Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: 1. Prepare a statement of cash flows using the indirect method. 2. Prepare the operating section of the statement of cash flows using the

Question:

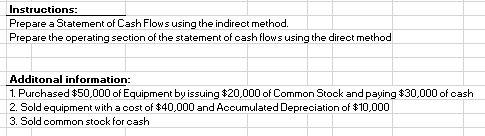

1. Prepare a statement of cash flows using the indirect method.

2. Prepare the operating section of the statement of cash flows using the direct method. ( basically do the operating section of the statement of cash flows using both the direct and indirect methods)

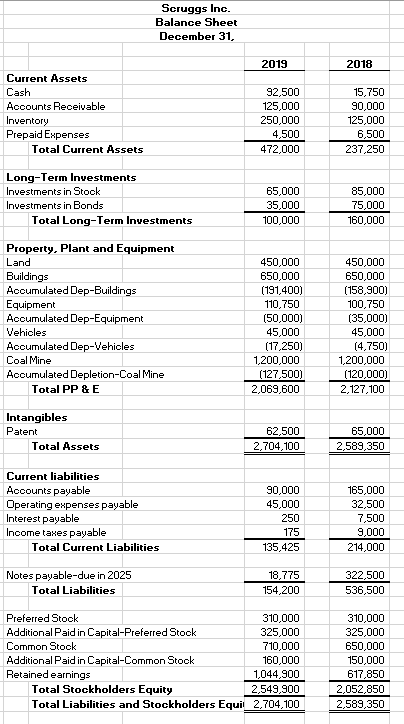

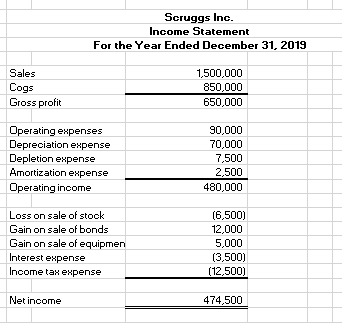

Instructions: Prepare a Statement of Cash Flows using the indirect method. Prepare the operating section of the statement of cash flows using the direct method Additonal information: 1. Purchased $50,000 of Equipment by issuing $20,000 of Common Stock and paying $30,000 of cash 2. Sold equipment with a cost of $40,000 and Accumulated Depreciation of $10,000 3. Sold common stook for cash Scruggs Inc. Balance Sheet December 31, 2019 2018 Current Assets Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets 92,500 125,000 250,000 4,500 472,000 15,750 90,000 125,000 6,500 237,250 Long-Term Investments Investments in Stock Investments in Bonds Total Long-Term Investments 65,000 35,000 100,000 85,000 75,000 160,000 Property, Plant and Equipment Land Buildings Accumulated Dep-Buildings Equipment Accumulated Dep-Equipment Vehicles Accumulated Dep-Vehicles Coal Mine Accumulated Depletion-Coal Mine Total PP &E 450,000 650,000 (191,400) 110,750 (50,000) 45,000 (17,250) 1,200,000 (127,500) 2,069,600 450,000 650,000 (158,900) 100,750 (35,000) 45,000 (4,750) 1,200,000 (120,000) 2,127,100 Intangibles Patent Total Assets 62,500 2,704,100 65,000 2,589,350 Current liabilities Accounts payable Operating expenses payable Interest payable Income taxes payable Total Current Liabilities 90,000 45,000 250 175 135,425 165,000 32,500 7,500 9,000 214,000 Notes payable-due in 2025 Total Liabilities 18,775 154,200 322,500 536,500 Preferred Stock 310,000 Additional Paid in Capital-Preferred Stock 325,000 Common Stock 710,000 Additional Paid in Capital-Common Stock 160,000 Retained earnings 1,044,900 Total Stockholders Equity 2,549,900 Total Liabilities and Stockholders Equit 2,704,100 310,000 325,000 650,000 150,000 617,850 2,052,850 2,589,350 Scruggs Inc. Income Statement For the Year Ended December 31, 2019 Sales Cogs Gross profit 1,500,000 850,000 650,000 Operating expenses Depreciation expense Depletion expense Amortization expense Operating income 90,000 70,000 7,500 2,500 480,000 Loss on sale of stock Gain on sale of bonds Gain on sale of equipmen Interest expense Income tax expense ( (6,500) 12,000 5,000 (3,500) (12,500) Net income 474,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started