and income statements for 3M Company follow. Consolidated Statements of Income Years ended December 31 ($ millions), 2007 2006 2005 Net sales $24,462 $22,923 $21,167 Operating expenses Cost of sales 12,735 11,713 10,408 Selling, general and administrative expenses 5,015 5,066 4,631 Research, development and related expenses 1,368 1,522 1,274 Loss/(gain) from sale of business (849) (1,074) Total operating expenses 18,269 17,227 16,313 Operating income 6,193 5,696 4,854 Interest expenses and income Interest expense 210 122 482 Interest income (132) (51) (56) Total interest expense 78 71 26 Income before income taxes 6,115 5,625 4,828 Provision for income taxes 1,964 1,723 1,627 Net income including noncontrolling interest 4,151 3,902 3,201 Less: Net income attributable to noncontrolling interest 55 5 1 55 Net income $ 4,096 $3,851 $ 3,146 2007 2006 $1,896 579 $1,447 471 3,102 3,362 1,349 1.235 880795 623 571 2.852 1,149 ($ millions) Assets Current Assets Cash and cash equivalents Marketable securities-current Accounts receivable-net Inventories Finished goods Work in process Raw materials and supplies Total inventories Other current assets Total current assets Marketable securities-noncurrent Investments Property, plant and equipment Less: Accumulated depreciation Property, plant and equipment-net Goodwill Intangible assets-net - Prepaid pension benefits --- -- Other assets Total assets Liabilities Current liabilities Short-term borrowings and current portion of long-term debt Accounts payable Accrued payroll Accrued income taxes Other current liabilities Total current liabilities Long-term debt Pension and postretirement benefits Other liabilities Total liabilities Equity 3M Company shareholders' equity Additional paid-in capital Retained earnings Treasury stock Ar t edathancom hans medless 9.838 480 298 18.390 (11,808) (11,110) 6.5825.907 4.589 4.082 801 708 1,378 395 728 776 $ 24,694 5 21.294 $2.506 1,402 520 $901 -1.505 580 543 1.833 5.362 4019 3.566 12.947 11.335 99 2.785 2,484 20.316 17.933 (10.520) (8.456) 431 12.011) Equity 3M Company shareholders' equity Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive income (loss) Total 3M Company shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 2,785 20,316 (10.520) (843) 11.747 2484 17.933 (8,456) (2011) 9.959 11,747 9.959 524 694 $21204 (a) Compute net operating profit after tax (NOPAT) for 2007. Assume that the combined federal and statutory rate is: 35.9% (F 2007 NOPAT = (5 millions) (b) Compute net operating assets (NOA) for 2007 and 2006. Treat noncurrent investments as a nonoperating item. 2007 NOA (5 millions) 2006 NOA (5 millions) (c) Compute 3M's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2007. (Round your a 2007 RNOA = 2007 NOPM - 2007 NOAT = (d) Compute net nonoperating obligations (NNO) for 2007 and 2006. 2007 NNO = 15 millions) 2006 NNO - ($ millions) (e) Compute return on equity (ROE) for 2007. (Round your answers to two decimal places. Do not round until your final answer 2007 ROE (0) What is the nonoperating return component of ROE for 2007? (Round your answers to two decimal places.) Hint: Use your prior rounded answers to compute this answer. Equity 3M Company shareholders' equity Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive income (loss) Total 3M Company shareholders' equity Noncontrolling interest Total equity Total liabilities and equity 2.785 20.316 (10,520) (843) 11.747 2,484 17,933 (8.456) (2011) 9.959 11,747 9.959 $ 24,694 $21.294 (a) Compute net operating profit after tax (NOPAT) for 2007. Assume that the combined federal and statutory rate is: 35.9% (1 2007 NOPAT = (5 millions) (b) Compute net operating assets (NOA) for 2007 and 2006. Treat noncurrent Investments as a nonoperating item. 2007 NOA = (5 millions) 2006 NOA ($ millions) (c) Compute 3M's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2007. (Round your a 2007 RNOA 2007 NOPM - 2007 NOAT = (d) Compute net nonoperating obligations (NNO) for 2007 and 2006. 2007 NNO - (5 millions) 2006 NNO - (5 millions) (e) Compute return on equity (ROE) for 2007. (Round your answers to two decimal places. Do not round until your final answer 2007 ROE (1) What is the nonoperating return component of ROE for 20077 (Round your answers to two decimal places. Hint: Use your prior rounded answers to compute this answer. cal Compute net operating profit after tax INOPAT) for 2007. Assume that the combined federal and autory rates 359Round your answer to the nearest whole number.) 2007 NOPAT (5 milions by Compute net operating assets (NOA) for 2007 and 2006. Treat noncurrent investments as a nonoperating tem 2007 NOA 15 millions) 2006 NOA 5 millions Id Compute 3M'S RNOA net operating profit margin (OPM) and net operating asset turnover (NCAT) for 2007 Round your answers to be decimal places. Do not round until your final answer. Do not use NOPUNOA 2007 RNOA 2007 NOPM 2007 NOAT Id Compute net nonoperating obligations (NNO) for 2007 and 2006 2007 NNO (5 millions 2006 NNO- (5 milions lel Compute return on equity ROD for 2007. Round your answers to live decimal places. Do not reund until your final answer 2007 ROE en What is the nonoperating return component of ROE for 2007? (Round your answers to two deomal places) Hint: Use your prior rounded answers to compute this answer 2007 nonoperating return ( Which of the following statements reflects the best inference we can draw from the difference between MSROE and RNOA GROERNOA implies that 3M has taken on too much financial leverage GROERNOA implies that M is able to borrow money to fund operating assets that yield a return greater than its cost of debt CROERNOA implies that 3M's equity has grown faster than its NOA GROERNOA imples that 3M has increased its financial leverage during the period. Check